In Summary:

- South Africa, Egypt and Nigeria anchor Africa’s machinery landscape, each posting multibillion-dollar equipment markets driven by mining, construction and large-scale public works.

- Fast-growing economies such as Angola, Ghana and Kenya show strong machinery import momentum, supported by expanding infrastructure pipelines and urban development.

- Smaller markets including Namibia, Togo and Mauritania stand out for exceptional per-capita consumption and double-digit CAGR growth in excavators and earth-moving equipment.

- Across the continent, 2024 to 2025 data confirms rising demand for excavators, loaders and public-works machinery as African countries scale up roads, housing, utilities and industrial projects.

Deep Dive!!

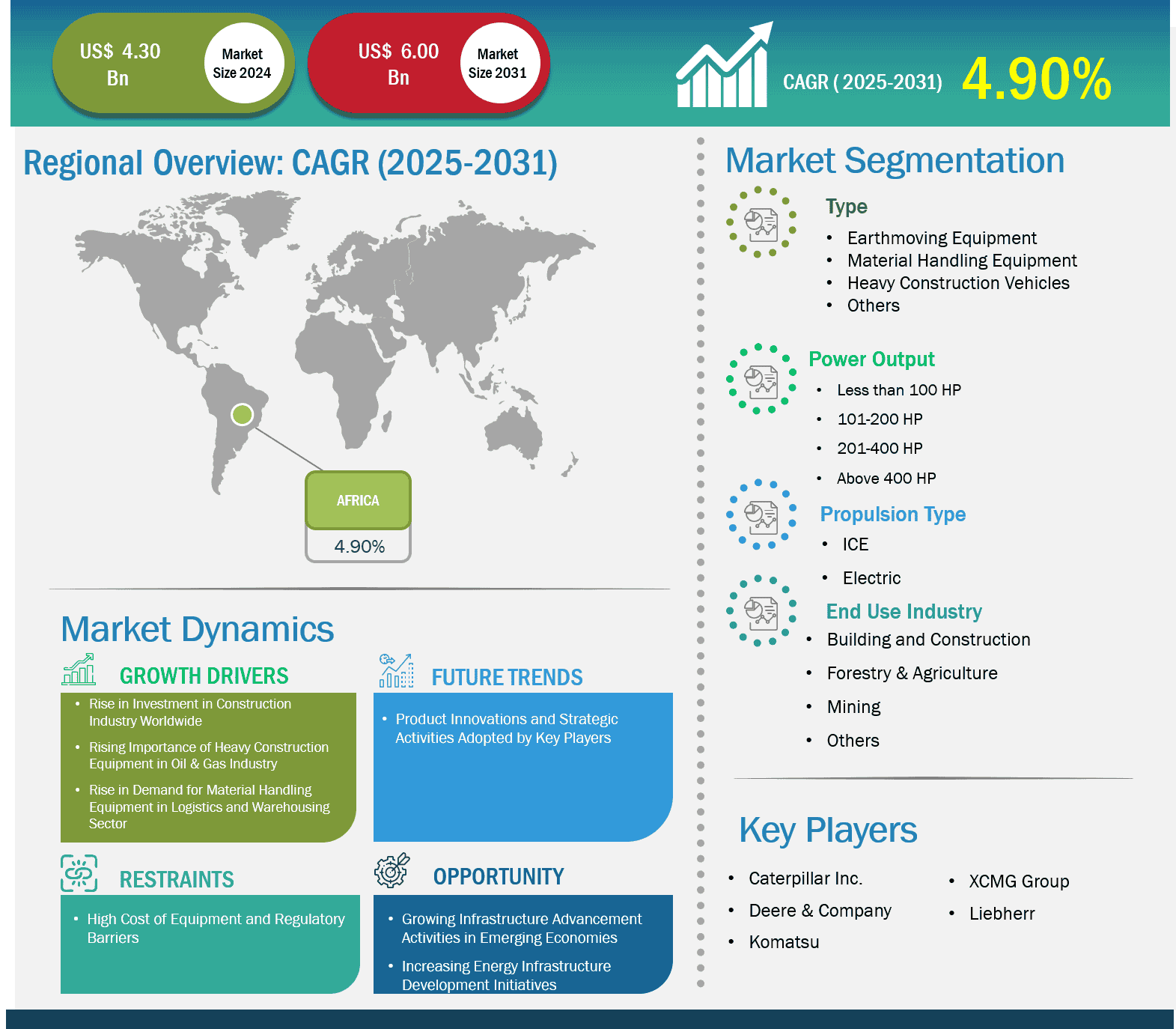

Friday, 28 November 2025 – Africa’s construction machinery market is expanding at a pace that mirrors the continent’s broader push for infrastructure, urban growth and industrial development. Across major economies, governments are investing in roads, housing, energy projects and transport corridors, which has created a strong pull for excavators, loaders, cranes and public-works machinery. By the end of 2024, several African countries recorded notable jumps in equipment imports and domestic consumption, with manufacturers reporting rising demand for efficient and durable machines that can operate across diverse terrains. This momentum forms the backdrop for understanding which countries now lead the continent in machinery market size heading into 2025.

What emerges from recent industry data is a clear pattern: the largest construction machinery markets are the same economies driving Africa’s biggest infrastructure pipelines and mineral extraction projects. Nations such as South Africa, Egypt, Nigeria, Kenya and Ethiopia influence regional demand due to their scale of construction output and the volume of public-works commitments they undertake. Other fast-growing markets like Angola and Ghana also demonstrate how mining activity and urban expansion translate into significant machinery consumption. Together, these trends offer a useful picture of where investment is flowing and why certain countries stand out as the continent’s heavy-equipment hubs in 2025.

Below, we have highlighted the top 10 African countries with the largest construction machinery markets in 2025, based on data from IndexBox and independent economic reports across the continent.

10. Namibia

Namibia’s role in Africa’s construction machinery market may not be defined by sheer volume, but rather by its unusually high per capita consumption, a signal that its demand for heavy equipment is disproportionately strong relative to its population. In 2024 the country registered the highest consumption rate of construction equipment blades on the continent, with an estimated 184 units per 1,000 persons. This places Namibia well ahead of most African peers, and marks it as a country where heavy machinery demand is concentrated relative to population size.

