The AUD/USD exchange rate remained under pressure on Tuesday after the Reserve Bank of Australia (RBA) delivered its second interest rate decision of the year. It was trading at 0.6245, down slightly from the year-to-date high of 0.6390. So, what’s ahead for the Aussie ahead of the US jobs numbers and Liberation Day tariffs?

RBA interest rate decision

The AUD/USD exchange rate moved sideways after the RBA concluded its two-day meeting and left interest rates unchanged.

It left the official cash rate at 4.1% as it solidified its state as the most hawkish central bank in the developed world.

Unlike other major central banks, the RBA left interest rates unchanged in 202, even as the economy slowed down and consumer inflation moved downwards.

The RBA delivered its first interest rate cut in the last meeting, moving it from 4.35% to 4.1%. In its Tuesday’s meeting, officials decided to leave interest rates unchanged at 4.1%, noting that it wanted to see more evidence that inflation was moving downwards. The statement added:

“The assessment is that monetary policy remains restrictive. The continued decline in underlying inflation is welcome, but there are risks on both sides and the Board is cautious about the outlook.”

Recent economic numbers have painted a mixed picture about the Australian economy. The labor market remains tight, with the unemployment rate moving at 4.1%, while inflation has moved inside the RBA’s target range of between 2% and 3%.

Consumer spending has ticked up as inflation retreated. While these are important developments, the RBA is concerned that long-term inflation expectations are still high.

Trump Liberation Day tariffs

The next key catalyst for the AUD/USD pair will be the upcoming Liberation Day tariffs by Donald Trump.

These tariffs will greatly impact most economies, especially those with a large trade surplus with the United States.

On the positive side, Australia runs a trade deficit with the US, meaning that the Trump administration may not target it.

However, the administration will target countries like China that do a lot of business with Australia. These tariffs, could, in theory, affect companies’ prices of top commodities like iron ore as steel demand falls.

US NFP data ahead

The next key catalyst for the AUD/USD pair will be the upcoming nonfarm payrolls (NFP) data on Friday. This is important data that measures the health of the US economy.

Economists expect that these numbers will show that the headline the economy created over 140k jobs, while the unemployment rate remained unchanged at 4.1%.

While important, these numbers will likely have a limited impact on the Federal Reserve, which is focusing more on inflation instead of the labor market.

The US will release some flash jobs numbers before Friday’s NFP figure. The Bureau of Labor Statistics (BLS) will publish the latest JOLTS job openings repair on Tuesday, while ADP will release the private payrolls data.

AUD/USD technical analysis

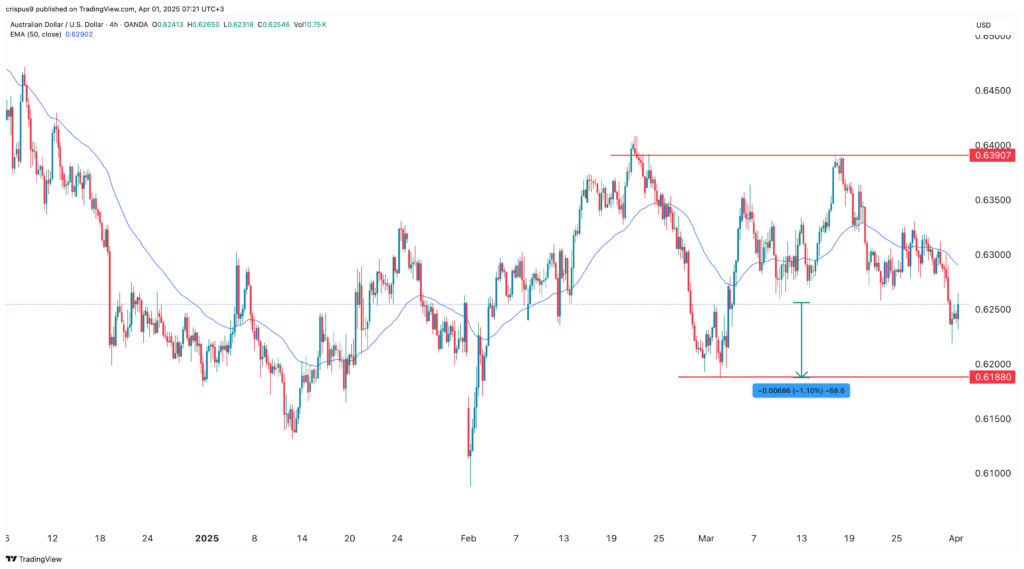

AUDUSD chart | Source: TradingView

The four-hour chart shows that the AUD/USD exchange rate has come under pressure in the past few months. It has dropped from a high of 0.6390 in April to the current 0.6255.

The pair formed a double-top pattern at 0.6390, and whose neckline was at 0.6188. A double-top is one of the most bearish signs in the market.

The AUD/USD pair has also moved below the 50-period moving average, a sign that bears are in control.

Therefore, the outlook is bearish, with the next point to watch being at 0.6188, the neckline of this pattern, which is 1.10% below the current level.

The post AUD/USD forecast: signal after the RBA interest rate decison appeared first on Invezz

https://invezz.com/news/2025/04/01/aud-usd-forecast-signal-after-the-rba-interest-rate-decison/