In Summary

- Kenya, South Africa, and Ghana lead Africa in mobile banking adoption in 2025, with Kenya maintaining the highest per-capita mobile-money usage globally, driven by M-Pesa and strong fintech competition.

- West and East Africa remain key growth regions, showing strong adoption through interoperability reforms, agent expansion, and improved digital infrastructure.

- Rising smartphone penetration and supportive regulation across other markets continue to accelerate financial inclusion and drive the continent’s shift toward a cashless digital economy.

Deep Dive!!!

Saturday, 25 October 2025 – Mobile banking continues to reshape Africa’s financial landscape in 2025, bridging access gaps and redefining how individuals, small businesses, and institutions interact with money.

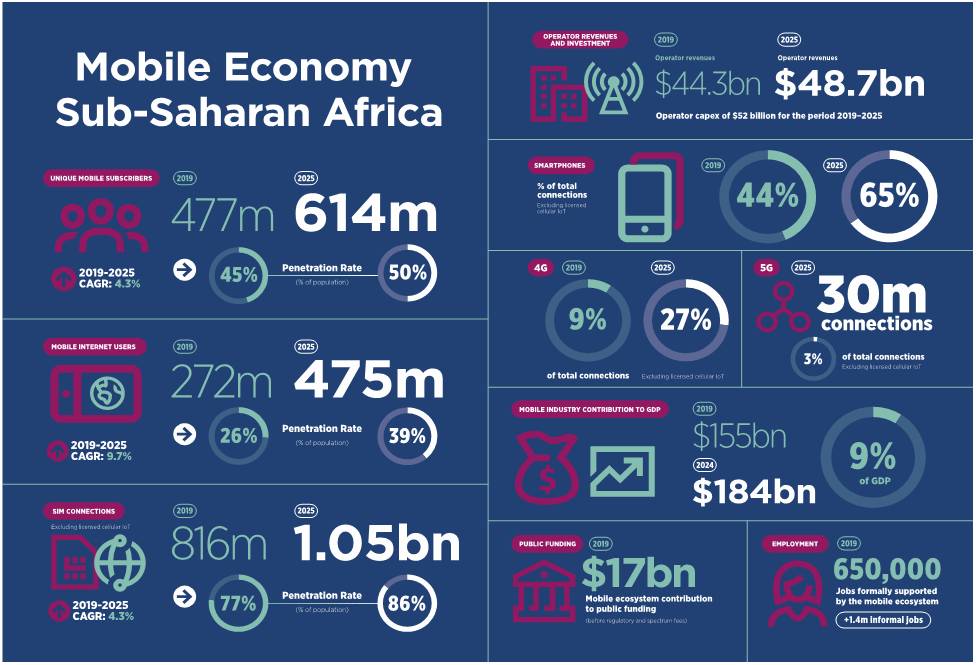

According to the GSMA’s 2025 State of the Industry Report on Mobile Money (SOTIR), sub-Saharan Africa remains the global epicenter of mobile financial innovation, accounting for more than 70% of the world’s mobile-money transactions. As smartphone penetration deepens and mobile networks expand, millions of Africans now rely on mobile platforms for payments, savings, credit, and investment, turning mobile banking into both a driver and a reflection of economic inclusion.

Across the continent, mobile banking adoption has moved beyond simple transfers to encompass full digital-finance ecosystems powered by fintechs, telcos, and traditional banks. Countries such as Kenya, Ghana, South Africa, and Côte d’Ivoire have established strong regulatory and infrastructure foundations that support scale, while Nigeria, Tanzania, and Uganda continue to record rapid year-on-year growth through agent banking, digital wallets, and app-based services. These trends are reinforced by regulatory openness, interoperability frameworks, and partnerships between mobile operators and banks that have made cashless transactions more trusted, faster, and accessible even in rural areas.

This ranking of the Top 10 African Countries with the Largest Adoption of Mobile Banking in 2025 draws from verified datasets and analyses, including the GSMA SOTIR 2025, central bank payment statistics, and operator financial disclosures. It highlights not only where mobile banking is most widely used but also the structural, economic, and technological forces driving this transformation. Together, these insights illustrate how mobile finance has evolved from a niche service into a continental growth engine, empowering millions and positioning Africa at the forefront of global digital banking innovation.

