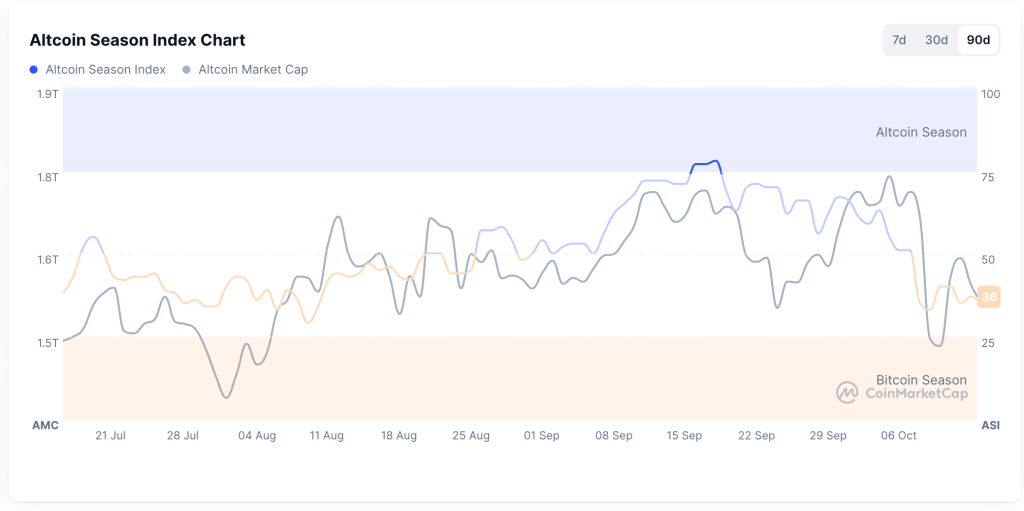

Weak breadth does not fully capture today’s tape. With the Altcoin Season Index sitting at 35, broad participation looks thin, yet a few names are pushing higher on clear activity and usable depth. Flows are gathering where execution is straightforward and where the current narrative matches what traders see on order books.

Zcash is out front in this altcoin season, with Morpho and Dash moving alongside it. Prices underline the point as Zcash is currently trading near $256, up by 15% in 24 hours. Morpho is around $1.97, up by 10%. Dash is changing hands near $49, also up by 10%.

Analysts describe rotation into these pairs while many peers stall, which fits a day when the index points down but selected charts point up.

Zcash: Privacy Bid and Sustained Turnover

ZEC’s run has extended beyond a single session as recent weeks brought a series of closes above old ranges, and today’s gain continues that climb with heavy spot participation. Data shows tight spreads and deeper books on major pairs, a setup that supports larger clips without forcing price action.

Analysts point to a simple mix. Privacy demand has returned to screens, momentum systems remain engaged above reclaimed levels, and funding cooled after the first burst, which implies that cash buyers are involved rather than just leveraging.

If ZEC maintains its current volume and holds the support band established during last week’s rally, leadership within this phase can persist, even with the index depressed.

Morpho: Lending Routes Draw Steady Users

MORPHO is trading higher on signs of increased lending and borrowing across its markets. Reports describe a pickup in vault usage and a healthier spread between offered rates and clearing rates, which tends to draw repeat participants. Order book depth improved through the session, and intraday pullbacks found bids near prior reference levels.

Morpho Price (Source: CoinMarketCap)

The appeal in quieter weeks is practical. Lending venues that route to better rates convert usage directly into fees and yields, so they attract flows when traders prefer utility over headlines.

A clean push above a short ceiling earlier today set a new reference for momentum desks. Follow-through depends on whether utilization and deposits stay firm while volumes remain balanced across venues.

Dash: Technical Reclaim and Cleaner Execution

DASH added 10% after reclaiming a range that capped rallies in recent sessions. Analysis notes a daily moving-average crossover and improving relative strength versus large caps. Spot led much of the move rather than derivatives, a detail that often produces steadier progress.

Payment names tend to catch rotation when traders want liquid pairs that can clear size. Desk notes mention tighter spreads and larger ticket printing without sharp slippage. Holding above today’s reclaim zone would keep DASH in the mix when screens scan for continuation candidates during altcoin season.

Altcoin Season Index (Source: CoinMarketCap)

Altcoin Season Read

The index at 35 indicates that breadth is weak, yet these three names suggest that selective rotation is active. Zcash continues to benefit from a privacy bid, sustained turnover, and a supportive technical base. Morpho advances in lending activity that translates into enduring participation. Dash rides a technical improvement with cleaner execution across spot pairs.

A short checklist can gauge durability. For ZEC, watch the volume and the new support band that was built during the climb. For MORPHO, track utilization, borrow depth, and vault inflows. For DASH, monitor spreads, spot share, and whether today’s range becomes a floor. If those markers hold, this narrow lane of altcoin season can persist even as the index remains subdued.

https://cryptonews.com/news/altcoin-season-index-sinks-to-35-yet-zcash-leads-while-morpho-and-dash-advance/