In summary

- The African animal health market is a competitive field split between global giants (Zoetis, MSD) providing premium products and deeply-rooted African companies. Topping the list is the homegrown South African firm, Afrivet, with approximately $450 million in revenue, whose success is built on a “full-spectrum” approach tailored to local farmers.

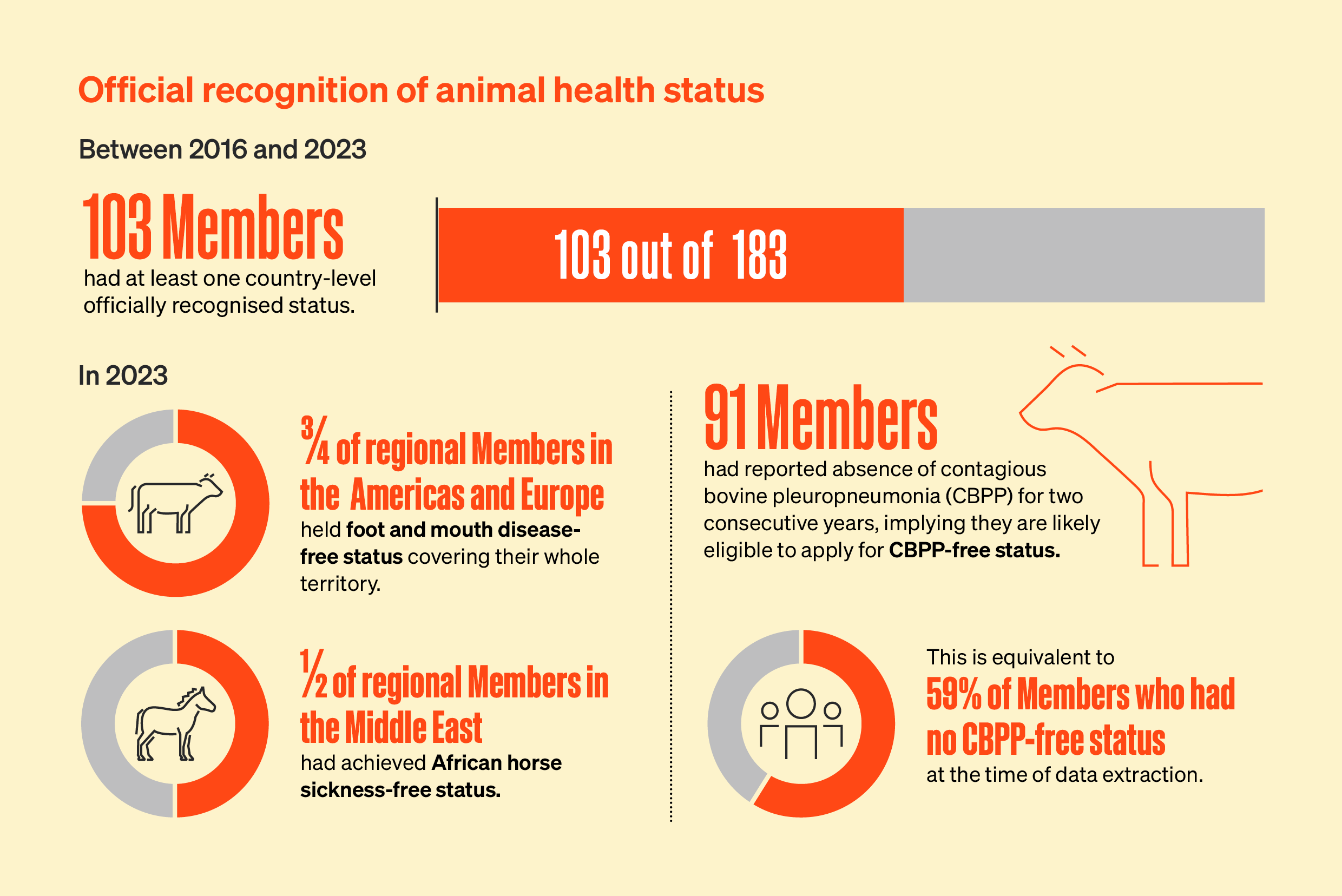

- The industry is critical for continental food security, economic stability, and public health. Companies are pivotal in preventing livestock diseases that cause massive economic losses, supporting exports, and combating zoonotic threats through vaccination and “One Health” initiatives.

