Key Takeaways:

- Bitcoin dominance has dropped below 60%, sparking speculation that an altcoin season could begin if it moves toward the 50% threshold.

- Experts point to Ethereum and Solana as ecosystems best positioned to benefit from capital rotation, thanks to strong network activity and institutional interest.

- Solana ecosystem tokens like Marinade and Raydium surged in August, while Ethereum projects such as Ethena saw triple-digit growth before a correction.

- While momentum is building, analysts warn there’s no guarantee of an altcoin season just because it’s happened in previous cycles. Market conditions and Bitcoin’s movement remain key variables.

After a strong rally in July and parts of August, the altcoin market is now in wait-and-see mode. Despite a recent pullback, Ethereum (ETH) continues to hold above $4,100, while Bitcoin (BTC) slipped below the $110,000 mark.

Bitcoin dominance has dropped below 60%, down from 66% earlier this summer, according TradingView. For many analysts, the key trigger for a true altcoin season would be a drop below 50%. That would signal a stronger capital rotation into Ethereum and the broader altcoin market.

Still, the big question remains: can this cycle mirror previous ones, or is the market evolving past that narrative? In this Cryptonews Report, we examine what to expect next.

Bitcoin Dominance Falls — Is an Altcoin Season Coming?

With Bitcoin dominance slipping below 60%, the market appears to be entering a new phase. Historically, such levels have preceded a rotation into Ethereum and other altcoins. But does this mean an altcoin season is really about to begin?

Eneko Knorr, CEO and founder of Stabolut, believes conditions are setting up for a potential altcoin season, though he warns it’s not guaranteed:

My general take is that the stage is set for a potential ‘altseason.’ We usually see money rotate from Bitcoin into the major alts after a big BTC run, and ETH’s latest pump feels like the first inning of that move. But I’d caution that history is a guide, not a guarantee…We’re not owed an altseason just because it happened before.

Knorr sees signs that the market may be entering a new phase of altcoin momentum, but urges caution against assuming history will repeat itself:

That said, the whole space is on much firmer ground than in past cycles. With the spot ETFs, banks getting involved, and real adoption happening, there’s a nice tailwind giving everything a lift.

Leo Zhao, Investment Director at MEXC Ventures, suggests that current market dynamics could create the right conditions for altcoins to gain momentum in September, especially if Bitcoin remains in a sideways trend:

While Ethereum and Solana hold key levels, September could mark the inflexion point where altcoins finally step into the spotlight if Bitcoin continues to consolidate. The path won’t be linear, but the foundations are for a stronger and more diversified market cycle.

Ethereum and Solana Ecosystems Lead the Altcoin Push

Eneko Knorr notes that Ethereum continues to attract institutional capital, while Solana has established itself as a strong alternative among Layer-1 networks:

Altcoins look poised for a strong September. Ethereum remains the top choice for institutional capital, as most tokenization activity is unfolding on its platform. A powerful magnet for long-term capital. When it comes to the ‘Layer 1 wars,’ Solana has pretty much won the silver medal. It’s fast, the ecosystem is buzzing, and it’s captured the attention of both developers and users. It’s become a must-have for anyone serious about this space.

