Ethereum is showing signs of stabilization after a volatile week that sent its price below $3,800. The drop came after a series of massive liquidations that swept across the crypto market in a similar fashion to Bitcoin’s retest of the $112,000 support zone. Analysts now believe that Ethereum’s correction phase could be coming to an end as momentum indicators start to turn upwards. They say that a decisive recovery in Bitcoin could give the impetus for Ethereum to reclaim the $4,500 level within weeks.

The market is still cautious, but traders are much more bullish about the medium-term outlook of Ethereum. Technical analysis indicates that the sell pressure has been reduced, creating conditions for a rebound. Analysts highlight that Ethereum’s strong fundamentals and growing network activity continue to support the asset’s value. Meanwhile, investors looking for faster returns are rotating into new projects such as MAGACOIN FINANCE, which is gaining early traction as the market consolidates.

Ethereum Consolidates as Market Awaits Direction

Ethereum has been consolidating inside a small range between $3,700 and $3,950, which forms a short-term base of support. The Relative Strength Index (RSI) is approaching neutral levels after spending a few sessions in oversold territory. Analysts said this stabilizing effect indicates the worst of the selling pressure could be over. A breakout above the $4,050-$4,100 zones would confirm a reversal and indicate renewed momentum.

Trading volume is stable with both retail and institutional traders tracking Bitcoin’s moves. Ethereum continues to show resilience despite the slowdown, with staking participation and on-chain activity remaining solid. Analysts say that this type of consolidation is often followed by large directional movement, which makes the current zone an important battleground for traders.

Technical Structure Suggests a Potential Bounce Back

Technical indicators still point to a recovery scenario. Ethereum’s 50-day moving average is currently around $3,900, while the 200-day is still around $3,500; thus, its long-term support base is clear. This alignment would suggest that the overall bullish structure is still in place. Analysts feel that the recent dip gave long-term buyers an opportunity to accumulate at discounted levels.

If Ethereum manages to breach above $4,100, analysts believe a run toward $4,500 by the first quarter of next year is likely. Fibonacci retracement levels between $3,750 and $4,500 are also moving in line with this projection, strengthening the case for a steady climb. Traders are now waiting for confirmation with higher lows and stronger daily closes.

