Key Takeaways:

- Ethereum price outlook remains weak, with analysts expecting a difficult month and no clear signs of a near-term rebound.

- A drop below $2,000 is possible, as ETH continues to underperform Bitcoin during market corrections.

- The gap between Ethereum’s strong fundamentals and its price action persists, despite its central role in crypto infrastructure.

- Bitcoin’s behavior remains the key driver. Until BTC shows stability, pressure on Ethereum and altcoins is likely to continue.

- Privacy coins have re-entered the spotlight, led by Zcash and Monero, as regulatory pressure and surveillance concerns grow.

- For Ethereum, the issue is timing, not relevance. Long-term confidence remains, but the short-term outlook stays cautious.

Pessimism has returned to the market. Things look weaker now, and investors are starting to feel it again.

Ethereum price looked bullish back in January. ETH even managed to climb above $3,300 for a short time. That optimism has faded. The risk is now much clearer, and losing the $2,000 level is no longer a distant scenario.

This brings back a familiar issue, one that has been discussed repeatedly over the years. The disconnect between Ethereum’s strength as an ecosystem and the performance of its token.

Ethereum has become the backbone of crypto infrastructure. Many major projects would not exist without it today. Yet the price of ETH still fails to reflect that role.

Over the past four years, Ethereum has set only two new all-time highs, one in 2021 and another in 2025. There was little difference between the two. In 2025, ETH never managed to break above $5,000, despite widespread expectations that it would.

Analysts continue to point to Ethereum’s importance as an ecosystem. In the long run, forecasts remain optimistic. But the price tells a different story, and the outlook here is far less convincing. Some analysts still believe ETH can perform well this year, yet expectations for the near term are noticeably more cautious.

In this month’s Cryptonews report, we spoke with experts about what to expect from Ethereum price and altcoins in the weeks ahead, and why patience may matter more than optimism right now.

A Familiar Setup From Last Year

Before looking ahead, it helps to look back about a year. The setup feels familiar, even if the timing is not exactly the same.

In December 2024, the crypto market peaked alongside Bitcoin, which climbed above $110,000 for the first time. The broader market had been trending higher since August, riding a steady uptrend. Then momentum faded, and prices started to roll over.

By February 2025, Bitcoin had dropped to around $97,000, while Ethereum was trading near $2,800. Those levels are not far from where the market stands today. The difference lies in how quickly things played out. In 2026, prices have already moved closer to the lower end of those ranges.

Among the top 10 cryptocurrencies by market capitalization, Solana was hit the hardest. A year ago, SOL was trading near $200. Today, it sits closer to $90.

In a separate Bitcoin report, Cryptonews noted that in April 2025, Bitcoin found a bottom near $74,000. A recovery followed, eventually pushing Bitcoin to a new all-time high. Only after that rebound did Ethereum begin to move higher, something it had struggled to do for years. That sequence feels relevant again.

The market has been under pressure since October 2025, a month many now describe as a crypto crash. The timing is different this time, but the backdrop feels familiar. Both downturns followed Donald Trump’s taking office. Now, the pressure is even heavier. Macroeconomic uncertainty, tariffs, and geopolitics are all weighing on crypto at once.

Why Ethereum Price and Crypto Feel More Fragile

Speaking with Cryptonews, Gavin Thomas, CEO and co-founder of TEN Protocol, explained why Bitcoin and the broader crypto market are currently more sensitive than traditional assets:

Geopolitical tensions are not easing up and with crypto being a 24h trading industry the Bitcoin movements are potentially an early indicator of how global TradFi markets are going to react when they open.

Thomas added that this environment is more likely to scare smaller holders than large players. Big investors, he said, are more inclined to keep accumulating. That includes Michael Saylor, one of Bitcoin’s most vocal supporters:

It will be the smaller holders selling into the Bitcoin slide whilst mega whales will continue to accumulate. Chatter around MicroStrategy’s Bitcoin position being underwater will be playing on many people’s minds but the reality is Saylor has plenty of options available to manage their risk and avoid forced selling.

For now, the focus remains on Bitcoin. How buyers respond to corrections matters. If Bitcoin shows stability and strength, Ethereum may get its chance to recover.

If Bitcoin continues to struggle, pressure will spread across the crypto market. There may be exceptions. Some tokens can still rally sharply, even against the trend. But for Ethereum, everything still depends on Bitcoin.

How Low Could Ethereum Price Fall?

Thomas said Ethereum could fall below the $2,000 level. He also explained why ETH currently feels more fragile than Bitcoin:

Ethereum has always been more volatile than Bitcoin. Ethereum could well hit $1,800 because it historically underperforms compared to Bitcoin.

