Key Takeaways:

- Monero surged toward $800 after trading near $450 just a week earlier, bringing privacy coins back into focus.

- Zcash’s strong rally in late 2025 helped revive interest in the privacy sector and set the stage for Monero’s move.

- Monero has now overtaken Zcash in market capitalization, becoming the leading privacy coin.

- Monero continues to face regulatory pressure and exchange delistings, adding extra risk to the rally.

- With the broader crypto market still fragile, some traders are turning to privacy coins as an alternative play in 2026.

Monero’s price recently came close to the $800 level. Just a week ago, XMR was trading near $450. This move has brought privacy coins back into the spotlight.

Privacy coins have been part of the crypto market for a long time. At one point, many of these projects faded into the background. Interest dropped, and the sector went quiet. That changed in autumn 2025, when Zcash surprised the market.

Now, attention has shifted to Monero. For many traders, the situation feels familiar. The setup looks similar to what happened with Zcash. The key difference is that ZEC failed to hold above $1,000. The question is whether XMR can do better.

Monero Overtakes Zcash

During the summer, ZEC was trading around $30. By November, its price surged above $750. This happened while the broader crypto market was selling off after Oct. 10.

For many traders, Zcash became a safe haven. Even after corrections, the ZEC price repeatedly returned to the $450 level and above.

This renewed interest pushed privacy coins back into the conversation. Many in the crypto community began to discuss why privacy-focused projects still matter. The rally also created strong FOMO. At one point, it looked like the momentum was fading. Still, Zcash managed to hold above $400, despite claims that its price structure looked like a “Burj Khalifa” pattern. That term is often used to describe sharp rallies that end in equally sharp crashes.

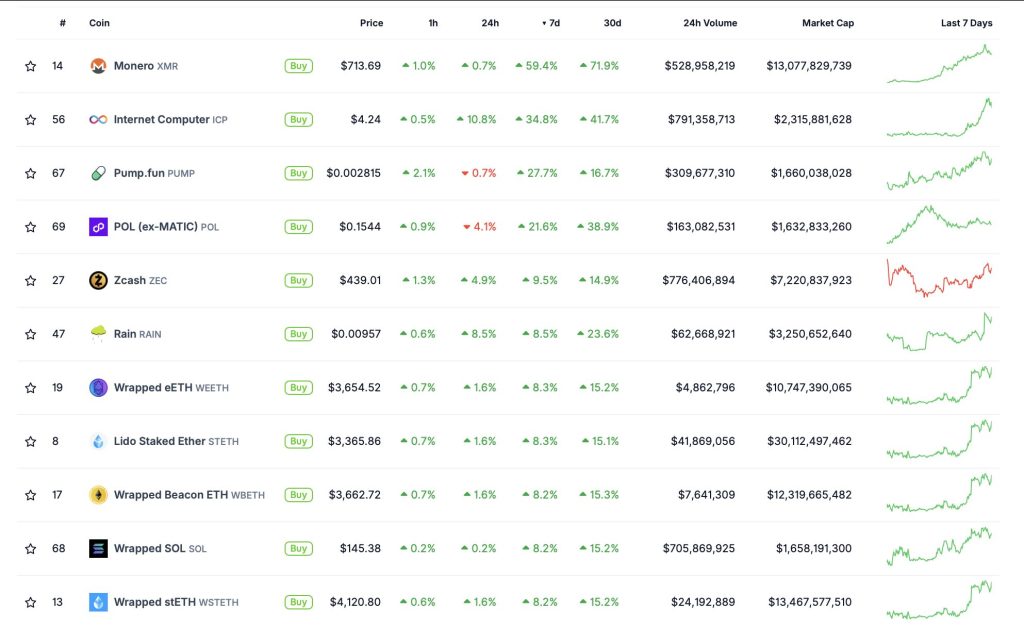

Most of the top privacy coins are now posting gains. Over the past seven days, Monero’s price has risen by nearly 60%. Zcash is also higher, though more modestly, with gains of around 10%.

Another standout is Dash, which outperformed both with a 114% increase.

For now, the spotlight remains on Monero. XMR has taken the lead in the privacy sector by market capitalization. Zcash has moved into second place.