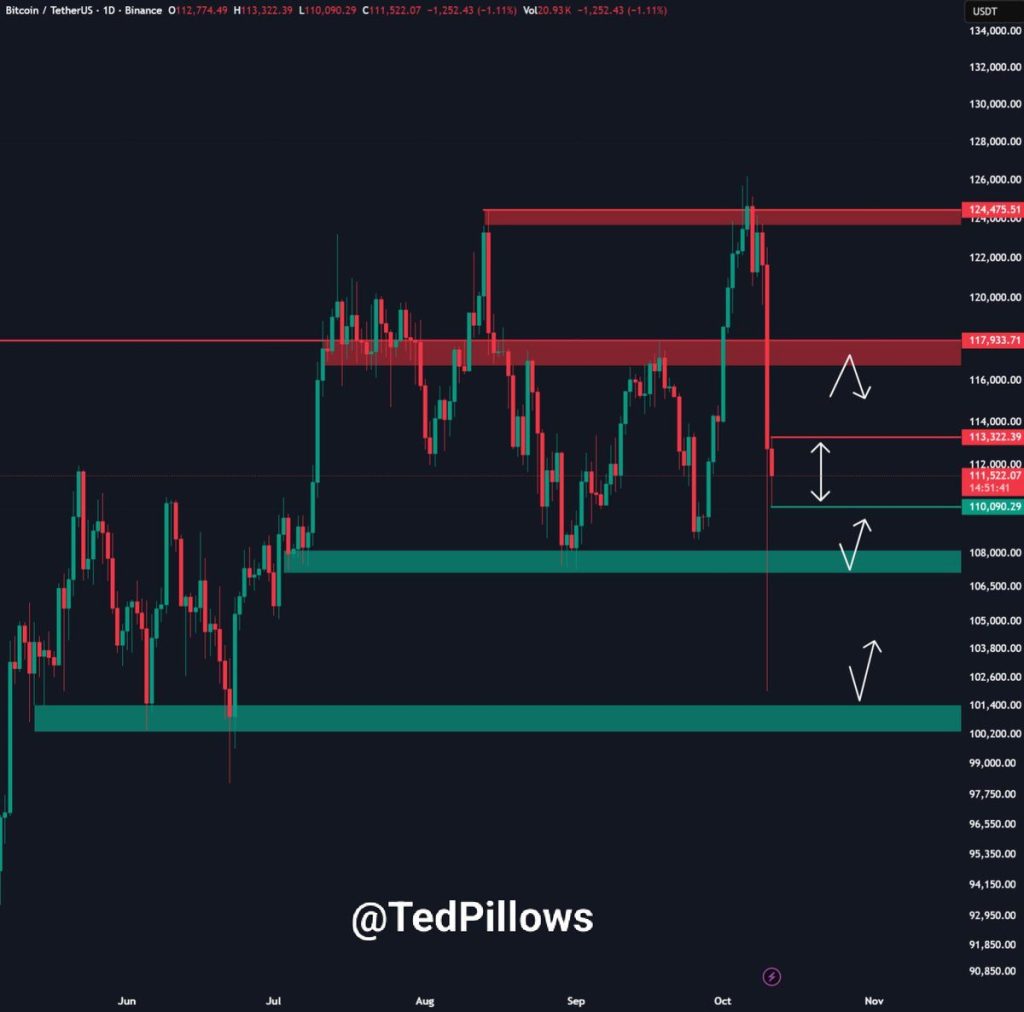

Bitcoin’s $112K Support Effects Ethereum Outlook

Bitcoin’s recent test of $112,000 continues to play a major role in determining Ethereum’s price action. The two assets have a strong correlation, meaning that the recovery of Bitcoin often leads to a resurgence of interest in Ethereum. Analysts said that if Bitcoin maintains its current support and recovers to $120,000, there could be a spillover effect for Ethereum.

Market sentiment is still fragile, and both assets show signs of stabilisation. Analysts highlight that the coming days will play a key role in deciding whether the wider crypto market will continue its bullish trend. If Bitcoin loses its key support, Ethereum’s road to $4,500 is going to take longer to materialize.

Analysts Eye $4,500 Target

Most analysts are bullish on Ethereum’s medium-term prospects. They point to steady developer activity, increased network usage, and growing institutional inflows as positive drivers. Several projections highlighted Ethereum reclaiming $4,500 before the end of the year, provided that current levels of support are maintained.

Whale accumulation has also been growing, which is a sign that long-term holders are confident. On-chain data reveals big wallets adding to their positions in the recent dip. Analysts say this behavior usually indicates confidence leading into possible breakouts. Combined with improving liquidity, these trends strengthen expectations of a broader market recovery.

Among them, MAGACOIN FINANCE stands out for its blend of community hype and real-world utility, something many meme coins lack. Hype alone is often enough to drive short-term hype, but projects with tangible use cases in addition to hype tend to hold their long-term value.

MAGACOIN FINANCE seeks to accomplish both — attracting traders with a vibrant community engagement with a functional application that goes beyond speculating. Analysts say that this dual focus puts it in a different position from most meme coins, which are completely based on virality. The trend of steady accumulation and increasing social presence of the project indicates investors are realizing the value of a meme token designed for both hype and longevity.

Conclusion

Ethereum is still in a consolidation phase but is showing signs of recovery as selling pressure fades. Analysts believe holding above $3,700 could pave the way for a rebound towards $4,500, especially if Bitcoin stabilizes near $112,000. Momentum indicators are coming in better, and there is on-chain data to back up a change in sentiment.

As confidence returns, Ethereum may spearhead the next stage of market recovery, buoyed by strong fundamentals in the network and renewed demand from investors. Meanwhile, projects such as MAGACOIN FINANCE are gaining early attention for their blend of utility and community strength, demonstrating that innovation is alive and well within the wider crypto market.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

https://cryptonews.com/press-releases/ethereum-price-prediction-can-eth-reclaim-4500-as-bitcoin-tests-112k-support/