- The top companies employ varied strategies, from the high-volume, low-margin essential vaccine production of South Africa’s Biovac ( approximately $400 million) to the specialized premium pet care and livestock focus of multinationals like Zoetis (approximately $280 million) and the regional dominance of Francophone-focused Vétopharm with approximately $110 million.

Deep Dive!!

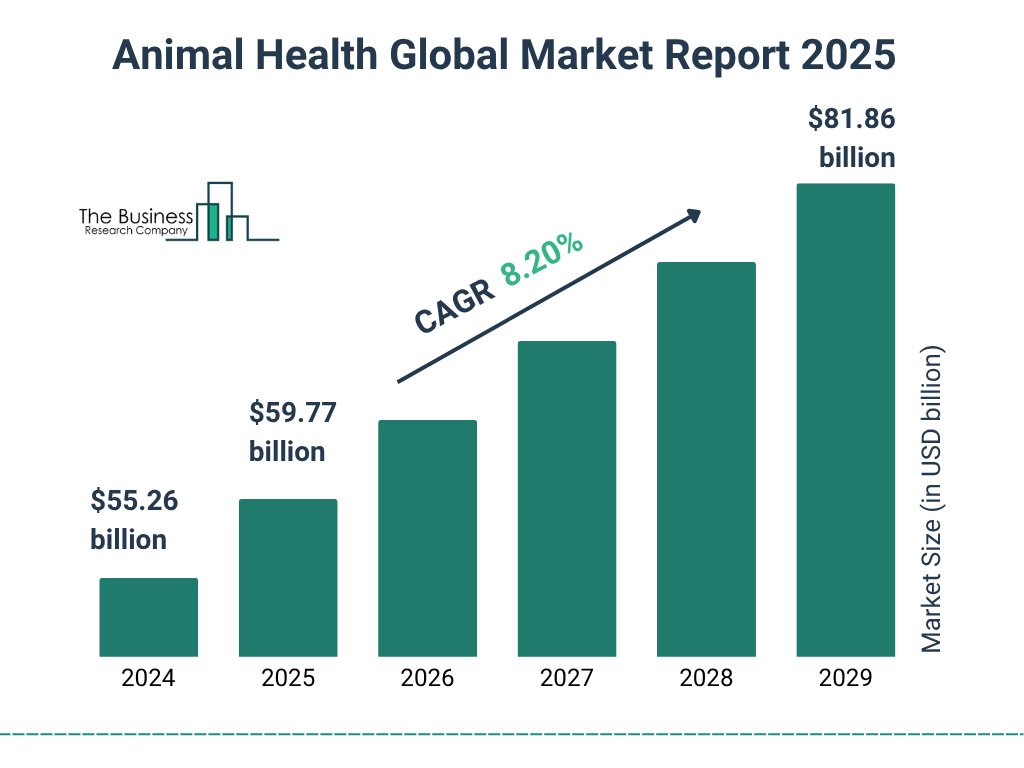

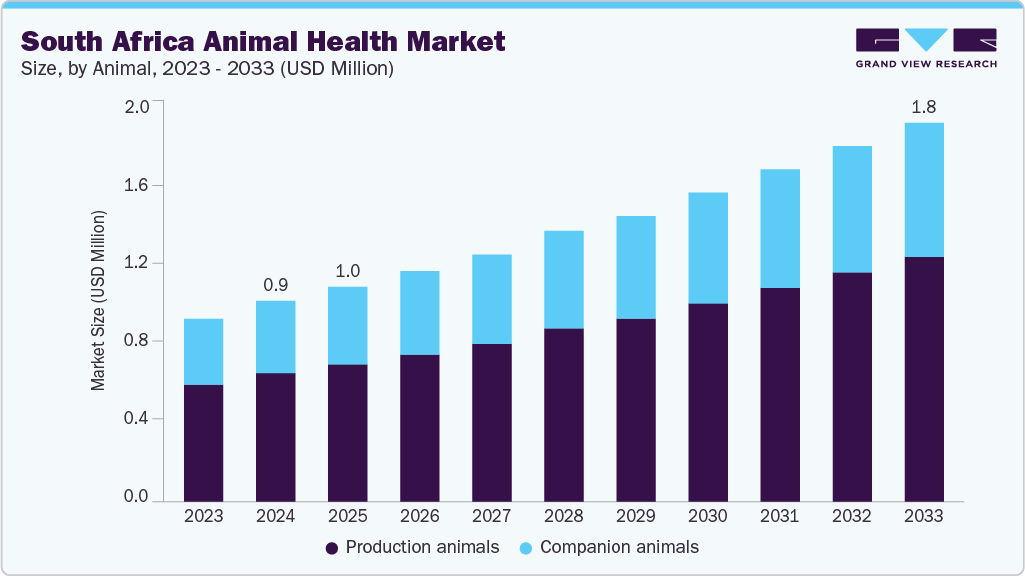

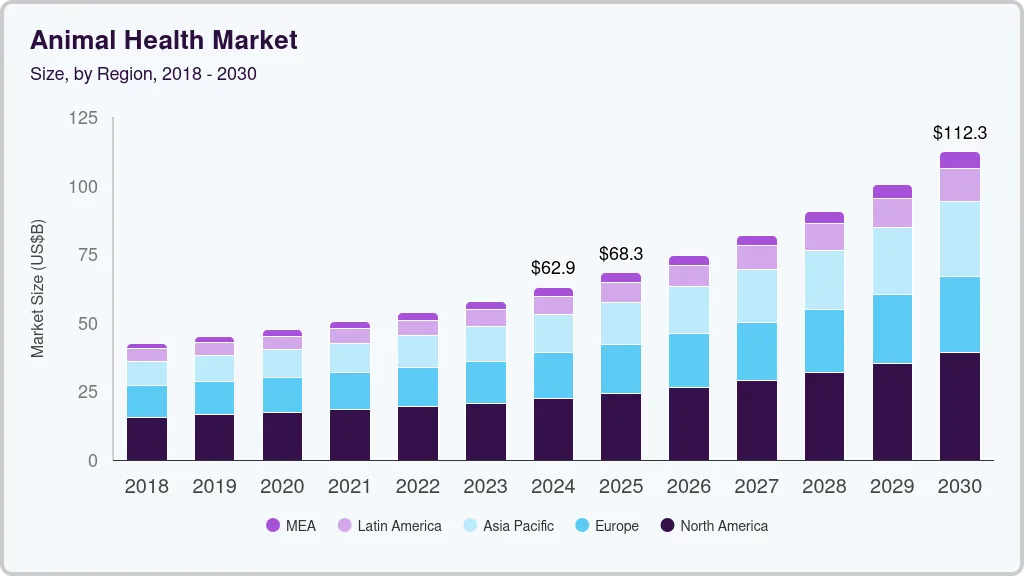

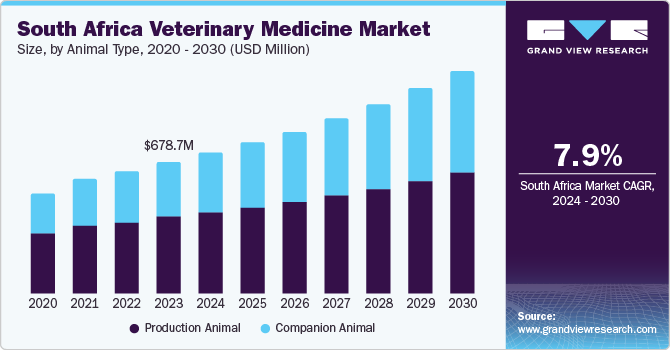

The African continent stands at the convergence of two of the most critical challenges and opportunities of the 21st century; which are, achieving sustainable food security and navigating a rapidly evolving economic landscape. At the heart of both lies the vital, yet often overlooked, animal health industry, a sector that is both a barometer of agricultural development and a catalyst for economic growth. As the demand for animal protein surges alongside population growth and urbanization, and as climate change alters disease patterns, the role of robust veterinary healthcare has never been more critical. This burgeoning need is fueling a dynamic and competitive market, projected to exceed $2.5 billion in 2025, where global multinationals and homegrown African champions vie for prominence.