10. Mozambique

Mozambique’s ascent in mobile banking adoption is best explained by a rapid build-out of agent networks and pragmatic regulator-led policies that widened access to basic financial services. Since 2023 the number of electronic-money agents has exploded, with official Banco de Moçambique data showing a jump in access points and a double-digit rise in mobile-money agents through 2024–2025. This agent density, now covering all districts and reaching well into rural areas, has been the single most powerful driver of adoption, turning simple feature-phone wallet use into a mainstream channel for cash-in/cash-out, bill payments and person-to-person transfers.

Behind the agent story sits stronger market competition and operator activity. Vodacom’s M-Pesa, alongside local offerings such as mKesh and e-Mola, have increased product choice and marketing reach; operator reports and industry trackers document steady growth in registered accounts and transaction volumes. Interoperability efforts between mobile wallets and bank accounts, encouraged by the central bank and reflected in the National Financial Inclusion Strategy, have helped shift some users from purely cash workflows to more permanent stored-value relationships, nudging Mozambique up regional adoption rankings even if volumes remain smaller than West Africa’s largest markets.

The macro impact is visible: financial-inclusion indicators reported by the central bank show mobile money accounts per 100 adults climbing into triple digits by late-2024, while electronic-money institutions reported rising profits and greater deposit mobilisation. GSMA’s 2025 industry report places Mozambique among the faster-growing mobile-money markets by agent growth and account penetration, noting that the country’s trajectory is a template for how operator–regulator cooperation and donor-backed inclusion projects can accelerate uptake. Still, the scale of economic activity per user and average ticket sizes remain below headline markets, reflecting lower incomes and continuing reliance on cash for higher-value transactions.

Looking ahead, Mozambique’s mobile banking story is one of promising foundations mixed with structural constraints. Continued growth will depend on (1) deepening smartphone and internet penetration to enable richer bank-app services, (2) improving agent sustainability and liquidity management, and (3) expanding formal savings and credit products accessible through wallets. The central bank’s NFIS 2025–2031 emphasises these priorities, and if implemented alongside sustained operator investment and interoperability improvements, Mozambique could move from a notable growth market to a regional exemplar of inclusive digital finance. Risks to that path include macro volatility, agent attrition where margins compress, and the need to manage AML/CFT and consumer-protection issues as volumes scale.

9. Democratic Republic of Congo (DRC)

The Democratic Republic of Congo (DRC) has emerged as one of Africa’s fastest-growing markets for mobile banking and mobile-money services in 2024–25, driven by rapid mobile penetration and a surge in digital-financial adoption in urban centres. Mobile connections rose sharply between 2024 and 2025, with millions of new SIM and data connections added, helping expand the potential user base for wallets and bank apps across cities such as Kinshasa and Lubumbashi. Large operators and fintech entrants have raced to capture this expanding addressable market, rolling out agent networks, simple wallet products and merchant acceptance points that make digital payments workable for everyday commerce.

Industry trackers and field studies show an extraordinary rise in registered mobile-money accounts and active users from a low base: some analyses report triple-digit percentage growth in mobile-money adoption over a three-year period ending in 2024. That momentum isreflected in growing agent density and transaction volumes, especially in urban corridors where cash logistics are costly and bank branches are sparse. International operators and local mobile-money providers are therefore focusing on city-led scale first, using agent liquidity networks and merchant onboarding to increase frequency of use and move customers up the value chain from transfers to payments, savings, and merchant acceptance.

At the same time, the DRC’s mobile-banking story is uneven and faces significant constraints that temper near-term upside. Data reliability remains a challenge, national statistics are patchy and much activity occurs off-the-books in informal channels, while infrastructure gaps (power, last-mile connectivity), intermittent regulation, AML/CFT weaknesses and security concerns in eastern provinces complicate scaling to a national footprint. Humanitarian and government payments pilots have also exposed operational frictions (for example, suspension of some mobile cash disbursements to address reconciliation shortfalls), underscoring the need for stronger operator-bank integration and compliance processes before the market can safely absorb very large value flows.

