If diplomats were on TikTok, “de-risk” would be trending. The word has suddenly become popular among officials trying to loosen China’s grip on global supply chains but not cut ties entirely, with the joint communiqué from this weekend’s Group of 7 meeting making clear that the world’s largest democratic economies will now focus on “de-risking, not decoupling.”

The former is meant to sound more moderate, more surgical. It reflects an evolution in the discussion over how to deal with a rising, assertive China. But the word also has a vexing history in financial policy — and since the debate over de-risking will continue, we all might as well get up to speed.

How De-risking Went Viral

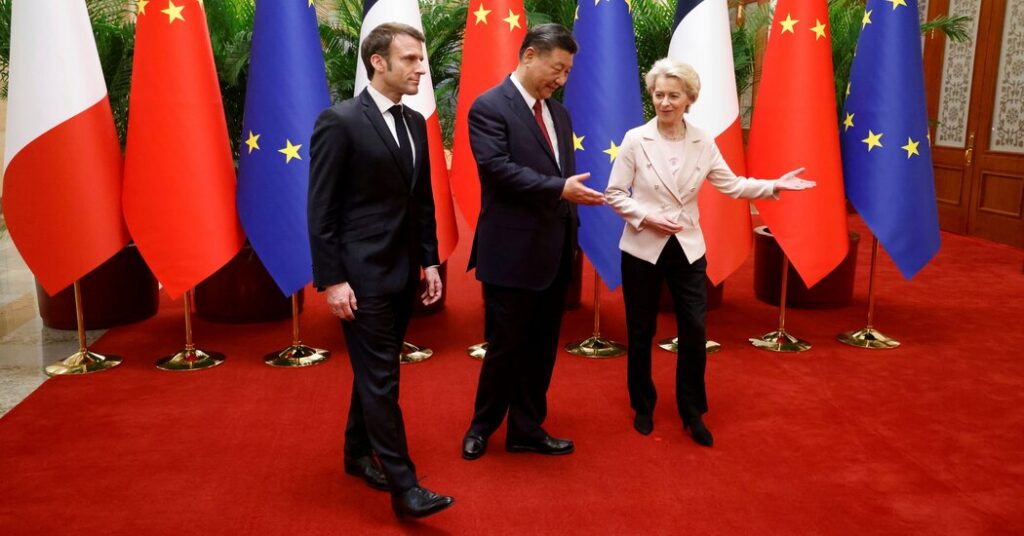

“De-risking” relations with China caught on after a speech by the European Commission president, Ursula von der Leyen, on March 30, when she explained why she’d be traveling to Beijing with President Emmanuel Macron of France, and why Europe would not follow the calls for decoupling that began under President Trump.

“I believe it is neither viable — nor in Europe’s interest — to decouple from China,” she said. “Our relations are not black or white — and our response cannot be either. This is why we need to focus on de-risk — not decouple.”

German and French diplomats later pressed for the term in international settings. Countries in Asia have also been telling American officials that decoupling would go too far in trying to unravel decades of successful economic integration.

In an interview, David Koh, Singapore’s cybersecurity commissioner, explained that the goal should be safety, with separation in some domains and cooperation in others.

“I think we derive a huge amount of economic, social and safety value when systems are interoperable,” he said. “I want my plane to take off from Singapore and land safely in Beijing.”

What worries globalized economies, he added, is “bifurcation,” with Chinese markets and manufacturing on one side, and American-approved supply chains on the other.

These arguments appear to have worked in de-risking’s favor. On April 27, the U.S. national security adviser, Jake Sullivan, used the word in a major policy speech.

“We are for de-risking, not for decoupling,” he said. “De-risking fundamentally means having resilient, effective supply chains and ensuring we cannot be subjected to the coercion of any other country.”

On May 17, S. Jaishankar, the Indian foreign minister, added his voice, saying it was “important to de-risk the global economy and yet to ensure that there is very responsible growth.”

What China Thinks

To the Chinese government, unsurprisingly, “de-risking” isn’t much of an improvement.

“There is a sense that ‘de-risking’ might be ‘decoupling’ in disguise,” the state-run Global Times wrote in a recent editorial. It argued that Washington’s approach had not strayed from “its unhealthy obsession with maintaining its dominant position in the world.”

Some commentators in the region are also de-risk skeptics. “A substantial change in policy?” asked Alex Lo, a columnist for The South China Morning Post. “I doubt it. It just sounds less belligerent; the underlying hostility remains.”

De-risking’s Sordid History

Before it entered diplo-speak, de-risking had a long life in the response to American government sanctions against terrorism and money laundering, where it’s associated with overreaching.

According to the Treasury Department, “de-risking refers to financial institutions terminating or restricting business relationships indiscriminately with broad categories of customers rather than analyzing and managing the specific risks associated with those customers.”

In other words, de-risking — in its common usage, pre-April — carries negative connotations of unnecessary exclusion.

Human rights groups, for example, have condemned how banks de-risk by denying service to aid agencies that work in places like Syria, fearing fines if an organization strays into a gray zone of providing aid to nations under sanction.

A 2015 report from the Council of Europe offered an additional critique: “De-risking can introduce further risk and opacity into the global financial system, as the termination of account relationships has the potential to force entities and persons into less regulated or unregulated channels.”

That means de-risking leads to enforcement challenges: Dubious and legitimate actors move into darker corners and innovate, making their actions harder to manage.

Takeaway

De-risking’s history highlights the challenge facing the world’s democracies: how to disconnect from China enough to reduce the threat of coercion, without encouraging paranoia or rogue behavior that causes unneeded harm.

De-risking requires tough, in-the-weeds decisions and solutions. Which semiconductors must be kept out of China’s hands? Do all medical devices need to be produced somewhere other than China? What could TikTok do to firewall the risks of being owned by a Chinese company?

De-risking may feel more diplomatic than decoupling. “Who doesn’t like reducing risk?” said Bates Gill, director of the Asia Society’s Center for China Analysis. “It’s just rhetorically a much smarter way of thinking about what needs to be done.”

To make it work, the United States and it allies will need to do more thinking and regulation writing for some businesses, while allowing others to stay in China, which is navigating its own push to become self-sufficient.

In the sanctions world, sifting risk from fair treatment and economic benefit is an imperfect, evolving challenge — so will it be with China.