Expanding on that view, Thomas said a drop below $2,000 would not be surprising. A strong rebound, however, looks unlikely in the near term.

Ethereum may continue to struggle for now. New price peaks are probably off the table this month. At the same time, he stressed that the broader picture has not changed.

That said, the Ethereum ecosystem continues to grow, innovate and attract the attention of institutions who are ready to move some of their business on-chain. There are very few alternatives to Ethereum for companies serious about using blockchain technology.

This structural strength is unlikely to translate into a new all-time high anytime soon. Thomas believes that moment will come later.

Instead it will strengthen Ethereum’s rally at the back end of this current cycle.

A similar view was shared by Tanisha Katara, a blockchain governance consultant and researcher for Avail, Filecoin, and Polygon. She said she does not expect a meaningful upside move from the market this month either.“

I’ve seen this movie before in 2018, March 2020, and post-FTX. Each time felt like the end; each time created generational entry points for those with conviction and patience. This month, I am not seeing the structural conditions for a V-shaped recovery.

Katara added that corrections like this always feel uncomfortable. That does not make them unusual:

However, in the long run, this will pay off, and I’m an informed optimist about that.

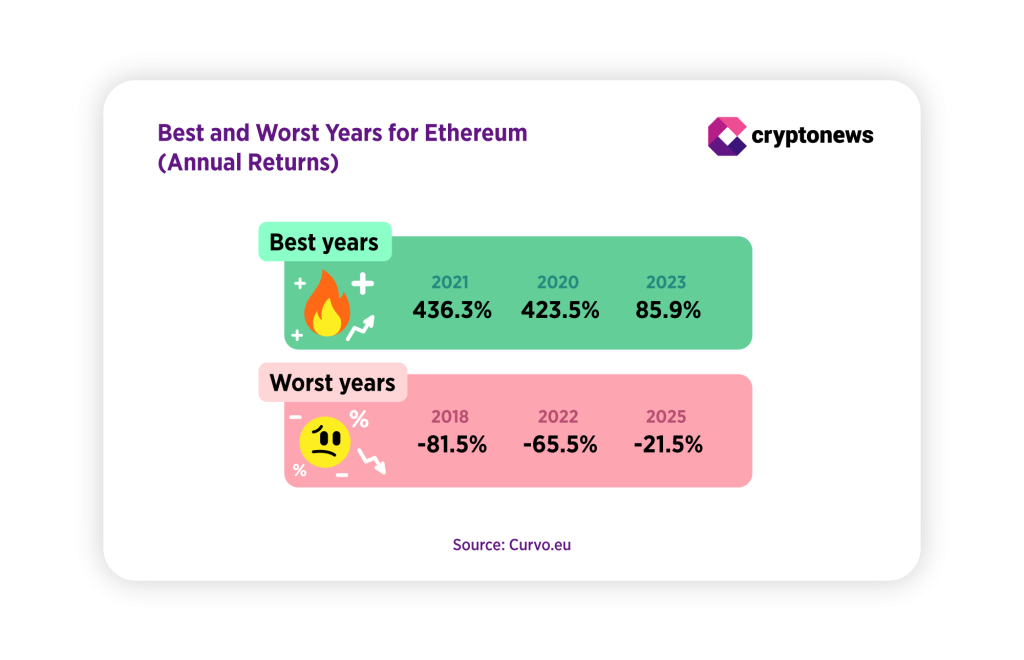

Data from Curvo.eu shows that Ethereum’s last strong performance year was 2023, when ETH gained roughly 86%. The standout year remains 2021, when Ethereum surged by 436%.

By contrast, 2025 now ranks among Ethereum’s weaker years, with a decline of around 21.5%. In the context of the broader crypto market, where sharp corrections are common, this drop is not extreme. It has been disappointing for many investors. Expectations for 2025 were high. A new all-time high near $5,000 was widely anticipated. So far, that scenario has failed to materialize.

Where the Market Is Looking Now

Since October, privacy coins have been quietly moving back into focus. The rally started with Zcash, then spread to Monero. What was once a sidelined niche has turned into one of the more talked-about segments of the market.

Experts say the renewed interest is not random. Growing regulatory pressure, tighter compliance rules, and rising concerns around surveillance are pushing some investors toward privacy-focused assets. That said, the broader market still matters. Sentiment remains fragile, and privacy coins are not immune to wider crypto trends.