Looking ahead, the DRC offers a large-scale opportunity for mobile banking to accelerate financial inclusion if three conditions are met: (1) continued expansion of affordable mobile and broadband access to convert connection growth into active digital-finance users; (2) strengthened agent liquidity management, interoperability and commercial partnerships between telcos, banks and fintechs to broaden use cases beyond P2P; and (3) clearer regulatory and AML frameworks to bring informal flows into regulated rails. If these conditions hold, the DRC’s rapidly growing base of mobile users and rising fintech activity could translate into a durable, urban-led mobile-banking ecosystem that becomes a major contributor to inclusive digital finance in Central Africa.

8. Angola

Angola’s mobile banking sector has expanded rapidly through 2024–2025, reflecting a broader post-liberalisation shift in the country’s financial and telecommunications environment. Following the easing of foreign exchange restrictions and reforms by the Banco Nacional de Angola (BNA) to promote digital payments, the financial ecosystem has become more open to innovation. Improved mobile and broadband coverage, now reaching over 60% of the population according to GSMA’s State of Mobile Internet Connectivity 2025, has given rise to a surge in mobile wallet and banking app adoption. Urban centres such as Luanda, Benguela, and Huambo have become focal points of this transformation, where increased smartphone penetration and youth-driven digital literacy are helping to transition from cash-based to digital transactions.

Data from the GSMA Mobile Money Metrics 2025 and the World Bank’s Global Findex 2024 Update indicate that registered mobile money accounts in Angola grew by more than 35% year-on-year, driven by both telco-led platforms and commercial bank apps. Institutions like Banco de Fomento Angola (BFA), Banco Económico, and Standard Bank Angola have expanded mobile-banking features, while fintechs such as Unitel Money have gained traction with simple, interoperable wallet products. These developments have also been encouraged by the BNA’s 2023–2024 regulatory reforms, which streamlined agent-network operations and allowed non-banks to participate more fully in digital payments — creating a more competitive and dynamic market landscape.

Despite these gains, challenges persist in extending mobile banking beyond urban and peri-urban zones. The rural population still faces limited connectivity and financial literacy barriers, and cash remains dominant for informal and small-scale transactions. Additionally, network downtimes, agent liquidity constraints, and occasional currency volatility continue to affect user confidence in digital financial services. Nevertheless, donor-funded digital inclusion programs, including the World Bank’s Financial Sector Development Project and UNDP-backed fintech acceleration initiatives — are addressing these limitations through agent training, digital skills programs, and investment in network infrastructure.

Looking forward to 2025 and beyond, Angola’s mobile-banking ecosystem is expected to mature significantly as regulatory clarity, telecom competition, and fintech integration converge. The introduction of interoperable payment systems under the BNA’s Sistema Nacional de Pagamentos and the continued rise of smartphone affordability will enable seamless transactions across banks, wallets, and merchants. As a result, Angola stands out in Southern Africa as one of the few post-oil economies successfully leveraging financial technology to enhance inclusion, increase formal financial participation, and reduce the urban-rural divide in digital finance adoption.

7. Tanzania

Tanzania remains one of Africa’s most advanced mobile money markets in 2024–2025, maintaining a mature ecosystem that integrates seamlessly with its banking and payments infrastructure. According to the GSMA State of the Industry Report on Mobile Money (SOTIR) 2025, over 40 million registered accounts and more than 20 million active users are now recorded, supported by a nationwide agent network exceeding 280,000 outlets. This extensive reach has enabled even low-income and rural households to engage in digital transactions for daily needs such as school fees, bills, and micro-trade settlements. Tanzania’s success stems from its early liberalization of the mobile money space and proactive regulatory frameworks under the Bank of Tanzania (BoT), which have encouraged multiple operators, including Vodacom’s M-Pesa, Airtel Money, and Tigo Pesa, to compete and innovate within an interoperable ecosystem.