That elevated per capita consumption suggests Namibia is leveraging heavy equipment disproportionately in its building, earth moving, and infrastructure sectors. While larger economies like Nigeria or South Africa naturally consume more units overall, Namibia’s consumption intensity points to targeted infrastructure investment, possibly in public works, housing developments or mining related earth works. Its growing annual consumption, which has increased at an average annual rate of +13.0 percent per capita over 2013–2024, indicates persistent and rising demand over the last decade.

In the broader 2025 ranking of African countries with the largest construction machinery markets, Namibia’s niche lies in strong per capita uptake rather than sheer scale. This nuance underscores why Namibia should feature among the top ten the country reflects how smaller populations can still drive heavy machinery demand when infrastructure needs, industrial activity or procurement policies align. In doing so, it demonstrates that Africa’s machinery market landscape includes both large volume giants and smaller but intensely active niche markets.

9. Togo

Togo stands out among smaller African economies thanks to its rapid long term growth in demand for construction and earth moving machinery, particularly excavators and shovel loaders. According to a 2025 overview by IndexBox, over the period 2013–2024, Togo recorded a compound annual growth rate (CAGR) of approximately +13.1 percent in machinery consumption, signalling stronger infrastructure activity and increasing importation of heavy equipment.

This growth trend suggests that Togo’s infrastructure development, be it road works, housing, or public works projects, is generating consistent demand for heavy machinery, even though absolute consumption remains lower than continental giants. While in 2024 Togo was not among the top three volume consuming countries, its rate of increase outpaces many others.

Within the 2025 ranking of African nations with the largest construction machinery markets, Togo occupies an important niche. Its strong growth trajectory reflects rising investment in infrastructure and signals to suppliers and manufacturers that smaller markets offer meaningful opportunities, adding depth and dynamism to Africa’s broader construction equipment landscape.

1715687905.webp)

8. Mauritania

Mauritania may not lead Africa in total volume, but its trajectory in heavy machinery demand, especially mechanical shovels, excavators, and related earth moving equipment, stands out for its rapid growth. According to a 2025 report from IndexBox, Mauritania achieved the fastest compound annual growth rate (CAGR) among leading African consuming countries between 2013 and 2024, at around +15.9 percent.