The landscape of this industry is a complex tapestry, reflecting the diverse economic realities of the continent itself. On one end of the spectrum are the innovative, research-driven multinational corporations, such as Zoetis and Boehringer Ingelheim, which bring cutting-edge vaccines and pharmaceuticals to large-scale commercial farms and an expanding companion animal sector. On the other are the agile, deeply rooted African companies like Afrivet and Biovac, whose strength lies in their vast distribution networks, tailored product portfolios, and an intrinsic understanding of the local farmer’s needs. This competition is not merely about market share; it is a contest of philosophies between global standardization and hyper-localized solutions, with the health of billions of livestock and the livelihoods of millions hanging in the balance.

This article provides a definitive ranking and analysis of the top 10 largest animal health companies in Africa by revenue for 2025. Moving beyond mere financial figures, we delve into the unique strategies that drive their success, from pioneering vaccine research to mastering last-mile distribution. We will explore their profound economic impact on their countries of origin and operation, and assess how these key players are not only shaping a vibrant industry but are also fundamentally underpinning the resilience of Africa’s agricultural sector and the well-being of its people.

10. Virbac South Africa [South Africa]

Kicking off our list is the African subsidiary of the French veterinary pharmaceutical giant, Virbac. While a global player, its specific focus on key African markets, particularly South Africa, Nigeria, and Kenya, allows it to carve out a significant niche. Virbac’s strength lies in its diversified portfolio, which spans vaccines, pharmaceuticals, and nutritional products for both livestock and pets. In 2025, the company is doubling down on its strategic focus areas: preventative medicine for dairy and poultry farms, and the high-growth companion animal segment in urban centers. A company spokesperson recently highlighted this dual strategy, stating, “Our mission is to bridge the gap between large-scale food security and the evolving concept of pet family membership, providing tailored solutions for both realities.”

The economic impact of Virbac’s operations is twofold. For the commercial farming sector, its advanced vaccines and parasiticides directly contribute to reducing mortality rates and improving feed conversion efficiency, which bolsters the profitability of Africa’s agribusinesses. For the growing middle class, Virbac’s specialized pet care products, from dermatology treatments to advanced vaccines, cater to the trend of humanization, where pets are increasingly considered family members. This focus on value-added, specialized products allows Virbac to maintain a strong position despite not competing on volume alone with the top-tier players.

In terms of financial performance, Virbac’s African operations are a key growth engine for the global group. The company boasts of an estimated revenue of approximately $85 million in 2025. This revenue stream, while a fraction of its global total, is growing at a double-digit percentage, underscoring the strategic importance of the continent. The impact in its primary operational base, South Africa, is significant. Virbac supports a network of local distributors and veterinary practices, providing high-skilled employment and ensuring that South African farmers and pet owners have access to the same quality of products available in Europe and North America, thereby elevating the standard of animal care in the country.

9. Vétopharm [Morocco]

Based in Morocco, Vétopharm has established itself as a cornerstone of the animal health industry across Francophone Africa. With a manufacturing base in Casablanca and a distribution network spanning from West Africa to the Maghreb, the company has deep roots and a formidable reputation in the region. Its comprehensive portfolio includes a wide range of vaccines, anthelmintics, and antibiotics for ruminants, poultry, and pets. In 2025, Vétopharm is leveraging its regional expertise to expand its footprint, capitalizing on intra-African trade agreements to introduce its competitively priced, locally relevant products to new markets. A senior company executive noted, “Our strength is our understanding of the specific disease challenges and economic realities of the farmer in Senegal, Ivory Coast, and Mali. We don’t just sell products; we provide solutions for our region.”

