Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

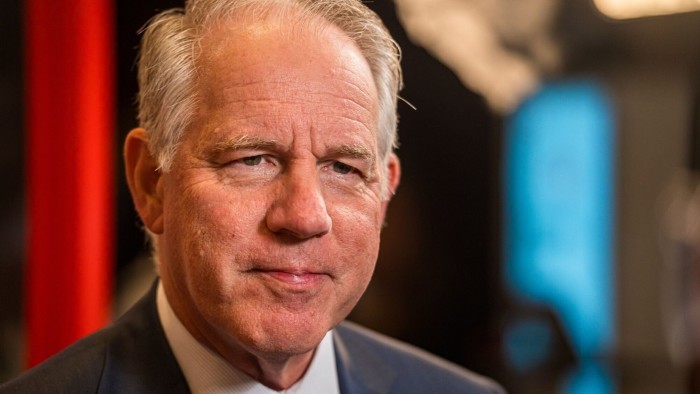

Private credit is “not a bubble”, Apollo Global Management president Jim Zelter has said, adding that he did not think adverse economic conditions would trigger “massive losses” in a sector that has witnessed rapid growth in recent years.

Speaking at HSBC’s investment conference in Hong Kong on Thursday, Zelter was asked how private credit would perform in an economic downturn.

“The biggest question I get from everybody around the globe is, is private credit a bubble?” said Zelter. “And I would say it’s not a bubble, but it’s certainly been long in the tooth in the cycle.

“Bubble means there’s very much irrational actions, and while I think there are folks that are probably taking [a] more aggressive portfolio construction than I would take, I don’t think it’s a bubble where you’re going to find the massive losses that you saw in other bubbles since I’ve been around,” he added.

Apollo is dominant in private credit and has made a major push in recent years into extending credit not only to the mid-market groups that have traditionally tapped the market but also to some of the world’s largest companies.

Private credit groups — which raise funds from investors and make loans directly to businesses — have boomed as rising interest rates have led investors to plough larger sums into their funds. They are increasingly playing a role previously held by banks, which face tighter regulation.

The IMF said in its Global Financial Stability Report last year that private credit assets had grown to about $2.1tn, and while the lending could create economic benefits, “the sector has never experienced a severe economic downturn at its current size and scope”.

“Such an adverse scenario could see a delayed realisation of losses followed by a spike in defaults and large valuation markdowns,” the report said.

“If the asset class remains opaque and continues to grow exponentially under limited prudential oversight, the vulnerabilities of the private credit industry could become systemic.”

Zelter said Apollo defined private credit as “really anything that’s on a financial institution balance sheet” and added that most of it was investment-grade. He described private credit as “a $40 trillion ocean”.

Credit is “about a $600bn business” for Apollo, while private equity, which Zelter described as the group’s “historic expertise”, is “about a $100bn business”, he said.

At the HSBC event, Zelter also said there was a “tug of war” taking place in the global economy between “inflationary forces versus the deflationary forces of AI and technology”.

“It’s our view that the inflationary forces are going to be taking the headline over the next six to 12, 18 months before the real deflationary impact of AI comes into play,” he said.

https://www.ft.com/content/23707b5f-ff72-4d96-9171-26a536013fb0