This sharp growth suggests that Mauritania’s infrastructure and possibly mining or resource driven sectors are driving consistent and accelerating demand for heavy duty equipment. While total machinery consumption remains lower than in major African economies, the per capita consumption metric, 5.6 excavator/shovel units per 1,000 persons in 2024, places the country among the top for intensity of usage on a per person basis.

In the broader 2025 ranking of African markets for construction machinery, Mauritania captures attention not for size but for momentum. Its strong growth curve and rising per capita equipment uptake illustrate how smaller economies can become meaningful, high-growth machinery markets. This makes Mauritania a noteworthy case of infrastructure-driven demand adding diversity to Africa’s heavy machinery landscape.

7. Ghana

Ghana remains one of Africa’s most important markets for construction machinery, particularly when it comes to mechanical excavators and earth moving equipment. In 2024 the country consumed about 38,000 units of mechanical shovels, excavators, and shovel loaders, placing it among the top three in terms of volume on the continent.

In value terms, Ghana’s market for such heavy machinery was estimated at roughly $1.2 billion in 2024, a strong signal that infrastructure, mining, and road building projects are driving significant demand for earth moving equipment in the country. Given the combination of volume and value, Ghana accounts for a substantial share of Africa’s total mechanical equipment market, alongside larger economies such as South Africa and Angola.

This data underscores Ghana’s critical role in shaping the continent’s heavy machinery landscape. As urbanization, infrastructure upgrades, and industrial or mining activity continue, Ghana’s sustained demand for excavators and similar equipment positions it not only as a major machinery market today, but also as a promising growth environment for suppliers and investors looking to tap Africa’s infrastructure-driven expansion.

6. Angola

Angola holds a prominent place among Africa’s key markets for heavy construction machinery, particularly in mechanical shovels, excavators and earth moving equipment. In 2024 the country consumed approximately 44,000 units, making it second only to Johannesburg Stock Exchange (via South Africa) in volume among African nations.

In terms of market value, Angola’s demand translated into roughly $1.4 billion for excavators and related equipment, the second largest market value on the continent that year, just after South Africa. This strong valuation reflects ongoing infrastructure expansion and mining driven equipment requirements, as both sectors rely heavily on earth moving machinery for roads, development projects, and resource extraction.

Given its combination of high consumption volume and substantial value, Angola is clearly a heavyweight in Africa’s construction machinery landscape for 2025. The country’s ongoing infrastructure and mining activities suggest continued demand for heavy equipment, making it an important market to watch for suppliers, investors, and policymakers targeting growth in Africa’s industrial and construction sectors.

5. Ethiopia

Ethiopia has emerged in 2025 as one of Africa’s leading markets for public works and construction machinery, reflecting the country’s broad investment in roads, utilities, and infrastructure. According to recent data, Ethiopia led the continent in 2024 public works machinery consumption with about 21,000 units, ahead of other major markets such as South Africa and Kenya.

This strong demand is supported not only by high consumption but also by local production: Ethiopia accounted for roughly 31 percent of Africa’s total public works machinery output in 2024, making it the largest producer on the continent. These figures suggest that domestic construction and infrastructure activity are creating substantial demand for earth moving and public works equipment.

Given these trends, Ethiopia stands out in the 2025 ranking of African countries with the largest construction machinery markets, not because it necessarily matches the largest economies in sheer volume, but because its internal demand, production capacity, and infrastructure pipeline combine to produce a heavy machinery market that is both robust and growing.

4. Egypt

Egypt remains a heavyweight in Africa’s construction machinery market thanks to the sheer scale of its construction sector, in 2024 it accounted for about 37.8 percent of all construction activity across the continent. This dominance reflects a continuous push for new infrastructure, residential developments, transport networks, and urban expansion, which together fuel a high underlying demand for heavy equipment such as excavators, earth moving machines and related construction gear.

Although specific data on Egypt’s total machinery market value are less frequently published compared with larger markets, analyses of its construction equipment segment demonstrate strong demand for earth moving machinery. For example, in 2023 2024 earthmoving equipment accounted for the largest share of Egypt’s construction equipment sales, driven primarily by infrastructure investment and transport-sector expansion. The prevalence of crawler excavators, suited for Egypt’s sandy terrain, as nearly 90 percent of the equipment used also underscores how local conditions influence heavy machinery demand patterns.