The company’s role in the regional economy is substantial. As a local manufacturer, Vétopharm creates skilled jobs, supports a network of local distributors and veterinarians, and contributes to the technological sovereignty of the African continent by reducing dependency on imports. For farmers in its core markets, Vétopharm provides accessible and reliable animal health inputs that are critical for protecting their livelihoods against endemic diseases like Peste des Petits Ruminants (PPR) and Newcastle disease.

Financially, Vétopharm is a testament to the viability of local pharmaceutical production in Africa. It’s estimated 2025 Revenue in Africa is approximately $110 million. As a privately held Moroccan company, it is a significant contributor to the national economy through taxes and employment. Its success has a multiplier effect in Morocco, fostering a skilled workforce in biomanufacturing and reinforcing the country’s position as an industrial and pharmaceutical hub for the entire Francophone African region, aligning with the King’s vision for South-South cooperation and economic integration.

8. Centurion [South Africa]

South Africa’s Centurion has grown from a local distributor to a fully-fledged, research-driven animal health company with a formidable presence across Southern Africa. The company’s strategy is built on a “gate-to-plate” approach, offering a complete suite of products including vaccines, acaricides (tick treatments), and feed additives that are critical for the region’s massive beef and dairy industries. A key driver of its 2025 growth is the launch of its next-generation tick vaccine, a breakthrough product for a region where vector-borne diseases like East Coast fever cause massive economic losses. The CEO of Centurion recently stated, “We are investing heavily in R&D to solve Africa’s most persistent animal health challenges. Our goal is not just to treat disease, but to build resilience within the entire livestock value chain.”

Centurion’s impact on the South African economy and its neighbors is deeply intertwined with the agricultural sector. By providing effective tools to combat diseases that have plagued farmers for generations, the company directly enhances livestock productivity and food security. Its products enable farmers to access premium export markets by helping them meet strict biosecurity standards. Furthermore, as a homegrown success story, Centurion exemplifies the potential for African companies to develop world-class, innovative solutions tailored to local challenges.

As a proudly South African company, its financial success is retained within the country. It’s estimated 2025 Revenue in Africa is approximately $130 million. This revenue funds further local research and development, creating high-value jobs in science and manufacturing. Centurion’s growth is a direct boon to the South African economy, and its ability to compete with multinational corporations is a source of national pride. It demonstrates how domestic companies can leverage deep local knowledge to achieve commercial success while solving critical national challenges in food security and agriculture.

7. Ceva Santé Animale [Pan-African]

The French multinational Ceva has cemented its position in the African top ten through a consistent strategy of innovation and local partnership. Unlike some competitors, Ceva has made significant investments in local technical support and training, building strong relationships with veterinary professionals and large-scale integrators across the continent. Its portfolio is strong in poultry vaccines and pharmaceuticals, a critical sector for Africa’s rapidly urbanizing population, and it also holds a significant share in the ruminant and companion animal markets. In 2025, Ceva is focusing on its “One Health” initiatives, highlighting the connection between animal and human health, particularly in combating antimicrobial resistance through its vaccine-focused portfolio. A Ceva regional director for Africa commented, “Our commitment is to a preventative approach. By vaccinating more, we treat less, which safeguards both animal welfare and public health.”

Ceva’s economic contribution is amplified through its knowledge transfer. Its training programs for veterinarians and paraveterinary professionals elevate the standard of animal healthcare across the countries it operates in. For the poultry industry, which is a major source of employment and affordable protein, Ceva’s advanced vaccination protocols are essential for maintaining flock health and profitability in the face of constant disease pressure.

While a French company, Ceva’s African operations are a significant and growing part of its global business. It’s estimated 2025 Revenue in Africa is approximately $155 million. The impact in its key countries of operation, such as South Africa, Egypt, and Nigeria, is substantial. Ceva’s local offices employ hundreds of people and its extensive distribution networks support countless local businesses. By establishing robust local entities, Ceva ensures that its global profits are partially reinvested into the African economies where they are generated, fostering a cycle of professional development and economic activity.