The financial inclusion rate in Tanzania has climbed impressively, with over 78% of adults now having access to formal financial services, up from 66% in 2017 (Finscope Tanzania 2024). The government’s National Financial Inclusion Framework (NFIF) 2023–2028 further prioritizes digital financial inclusion as a core enabler of poverty reduction and economic resilience. As a result, mobile money is no longer seen merely as a payment tool but as a gateway to broader financial services. Partnerships between telcos, fintech startups, and banks have led to the rollout of mobile-based microloans, savings products, and insurance schemes, expanding the utility of mobile platforms well beyond person-to-person transfers. The increasing integration of bank apps with mobile wallets, particularly through APIs and open-banking regulations, is blurring the lines between traditional banking and mobile financial ecosystems.

Tanzania’s regulatory environment has also played a pivotal role in fostering innovation. The BoT’s interoperability mandate, which allows users to send and receive funds across different networks, has significantly improved convenience and transaction efficiency. Furthermore, ongoing infrastructure investments, particularly in mobile broadband expansion through Tanzania Telecommunications Corporation (TTC), have improved reliability and network coverage, ensuring even remote regions can access digital financial services. The World Bank’s Digital Tanzania Project (2024 update) notes that the growth of fintech and digital ID systems is helping to formalize more of the informal economy, a critical factor in sustaining long-term digital adoption.

As of 2025, Tanzania’s mobile banking sector is transitioning toward greater sophistication, with data-driven credit scoring, smartphone app adoption, and digital merchant payments gaining ground. The continued expansion of 4G and pilot 5G networks is set to enhance user experience and facilitate more advanced mobile banking solutions. With a strong regulatory foundation, high adoption rates, and continuous innovation, Tanzania stands as a model for mobile financial inclusion in Sub-Saharan Africa. Its experience demonstrates how well-coordinated policy, competition, and infrastructure investment can drive the transformation from basic mobile money transfers to a fully integrated digital banking ecosystem.

6. Nigeria

Nigeria’s mobile-banking landscape accelerated sharply through 2024–2025, driven by a convergence of rising smartphone penetration, aggressive fintech activity, and incumbent banks rapidly upgrading mobile apps. Institutional data show dramatic growth in electronic-payments activity: the Central Bank of Nigeria (CBN) reported that mobile-payment volumes rose by 19% and values by 30% in H1 2024 (3.49 billion transactions valued at ₦159.4 trillion), while NIBSS and industry trackers recorded large year-on-year increases in instant and mobile transfers into 2025. These headline figures underline that more Nigerians are using phones as primary financial access points, not just for peer-to-peer transfers, but increasingly for merchant payments, bills and bank-style services.

Several market forces explain this adoption. A deepening fintech ecosystem, led by players such as Moniepoint, OPay, PalmPay, Paystack/Flutterwave and others—has broadened product choice (wallets, merchant acquiring, embedded payments, micro-loans) and distribution (agency banking and merchant POS). PalmPay and other app-first challengers have leveraged smartphone OEM partnerships and aggressive user-acquisition strategiesto scale quickly, while traditional banks invested heavily in app features, open-banking APIs and merchant integrations. At the same time, infrastructure improvements (NIBSS instant rails, growing POS coverage) and interoperability drives are making digital payments cheaper and faster, lifting both volumes and average wallet functionality.

Yet adoption is not without constraints. Cash remains deeply entrenched across Nigeria’s informal economy, and issues such as agent liquidity management, network reliability, fraud and compliance costs continue to slow full migration from cash. Regulatory clarity has improved, but fintech funding cooled in 2024, which tightened expansion capital for some challengers, and AML/CFT vigilance has increased operational costs for providers. Data quality and market fragmentation also mean national-level active-user rates vary by source, so measuring true financial inclusion gains requires triangulating central-bank statistics, NIBSS payments data and independent surveys. Policymakers and operators must therefore balance rapid growth with strengthened consumer protection and settlement-level controls.