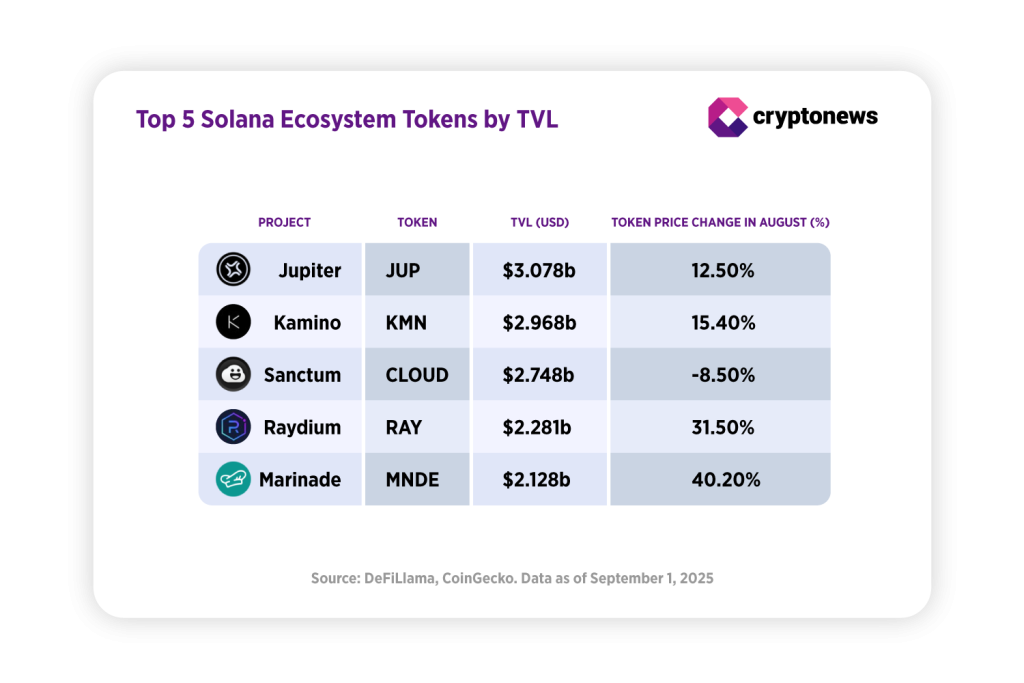

Several Solana-based tokens with the highest total value locked (TVL) showed notable price increases in August. Among the top five, Raydium (RAY) and Marinade (MNDE) stood out with gains of 31.5% and 40.2%, respectively. These projects are closely tied to key activity on Solana: Marinade focuses on liquid staking, while Raydium serves as a major DEX, especially popular among meme coin traders.

The only exception in the group was Sanctum (CLOUD), which posted a decline of 8.5%. Overall, most native tokens tied to Solana’s DeFi ecosystem responded positively to market dynamics, indicating investor interest despite broader uncertainty.

While Solana-based tokens saw more aggressive price moves in August, Ethereum’s ecosystem remained a magnet for long-term capital. Among projects with the highest TVL, Lido (LDO) and Aave (AAVE) posted solid gains of 30.4%and 25.3%, respectively. Meanwhile, newer players like Ethena (ENA) also drew attention with a price jump from $0.23 to $0.83 over the summer. That’s an increase of more than 260%, before pulling back in late August.

According to Leo Zhao, tokens like ENA reflect a broader shift toward real-world applications on Ethereum:

Ethena has grown into one of the most discussed tokens due to its synthetic dollar and yield model. It is now inching closer to the intersection of stablecoin demand and DeFi innovation. These types of tokens, ones that extend Ethereum’s utility into real-world use cases, may capture disproportionate interest should altseason momentum build.

Zhao also sees broader potential in infrastructure-related assets built around Ethereum. He believes that scaling solutions and DeFi protocols remain well-positioned if market interest in altcoins continues through September.

Final Thoughts: Is September the Start of a True Altcoin Season?

September brings mixed signals. Bitcoin dominance has dropped, Ethereum is holding above $4,100, and major Layer-1 ecosystems like Solana are showing strong token activity. While it’s too early to confirm a full-fledged altcoin season, the conditions are more favorable than in past cycles, according to experts.

Investor attention is shifting toward real-world use cases, infrastructure plays, and DeFi innovation. If Bitcoin continues to consolidate and macro data stays neutral, altcoins could take the spotlight, but history offers no guarantees.

Staying selective and watching for key support levels will be crucial. Whether this becomes the breakout month for altcoins or another false start will depend on how the market responds to September’s events.

Key Crypto Events to Watch in September 2025

- September 2 — Ethena (ENA) Token Unlock

Ethena unlocks 40.63 million ENA tokens, potentially affecting price volatility and staking dynamics. - September 3 — Ondo (ONDO) Expands to U.S. Markets

Ondo Finance opens global access to U.S. markets, marking a major milestone for its tokenized securities platform. - September 11 — XRP: Future of Onchain Finance Event

XRP Ledger hosts an event covering the latest in DeFi, infrastructure, and innovation on XRPL. Starts at 3 PM UTC. - September 28 — Jupiter (JUP) Token Unlock

Jupiter unlocks 53.47 million JUP tokens (~1.75% of circulating supply) at 2 PM UTC, which may impact short-term price action. - By September 30 — Bitcoin Staking Launches on Starknet (STKR)

Starknet introduces Bitcoin staking with sustainable rewards, enhanced security, and new developer tools. Expected by the end of Q3.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

The post Altcoin Season in September? What This Month’s Report Reveals appeared first on Cryptonews.

https://cryptonews.com/reports/altcoin-season-in-september-what-this-months-report-reveals/