Cais Manai, CPO and co-founder of TEN Protocol, told Cryptonews that what we are seeing now looks more like a structural shift than a short-lived trade:

After years on the sidelines, crypto privacy has staged one of the most convincing sector comebacks in the market. Since autumn 2025, privacy-focused assets have been among the strongest performers in crypto, outperforming many large-cap tokens during a period of broader market weakness. This is not a short-term anomaly. It reflects a deeper shift in how investors, users, and institutions are thinking about transparency, surveillance, and the future of blockchain infrastructure.

Manai added that the recent rally in privacy coins following Zcash may still be in its early stages:

The key takeaway for investors is that crypto privacy is no longer a contrarian side bet. It is becoming a core design requirement for on-chain systems operating in a surveilled world. The rally that began in late 2025 looks less like a peak and more like the opening phase of a longer structural repricing.

Eneko Knorr, CEO of Stabolut, shared his view that the rally in privacy coins reflects growing tension between the crypto market and regulators:

Monero and Zcash are rallying because they are the only honest money left, but let’s be real: we are heading for a street fight. Governments hate what they can’t control, so they will continue bullying centralized exchanges into delisting these tokens to choke off their liquidity.

Not all experts are equally optimistic. Tanisha Katar urged investors to separate short-term price action from long-term fundamentals. At the same time, Katara noted that privacy-focused technologies are likely to keep evolving, even if their role in regulated markets remains limited:

Privacy coins like Monero and Zcash are having a moment, but I’d separate the price action from the investment thesis. Privacy coins solve for anonymity — hiding who you are entirely. That works for certain use cases, but it’s fundamentally incompatible with institutional adoption. You can’t satisfy AML (anti-money laundering) requirements with a coin designed to make transactions untraceable. That’s why we’re seeing delistings and the EU’s 2027 ban on privacy coins from regulated platforms.

Privacy coins are not the only area drawing attention right now. Alongside renewed interest in anonymity, another part of the market is moving in the opposite direction. As regulation tightens, some investors are leaning into clarity rather than avoiding it. This is where euro-pegged stablecoins come into focus.

Frank Combay, COO of Next Generation NGPES, told Cryptonews that the EUR stablecoin market has entered a new phase following the rollout of MiCA:

The EUR-pegged stablecoin market, while still a fraction of its dollar-pegged counterpart, has entered a transformative phase of accelerated growth following the EU’s landmark MiCA regulation. After a pre-MiCA contraction, the sector reversed course in 2025, with its combined market capitalization doubling to nearly $700 million. Monthly transaction volumes have surged nearly ninefold to over $4 billion, signaling early adoption, even if the market remains small compared to dollar-based stablecoins.

Combay added that this year could be decisive for the sector, as growth increasingly depends on real-world use cases rather than crypto-native demand alone.

We see 2026 as a make-or-break year for EUR stablecoins. Growth now depends on moving into the financial mainstream, from settling tokenized real-world assets to functioning as efficient payment rails. With MiCA providing legal certainty and banks becoming less reluctant to engage, euro stablecoins have a clear path to broader adoption.

Conclusion

Ethereum sits between strong fundamentals and weak price action. Analysts see little reason to expect a meaningful rebound this month, especially while Bitcoin struggles to regain stability. In this environment, a move below the $2,000 level cannot be ruled out.

At the same time, few question Ethereum’s role in the broader crypto ecosystem. The issue is not demand, technology, or long-term relevance. It is timing. Until market conditions improve and Bitcoin finds firmer footing, Ethereum’s price is likely to remain under pressure, even as its long-term case stays intact.

February 2026: Crypto and Macro Events to Watch

February 5

- USD — ISM Non-Manufacturing Prices, Jan

- USD — ISM Non-Manufacturing PMI, Jan

- USD — Initial Jobless Claims

February 6

- Hyperliquid (HYPE) — 9.92M Token Unlock

February 8

- Sei (SEI) — V6.3 Mainnet Upgrade (Approx.)

- USCR (USCR) — Stablecoin Applications

February 10

- USD — Retail Sales (MoM), Dec

- USD — Core Retail Sales (MoM), Dec

February 11

- USD — CPI (MoM), JanUSD — CPI (YoY), Jan

- USD — Core CPI (MoM), Jan

February 12

- USD — Initial Jobless ClaimsFebruary 13USD — Existing Home Sales, Jan

February 16

- Arbitrum (ARB) — 92.65M Token Unlock

February 20

- USD — S&P Global Services PMI, Feb

- USD — S&P Global Manufacturing PMI, Feb

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

https://cryptonews.com/reports/ethereum-in-a-bloodbath-analysts-expect-a-lost-month-for-eth-price/