Looking ahead, Nigeria’s mobile-banking trajectory remains robust. Continued improvements in smartphone affordability, further rollout of NIBSS instant-payment capacity and deeper bank-fintech partnerships will expand use cases, especially merchant payments, digital credit and savings products delivered through apps. If regulators sustain supportive, proportionate frameworks (promoting interoperability and safeguarding consumers) and operators address agent liquidity and fraud, Nigeria is set to convert its scale advantage (population and growing connectivity) into sustained mobile-banking penetration that meaningfully advances financial inclusion and digital commerce across the country.

5. Uganda

Uganda’s mobile-banking sector has matured into one of East Africa’s most dynamic ecosystems, with adoption levels remaining strong through 2024–2025. According to the Bank of Uganda (BoU) Annual Payment Systems Report 2025, the number of active mobile-money accounts surpassed 34 million, a substantial rise from about 29 million in 2023. Transaction volumes reached over 5.8 billion during 2024, reflecting consistent double-digit growth, while total transaction value exceeded UGX 195 trillion (≈USD 50 billion). The dominance of mobile-based financial services has effectively positioned mobile platforms as Uganda’s primary channel for domestic money transfers, merchant payments, savings, and microcredit.

This widespread usage is underpinned by a robust network of agents and increasing interoperability between service providers. Uganda’s regulatory reforms, especially the implementation of the National Payment Systems Act (2020) and its subsequent operational guidelines, have encouraged competition and enhanced consumer protection, spurring innovation among telcos and banks alike. Operators such as MTN Mobile Money Uganda Ltd and Airtel Money continue to dominate the sector, but newer fintech entrants are offering digital banking apps that bridge wallets with formal financial institutions. This has allowed users to easily transfer funds between mobile accounts and bank accounts, boosting both inclusion and convenience.

The shift toward mobile-banking apps has accelerated as smartphone penetration improves, estimated at 52% in 2025, according to the GSMA State of Mobile Internet Connectivity Report 2025. Digital lenders like Eversend, Chipper Cash, and Wave have also expanded their offerings beyond simple remittances, now providing savings, cross-border payments, and small loans directly through mobile platforms. These trends reflectUganda’s transition from basic mobile-money usage to comprehensive mobile banking, where mobile apps increasingly replicate traditional banking services.

Looking forward, Uganda’s trajectory is expected to remain positive. The BoU’s National Financial Inclusion Strategy 2025–2030 emphasizes deepening digital finance infrastructure and broadening access to rural and low-income populations. Challenges remain, such as high transaction fees and intermittent network downtimes, but the combination of regulatory support, interoperability, and the expanding fintech ecosystem gives Uganda a competitive edge. By 2025, it stands among Africa’s leaders in mobile-banking adoption, exemplifying how coordinated policy, innovation, and user trust can converge to drive sustainable financial inclusion.

4. Côte d’Ivoire

Côte d’Ivoire continues to stand out as one of West Africa’s fastest-growing mobile-banking markets in 2024–2025, consolidating its position as a key player in the region’s digital financial landscape. According to the GSMA State of the Industry Report on Mobile Money (SOTIR) 2025, the country recorded over 28 million registered mobile-money accounts, with more than 13 million active users, marking a year-on-year increase of nearly 10%. This surge reflects both urban and rural adoption, supported by the rapid expansion of telecom-led financial ecosystems such as Orange Money, MTN Mobile Money, and Moov Money, which dominate the country’s financial transactions. The volume of mobile-money transactions in 2024 surpassed CFA 85 trillion (≈USD 140 billion), highlighting the growing reliance of Ivorians on digital finance for remittances, bill payments, and merchant transactions.

The Ivorian government’s strong policy framework has further accelerated this growth. The Ministry of Digital Economy, Telecommunications and Innovation continues to promote interoperability between mobile networks and traditional banks, ensuring a seamless transfer of funds across platforms. This strategy aligns with the BCEAO (Central Bank of West African States) initiative to standardize mobile-money operations within the WAEMU region. By 2025, Côte d’Ivoire had achieved near-total interoperability among major providers, allowing users to transact across different networks without friction. This policy shift has not only driven user convenience but also enhanced competition among providers, leading to more innovative services, including microcredit, savings, and insurance products integrated within mobile platforms.