6. Elanco [Pan-African]

Following its strategic acquisition of Bayer Animal Health, Elanco has emerged as a more diversified and powerful player in the African market. The company has undertaken a significant restructuring to optimize its product portfolio, focusing on its core strengths in pet health (with blockbuster products in parasiticide and therapeutics) and poultry. In 2025, Elanco is leveraging its expanded scale to deepen its market penetration, particularly in the high-growth pet care segment, while maintaining its stronghold in key livestock sectors. An Elanco Africa business lead explained the rationale: “The African market is bifurcating. Our strategy is to lead in high-value pet innovation while providing trusted, efficient solutions for the commercial livestock farmers who are vital to food security.”

Elanco’s presence supports a vast network of veterinary clinics and pharmacies, providing them with a reliable stream of innovative products. For livestock producers, Elanco’s feed additives and antibiotics, when used responsibly, are critical tools for ensuring animal growth and health in intensive farming systems. The company’s size and global R&D pipeline ensure that the latest veterinary innovations eventually reach African markets, though often at a premium price point that can limit accessibility for smaller-scale farmers.

As a US-based company, Elanco’s revenue from Africa contributes to its global financial health. It’s estimated 2025 revenue in Africa is approximately $180 million. While this revenue is repatriated, its local operational impact is considerable. Elanco maintains significant offices and distribution hubs in South Africa and Kenya, employing local talent and managing a complex supply chain that stimulates the local logistics and services sectors. Its commitment to the market, however, is often judged by its level of local investment in manufacturing or R&D, areas where it faces pressure from more deeply rooted competitors.

5. Boehringer Ingelheim [Kenya]

The German family-owned company, Boehringer Ingelheim, has secured its top-five position through undisputed leadership in the vaccine market, particularly for poultry and swine. Its vaccines are considered the gold standard by many of Africa’s largest integrated livestock companies. Beyond its product excellence, Boehringer Ingelheim invests heavily in local technical services and disease surveillance, helping to monitor and control outbreaks of Avian Influenza and other notifiable diseases. In 2025, the company is pioneering the introduction of novel vaccine delivery systems, such as in-ovo technology for poultry, which allows for the automated vaccination of embryos, significantly improving efficiency and animal welfare. A company technical director noted, “Our goal is to bring the most advanced production animal technology to Africa, not as an afterthought, but as a core market. Healthy animals are the foundation of a stable food supply.”

The economic impact of Boehringer Ingelheim’s vaccine portfolio is immense. By preventing devastating diseases, its products save the African poultry industry hundreds of millions of dollars annually. This protection is crucial for maintaining a steady supply of affordable chicken and eggs, a key protein source for millions. Furthermore, the company’s high manufacturing standards and complex supply chain for biologics set a benchmark for the industry and create demand for a highly skilled local workforce.

Financially, Boehringer Ingelheim’s African operations are a robust and reliable revenue center. It’s estimated 2025 revenue in Africa is approximate $220 million. The company’s impact in countries like South Africa and Egypt, where it has a strong presence, extends beyond sales. It is a major employer of life sciences graduates and invests in local partnerships with research institutions. While its profits ultimately flow back to Germany, its policy of deep local integration and high standards of operation has a positive, elevating effect on the local animal health sectors and regulatory environments in its host countries.

4. Zoetis [South Africa]

As the world’s largest producer of animal medicines and vaccines, Zoetis brings an unparalleled scale and R&D capability to the African continent. The company dominates the high-value companion animal segment with its best-in-class parasiticides, therapeutics, and vaccines, which are widely demanded by veterinary clinics in South Africa, Nigeria, and other urban centers. Simultaneously, it maintains a formidable portfolio for livestock, including advanced vaccines and anti-infectives. In 2025, Zoetis is focusing on data-driven solutions, partnering with large dairy and poultry farms to implement precision livestock farming tools that use analytics to predict and prevent health issues. The President of Zoetis Europe, Africa, and the Middle East recently stated, “We are moving beyond products to platforms. Our ambition is to be the partner of choice for veterinarians and producers who want to leverage data for optimal animal health and productivity.”