It is worth noting that Monero’s rally is happening under more favorable market conditions. Since early January, some altcoins, including meme coins, have started to recover. The gains remain selective, but sentiment is stronger than it was during Zcash’s rally in 2025.

At that time, rumors circulated that ZEC was heavily overbought. There were also claims of strong insider activity. The broader market backdrop was weaker.

The Dark Side of Monero

The past few years have not been easy for Monero. Several major centralized exchanges removed XMR from trading. Binance delisted Monero in 2024.

These decisions followed regulatory pressure in multiple countries. Monero has often been linked to money laundering allegations. Such accusations are frequently paired with concerns around terrorism financing.

Another key difference between Monero and Zcash lies in transparency. Zcash has a known team. There have even been rumors linking the project to Satoshi Nakamoto, though none are confirmed.

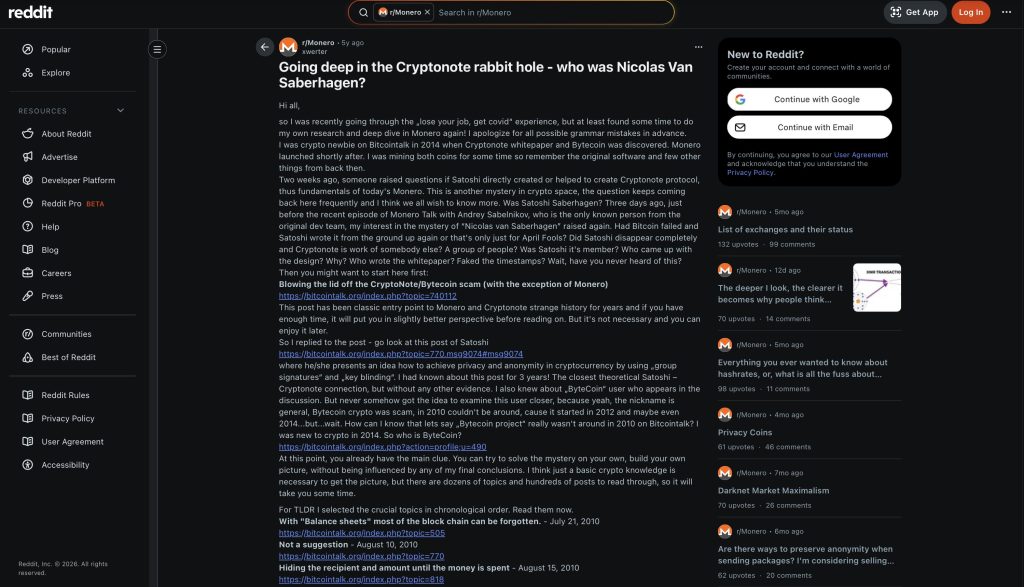

Monero’s founders, by contrast, remain anonymous. One name often mentioned is Nicolas van Saberhagen. Most believe this is a pseudonym. His real identity has never been established. In 2013, Nicolas van Saberhagen published the CryptoNote white paper. That protocol later became the foundation for Monero.

Community members have tried to uncover more details. A Reddit post explored possible links between CryptoNote and early Bitcoin ideas. No direct connection was found. While Satoshi Nakamoto never worked on CryptoNote, early Bitcoin discussions show that similar privacy concepts were already being explored years earlier.

Can Monero Reach $1,000?

Monero has quickly overtaken Zcash in market positioning. Part of this move is supported by stronger overall conditions. Zcash’s rally in 2025 played an important role. It showed that privacy coins were not gone. As a result, the sector regained credibility.

Several analysts now see privacy coins as one of the more interesting narratives for 2026.

With much of the crypto market still struggling, some traders view privacy coins as a defensive play. This can attract capital into the sector. Where capital flows, liquidity follows. And that often leads to sharp price moves.

Monero’s price has already approached the $800 level. On Jan. 14, it briefly touched $797.73, marking a new all-time high. This is higher than Zcash reached during its own rally.

Still, risks remain. XMR is trading near its highs. Caution is warranted. So far, 2026 has shown that the market is searching for alternatives. For now, privacy coins have once again moved to the top of the list.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

https://cryptonews.com/exclusives/can-monero-do-better-than-zcash-as-privacy-coins-return/