Australia’s jobs boom stalled in June with an uptick in unemployment that will add to calls for the Reserve Bank to cut interest rates.

The jobless rate lifted to 4.3 per cent for the month, up from 4.1 per cent in May, according to data released by the Australian Bureau of Statistics on Thursday morning.

Employment lifted by just 2000 people, softer than the white-hot run of figures seen through 2024.

It comes after the Reserve Bank shocked optimistic observers earlier this month by holding the official cash rate at 3.85 per cent.

The RBA board said it would wait for a clear signal inflation will remain under control before locking in a third cut.

That signal could come as early as June 30, when the next batch of full cost of living data will be released. The central bank’s board will meet soon after on August 11 and 12.

But the RBA will also have reasons for caution, with productivity growth slow and the risk that inflation bounces back when rates are cut too quickly.

It had been expecting unemployment to rise to 4.5 per cent over time as the heat of inflation comes out of the economy.

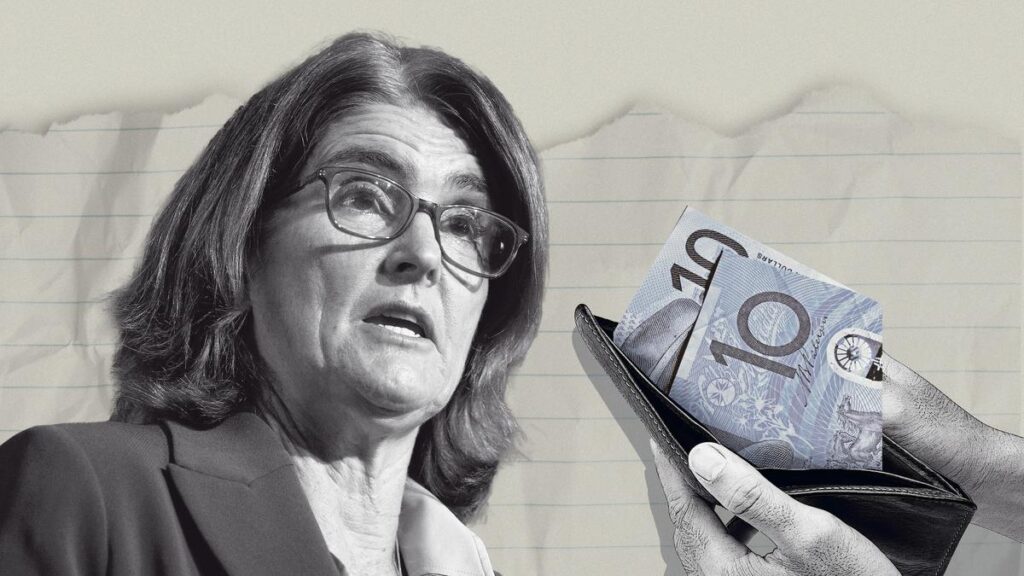

Speaking after the July decision, governor Michele Bullock signalled interest rates will be heading down, but her bank will be moving gradually.

“We don’t want to end up having to fight inflation again. We want to make sure we’ve nailed it,” she said.

Financial markets overnight remained optimistic about an interest rate cut next month, judging the chances as about nine-in-10.

Consumer confidence also rose modestly this month, according to Westpac data released this week.

But the RBA’s decision to hold rates dampened the mood, Westpac economist Matthew Hassan said.

More to come.

https://thewest.com.au/business/economy/australian-jobs-unemployment-lifts-to-43-per-cent-for-june-as-white-hot-labour-market-cools-c-19379566