Andrew Tate lost $67,500 on a leveraged WLFI position on Tuesday, then immediately opened another long bet on Trump’s crypto token.

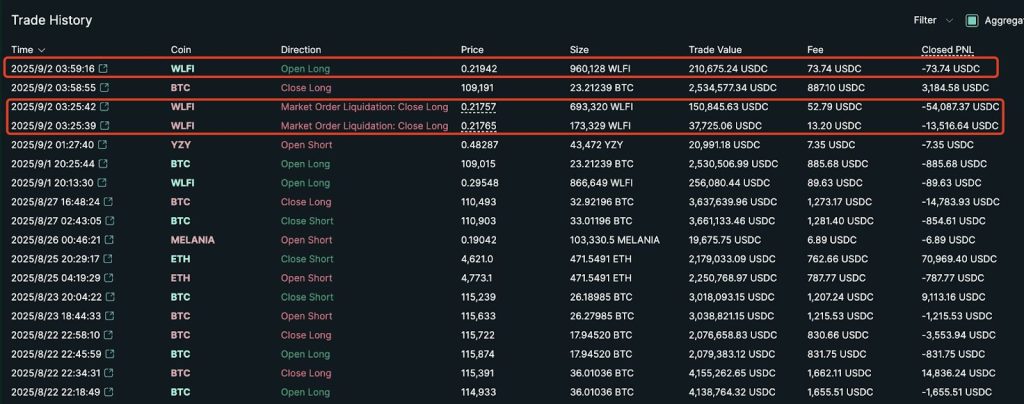

The controversial influencer’s liquidation on Hyperliquid extends his trading losses to nearly $700,000 across 80 trades with just a 36% win rate.

Tate reopened his WLFI position within minutes of the liquidation, continuing his pattern of high-leverage crypto betting despite the broader market downtime.

The setback follows a rare $16,000 profit from shorting Kanye West’s YZY token two weeks earlier at 3x leverage.

Trading Record Shows Consistent Losses

Blockchain analytics firm Lookonchain reported Tate’s WLFI position was liquidated six hours before their Tuesday morning update, wiping out his $67,500 investment.

Within minutes of the liquidation, Tate had reopened a long position on WLFI, betting again on the token’s price appreciation despite the fresh loss.

His latest WLFI bet occurred one day after the Trump family-tied token began trading on major exchanges Monday, ending months of private-only sales.

The token crashed from $0.331 to $0.210 within hours as 24.6 billion newly unlocked tokens entered circulation.

By Tuesday morning, WLFI recovered slightly to trade above $0.242, though it remained over 21% below its launch price according to CoinMarketCap data.

Tate’s liquidation occurred during this initial volatility period, with his leveraged position eliminated as prices fell below his entry point.

The WLFI loss continues a troubling pattern on Hyperliquid, where only 29 of his 80 trades have generated profits, resulting in $699,000 cumulative losses.

His August short on YZY at 3x leverage stands as a rare profitable position among his losing streaks.

Earlier in June, Tate also held a 25x leveraged long position on Ethereum, though blockchain analysis later revealed the trade resulted in steep net losses despite his claims of 138.5% profit.

Before his active engagement in trading, the former kickboxer previously launched his own meme token, Daddy Tate ($DADDY), on Solana, which reached a $124.57 million market cap in July 2024 before collapsing and was later dubbed as another influencer scam project.

Technical Vulnerabilities Compound Market Risks

While Tate battles personal trading losses, WLFI itself faces systematic security threats that could affect its long-term viability and add significant complexity for holders and active traders.

Security researchers at SlowMist recently identified coordinated attacks targeting WLFI token holders through critical vulnerabilities in Ethereum’s EIP-7702 upgrade implemented in May.

The report shows that hackers have systematically exploited the upgrade’s delegation features to install malicious smart contracts that automatically drain wallets containing WLFI and other tokens upon receipt.

Over 97% of EIP-7702 delegations have been linked to identical wallet-draining contracts designed specifically to sweep incoming funds, creating widespread risks for token holders.

These technical problems compound WLFI’s existing market challenges, as the token continues trading more than 21% below its launch price.

Meanwhile, the Trump family’s paper wealth reportedly surged by $6 billion on WLFI’s trading debut, with the family controlling nearly 25% of all tokens through locked holdings.

World Liberty Financial proposed a token buyback and burn program using protocol fees to create artificial demand, although specific details about fee amounts or implementation timelines weren’t mentioned.

The post Andrew Tate Gets Liquidated for $67K on WLFI, Immediately Bets Again With a Long Position appeared first on Cryptonews.

https://cryptonews.com/news/andrew-tate-gets-liquidated-for-67k-on-wlfi-immediately-bets-again-with-a-long-position/