Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

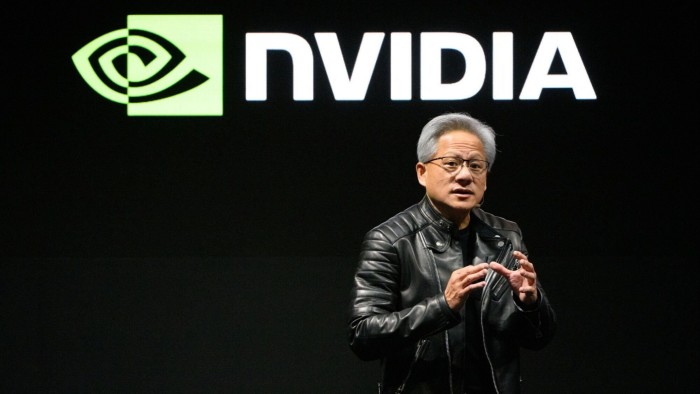

Whisper it softly, but is some of the investor fervour around Nvidia cooling just a little? The chipmaker has been a phenomenon, riding the surging demand for its artificial intelligence-empowering chips. The stock has jumped 180 per cent this year, fuelling about a fifth of the S&P 500’s gains in the process.

But trading volume in Nvidia has slowed in recent months with the average number of shares changing hands down 40 per cent from the first half of the year. And over the past six months, its shares are up just 3 per cent compared with more than 11 per cent for the S&P 500. In the last month, Nvidia shares have actually fallen about 9 per cent.

The retreat may simply be year-end profit-taking but it comes as investors consider how the developments in AI will play out in 2025 — probably one of the biggest new year calls they have to make given how important the technology is in driving returns.

“There’s a tension between momentum, which is very powerful in the early stages of technology adoption, and valuation,” says Vanguard chief economist Joe Davis, whose team has mapped the impact of tech adoptions since the Industrial Revolution and who warned recently the market may have got ahead of itself given the early stage of AI development. “If I had a longer horizon, I think being a smart investor would be saying, ‘OK, who’s going to utilise the technology? Who’s going to develop the technology?’”

So far, the companies that have done best in stock market terms are those such as Nvidia, which play a role akin to the sellers of shovels to speculators in a gold rush, facilitating the boom.

Investors have also already backed energy utilities, with nuclear providers Vistra and Constellation Energy both in the top 10 S&P 500 performers this year. In a sign of surging demand for power for AI-related uses, Microsoft in September signed a 20-year deal with Constellation that involves the reopening of the Three Mile Island nuclear plant.

Jonathan Bram, an infrastructure specialist and senior managing director at BlackRock, points to a recent meeting between OpenAI’s Sam Altman and the White House where the AI pioneer asked for help building a series of 5-gigawatt data centres to support AI development. For context, each would need roughly the output of five nuclear reactors.

“It tells you how challenging it’s going to be to build that infrastructure, as well as to provide the power to energise it,” says Bram, a founder of investment firm Global Infrastructure Partners. “We’re seeing trillions of dollars of potential opportunity to commit capital.”

Infrastructure in an AI sense could also include groups such as cloud providers, data-centre owners and security software companies — a sector with Palantir, the only S&P 500 stock to have gained more than Vistra and Nvidia, and the only one to have quadrupled in value.

However, increasingly investors will be looking to pick out which companies actually benefit from the use of AI. David Kostin, Goldman Sachs’ chief US equity strategist, outlined this year what he believes will be four phases of investor focus on AI — Nvidia, then AI infrastructure, AI-enabled revenues and AI productivity gains. Now, he says, we are about to move on to the third phase.

“Our thesis is in calendar 2025, we’re going to see a transition from the beneficiaries . . . of the infrastructure spending to the AI spending,” Kostin adds. Potential winners in this phase include software and IT services companies that can generate revenue from their AI-enabled products. Companies highlighted by Kostin’s team recently include Datadog, MongoDB and Snowflake, which help companies manage cloud-based data and infrastructure. Microsoft also made its list.

Phase four, should it happen, are the industries that would be transformed by AI as personal computers and the internet have previously revolutionised the way we operate.

“Ultimately, the bull case from here is the idea that we’re moving back to a productivity-focused corporate America — where companies were actually focused on the hard stuff like productivity and efficiency,” says Savita Subramanian, head of US equity & quantitative strategy at Bank of America, who’s predicting a rally of about 10 per cent in the S&P 500 next year. “We think that AI is part of that productivity and efficiency story, but there are also other routes that should drive that benefit, including digitisation, automation — themes that we’re already seeing come to fruition.”

There are a lot of bold predictions on how AI will change the world. Who knows how many will come to fruition? Given that, here-and-now productivity gains that can be measured through the revenue and costs lines in quarterly updates have a lot of appeal to more cautious investors.

jennifer.hughes@ft.com

https://www.ft.com/content/b0a0ddda-9b87-4c98-b012-cb3a51dc5e69