A significant contributor to this growth is the country’s expanding fintech ecosystem. Reports from Africa Fintech Forum 2025 and Disrupt Africa’s Fintech Report 2024 note that over 30 fintech startups now operate in Côte d’Ivoire, leveraging open banking APIs and mobile integrations to extend financial services to underbanked populations. Companies such as Djamo, Julaya, and Wave are leading the transition from simple mobile-money use toward full-fledged mobile banking, with app-based platforms enabling account management, payments, and credit services. Smartphone penetration, now exceeding 58% in 2025, has supported this transformation by making mobile apps more accessible to a broad population, particularly among the youth and small business owners.

Looking ahead, Côte d’Ivoire’s mobile-banking market is expected to maintain its upward trajectory as regulatory clarity, fintech collaboration, and infrastructural improvements deepen digital financial inclusion. The government’s “Vision 2030 Digital Côte d’Ivoire” plan continues to emphasize the role of fintech and mobile technology in achieving inclusive growth. With a vibrant digital ecosystem, a tech-savvy population, and sustained investment by operators, Côte d’Ivoire remains not just a leader in West Africa’s mobile-money revolution but also a model for how public-private synergy can drive financial innovation and inclusion across the continent.

3. Ghana

Ghana’s mobile-banking success in 2024–2025 is first and foremost a story of regulatory clarity and credibility. The country topped the 2024 GSMA Mobile Money Regulatory Index, scoring higher than 89 other jurisdictions, which signalled to operators, banks and fintechs that the policy environment was predictable, transparent and supportive of innovation. That institutional backing allowed Ghana’s central bank and regulators to pursue measured liberalisation (including interoperability and clearer licensing) while maintaining consumer protections, an essential foundation for rapid, durable adoption.

The adoption metrics tell a powerful story of scale and momentum. Bank of Ghana reporting and industry briefs show explosive growth in registered and active mobile-money accounts and transaction values: by early 2025 registered mobile-money accounts exceeded 70 million and monthly transaction values reached record levels (with single-month peaks reported in 2024–25), reflecting wide use for P2P transfers, merchant payments, and bank-to-wallet flows. Independent trackers and GSMA noted thatGhana’s per-capita penetration and transaction density now rank among the very highest in Africa, driven by both telco wallets and bank apps.

What drove this rapid uptake was a mix of healthy competition and technical enablers. Multiple mobile-money networks (telco and bank-led) competed on product breadth and price, while regulators pushed for and operators implemented interoperability, enabling seamless transfers across platforms. At the same time, Ghana’s fintech ecosystem, spanning payments, lending, and savings—leveraged open APIs and partnerships with banks to move users from basic wallets into richer mobile-banking services. Improved smartphone penetration and agent-network density rounded out the stack, converting access into frequent use.

Risks and policy priorities remain clear. Rapid scale brings challenges: AML/CFT compliance, customer-protection issues, agent-liquidity strains, and the need to manage fraud and operational resilience. GSMA and Bank of Ghana diagnostics emphasise strengthening supervision, improving dispute-resolution channels, and encouraging more bank–fintech collaborations to deepen savings and credit delivered via mobile channels. If regulators and firms sustain the current momentum while addressing these operational risks, Ghana’s model in 2025 will likely remain the benchmark for how enabling policy and competitive markets can drive mass mobile-banking adoption.

2. South Africa

South Africa’s mobile banking ecosystem in 2025 reflects a bank-led digital transformation, rather than the telecom-driven model dominant elsewhere in Africa. The country’s long-established banking sector, anchored by players such as Standard Bank, FNB, Nedbank, and Absa, has fully integrated mobile channels into mainstream banking. According to the GSMA’s 2025 Mobile Money Adoption Survey and Statista’s 2024 Digital Banking Penetration Report, over 80% of South African adults now use mobile banking apps regularly, the highest rate in Sub-Saharan Africa. This maturity stems from a well-developed financial system, near-universal access to smartphones, and strong consumer trust in formal institutions.