In the 2025 ranking of African countries with the largest construction machinery markets, Egypt’s broad construction-market share and consistent infrastructure investment make it a key player — not just by volume but by baseline demand intensity. As long as megaprojects, urban growth, and transport upgrades continue (especially in major nodes like Greater Cairo, coastal zones and new smart city developments), Egypt’s demand for heavy machinery will likely remain robust, cementing its position among the continent’s top machinery markets.

3. Kenya

Kenya has become one of the fastest growing markets for construction machinery in East Africa, driven by a surge in infrastructure, urban development, and public works activity. Massive projects, including road networks, rail corridors, housing developments, and utilities expansion, have increased demand for heavy equipment such as excavators, loaders, cranes and wheel loaders.

Recent market research shows that heavy construction equipment in Kenya is seeing rising demand partly because contractors and developers are seeking efficient and cost effective solutions. As of 2024, large scale excavators, 3–5 ton wheel loaders, and mid range cranes (26–100 ton capacity) dominated imports and usage, indicating that both major infrastructure jobs and more modest urban construction projects are fueling machinery demand.

In the context of 2025 Africa wide rankings, Kenya’s strong and growing heavy machinery sector places it among the continent’s top construction equipment markets. Its combination of sustained public works demand, infrastructure investments, and openness to imported heavy equipment means Kenya remains an attractive market for manufacturers, suppliers, and investors focusing on the continent’s infrastructure expansion.

2. Nigeria

Nigeria remains a major player in Africa’s heavy machinery market, driven by a mix of construction, oil & gas, housing, public works and industrial expansion that steadily fuels demand for earth moving and heavy equipment. According to a 2025 market industry report, the country’s “heavy construction equipment” sector was valued at about $421.67 million in 2024. Despite this headline figure, broader market analysis sources estimate Nigeria’s total machinery market, across construction, industrial, and infrastructure segments, at around $25 billion, indicating a much larger ecosystem when aggregated.

Within that machinery market, earth moving equipment (excavators, loaders, bulldozers) holds the dominant share, owing to widespread infrastructure initiatives: road construction, residential housing, power plant installations, and oil & gas related infrastructure. The pressure from rapid population growth and urbanization has created a constant need for heavy construction gear, a trend reinforced by government plans, such as the long term infrastructure master plan, to elevate national infrastructure stock significantly.

Given the combination of sectoral diversity, persistent demand, and broad applications (from mining to housing to public works), Nigeria’s heavy machinery market stands out as one of the largest and most dynamic in Africa. Its scale may still be catching up with the continent’s biggest machinery consuming economies in per unit value, but the breadth of demand, across industry, infrastructure, and development, secures Nigeria a top 10 place in the 2025 ranking of African countries by machinery market size and potential.

1. South Africa

South Africa remains the leading African nation when it comes to demand for construction machinery. According to a 2024 report by IMARC Group, the country’s construction equipment market was valued at about $1.75 billion. This high valuation reflects robust demand for excavators, earth moving machinery, compact loaders and other heavy equipment, a demand driven not only by urbanization and infrastructure expansion, but also by mining and industrial activity.

This leadership stems from South Africa’s active infrastructure and development agenda. Ongoing and planned investments in urban development, road upgrades and mining projects are creating steady demand for versatile and efficient machinery. As IMARC notes, compact excavators and fuel efficient machines are especially in demand, reflecting a shift among contractors toward cost effective, sustainable and multipurpose equipment. This trend signals greater sophistication and modernization in the machinery market, with buyers increasingly considering operational efficiency and long term value over basic acquisition.

Looking ahead, South Africa’s construction machinery market appears set for continued growth. The same IMARC report projects that market value could reach approximately $2.92 billion by 2033, assuming steady growth in construction, infrastructure and related sectors. With such dynamics, South Africa strongly anchors the 2025 ranking of African countries with the largest and most advanced construction machinery markets, offering suppliers, investors and policymakers a stable base of demand and opportunity.

We welcome your feedback. Kindly direct any comments or observations regarding this article to our Editor-in-Chief at [email protected], with a copy to [email protected].

https://www.africanexponent.com/top-10-african-countries-with-the-largest-construction-machinery-markets-2025/