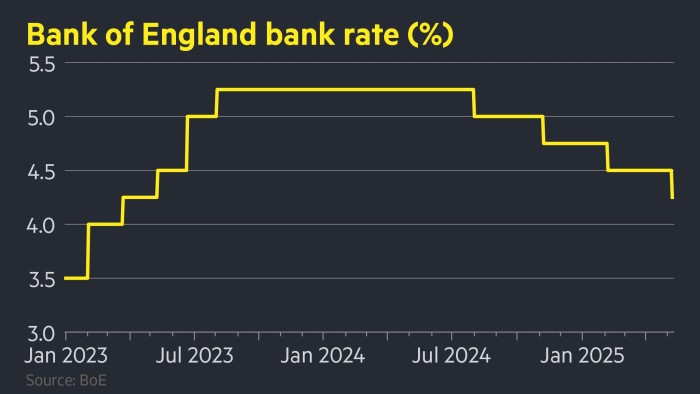

The Bank of England has cut interest rates by a quarter point to 4.25 per cent but stressed it was not on a preset path to further reductions, as it prepares for the impact of Donald Trump’s trade policy.

Thursday’s split decision, the fourth rate reduction since August, comes ahead of the announcement of a US-UK trade deal that London hopes will reduce the impact of Trump’s tariffs on British exports.

The BoE’s nine-person Monetary Policy Committee was split between the five members who supported the quarter-point cut, two who favoured a bigger, half-point reduction and two who wanted rates to stay at 4.5 per cent.

“Inflationary pressures have continued to ease, so we’ve been able to cut rates again today,” said Andrew Bailey, the BoE governor.

But he added: “Interest rates are not on autopilot — they cannot be.”

The pound moved above $1.33 after the vote, putting it in positive territory for the day, as the voting shift and language about rate cuts prompted traders to trim their rate-cut bets.

“Overall, it’s a hawkish surprise,” said Francesco Pesole, an FX strategist at ING, highlighting that BoE chief economist Huw Pill voted for no change.

The BoE forecast that the UK economy will expand by 1 per cent this year and a weaker-than-expected 1.25 per cent in 2026.

This week’s MPC meeting was the first since Trump announced his so-called liberation day tariffs in April.

UK officials suggest Thursday’s deal with Washington may be limited in scope and largely focused on the car and steel industries. Bailey said a deal would be “welcome” news that would help reduce uncertainty.

https://www.ft.com/content/d43d2b3d-1b3e-4496-96db-aa407ff17306