Fintech firms have further reshaped South Africa’s financial landscape, complementing traditional banks with innovative mobile-first solutions. Platforms such as TymeBank, Capitec’s mobile suite, and Discovery Bank’s app ecosystem have attracted millions of users, offering low-cost, app-based financial services accessible via smartphone or USSD. Meanwhile, the Vodacom/VodaPay ecosystem, bolstered by Alipay-backed infrastructure, has rapidly grown its user base, driving fintech revenues to record levels in 2024–2025 (Reuters, 2025). These hybrid ecosystems, combining bank-grade services with fintech agility, position South Africa as Africa’s leading digital-finance innovation hub.

Unlike mobile-money-heavy economies such as Kenya or Ghana, where telecom-led wallets dominate, South Africa’s mobile-banking adoption reflects a convergence of traditional banking and fintech integration. Interoperability across payment systems, real-time electronic funds transfers, and government-led efforts to promote digital inclusion (via the South African Reserve Bank’s Vision 2025) have expanded access across income levels. The availability of investment, insurance, and micro-lending options directly within mobile-banking apps has also encouraged deeper financial engagement beyond payments and transfers, contributing to higher overall digital-finance usage.

Nonetheless, the country’s rapid digitalization introduces new challenges—cybersecurity threats, digital literacy gaps, and persistent inequalities in rural access. Analysts note that while adoption is strong among urban and middle-income users, the digital divide remains a policy concern. The South African Reserve Bank’s 2025 Financial Inclusion Review highlights the need for sustained investment in rural digital infrastructure and consumer protection frameworks. Yet, South Africa’s ability to blend banking sophistication, fintech innovation, and regulatory foresight keeps it among the top two African nations with the highest mobile-banking adoption rates in 2025.

1. Kenya

Kenya’s leadership in mobile banking in 2025 is the product of long-running adoption, dense agent networks and continuous product innovation—anchored by Safaricom’s M-Pesa but reinforced by banks and fintechs. Official industry and operator reports show that mobile subscriptions, agent outlets and active mobile-money accounts remain at very high levels: Safaricom’s FY2025 disclosures and CBK payment statistics document tens of millions of active users and a near-400k agent network that keeps cash-in/cash-out ubiquitous across urban and rural corridors. These foundations mean Kenya still leads Africa in per-capita mobile-wallet usage, transaction density and the breadth of value-added mobile banking services.

The market structure and product set are central to that dominance. M-Pesa’s evolution, from simple P2P transfers to merchant payments (Lipa na M-Pesa), interoperability, savings and credit rails, and card integrations, has been emulated and complemented by banks’ mobile apps and emerging fintechs. GSMA’s 2025 industry analysis highlights how Kenya combines scale (large active-user bases), deep agent coverage and a competitive ecosystem that pushes adoption beyond transfers into merchant payments, micro-credit and digital savings, turning phones into full financial-service channels. Safaricom’s FY2025 notes underscore M-Pesa’s continued contribution to revenue and the growth in merchant and card products that broaden use cases.

The economic and social effects are tangible. Central-bank and market data show mobile-money transaction values rising substantially through 2024 (Kenya reported multi-trillion-shilling transaction volumes), supporting commerce, remittances and government payments while materially raising financial-inclusion metrics captured in Global Findex and national surveys. Mobile rails have reduced the costs and frictions of payments for small traders, widened access to credit scoring data for digital lenders, and enabled faster social-safety disbursements, all of which amplify the macro and micro benefits of digital finance in Kenya.

That said, the sector’s future gains hinge on addressing clear challenges. Regulators and operators must tackle slowing frequency per user seen in some months, agent liquidity and operational resilience, fraud and consumer-protection issues, and the digital divide for the lowest-income or least-connected groups. If Kenya preserves policy clarity, keeps investing in network and agent sustainability, and expands interoperability and bank-fintech partnerships, it should remain Africa’s reference market for mobile banking, shifting steadily from payment rails to a deeper, app-driven digital banking economy.

We welcome your feedback. Kindly direct any comments or observations regarding this article to our Editor-in-Chief at [email protected], with a copy to [email protected].

https://www.africanexponent.com/top-10-african-countries-with-the-largest-adoption-of-mobile-banking-in-2025/