Zoetis’s economic footprint is significant, not just in revenue but in shaping market standards. Its marketing and professional education initiatives help define best practices in veterinary medicine across the continent. For the livestock sector, its premium products are often a necessary investment for producers aiming to access export markets or maximize efficiency in high-input systems. However, its premium pricing strategy can sometimes limit its reach among Africa’s vast population of smallholder farmers.

As a US-based publicly traded company, Zoetis’s African revenue is a notable part of its international segment. It’s estimated 2025 Revenue in Africa is approximately $280 million. This substantial figure highlights the continent’s importance to global strategy. In South Africa, its regional headquarters, Zoetis is a major employer and a key player in the life sciences sector. Its presence ensures that the latest global innovations in animal health are available, but it also contributes to a two-tier market where advanced care is accessible to corporate farms and affluent pet owners, while smaller producers rely on more affordable alternatives.

3. MSD Animal Health [South Africa]

MSD Animal Health (known as Merck Animal Health in the United States) consistently ranks among the top three, renowned for its scientific innovation and extensive vaccine portfolio. The company is a leader in both poultry and ruminant health, with groundbreaking products like the first livestock vaccine against a parasite. Its commitment to Africa is demonstrated through ongoing clinical trials and field studies conducted on the continent to ensure product efficacy against local disease strains. In 2025, a key growth driver is the expansion of its companion animal portfolio, including advanced biologics and pharmaceuticals, to capture a greater share of this lucrative market. A regional director for MSD highlighted, “Our R&D is not conducted in a vacuum. We are on the ground in Africa, working directly with farmers and veterinarians to develop the solutions they need most.”

The impact of MSD’s work extends beyond commerce into global health security. Its vaccines play a crucial role in controlling zoonotic diseases—those that can jump from animals to humans—thereby protecting both livestock assets and public health. For the African dairy industry, MSD’s fertility and production management products are invaluable tools for improving yields and farmer incomes. The company’s deep-rooted presence and scientific credibility make it a trusted partner for governments and private enterprises alike.

MSD Animal Health’s financial contribution from Africa is a key metric of its global reach. It’s estimated 2025 revenue in Africa is approximately $320 million. This revenue is generated through a network of local subsidiaries, particularly in South Africa and Kenya, which operate as semi-autonomous units. These subsidiaries employ local staff, manage local supply chains, and contribute corporate taxes to their host governments. While the ultimate profit benefits its US-based parent, the company’s significant local infrastructure and employment make it an integral part of the professional veterinary landscape in its key African markets.

2. Biovac [Pan-African]

A unique success story, Biovac is a public-private partnership between the South African government and a consortium of international investors, with a core mission to secure vaccine supply for the African continent. While initially focused on human vaccines, its animal health division has become a behemoth in its own right. Biovac’s strength lies in its massive manufacturing capacity and its role as a strategic supplier of essential vaccines to national veterinary services and aid organizations. It produces tens of millions of doses of vaccines for diseases like Foot-and-Mouth Disease (FMD) and Bluetongue, which are critical for protecting the continent’s livestock wealth. Biovac’s CEO has often emphasized, “Our mandate is African health sovereignty. We are the backbone of disease prevention for the smallholder farmer who cannot afford market-rate vaccines, ensuring their livelihood and our collective food security.”

Biovac’s economic model is fundamentally different from its commercial competitors. It operates on thin margins but at a vast scale, making it the most impactful company in terms of the number of animals protected. Its operations are a major source of high-tech manufacturing employment in South Africa and it is a cornerstone of the African Continental Free Trade Area’s (AfCFTA) health security ambitions. By ensuring a reliable, locally-produced supply of essential vaccines, Biovac prevents economic catastrophes for rural communities that depend entirely on their livestock.

As a South African institution, Biovac’s financial success is a national asset. It’s estimated 2025 Revenue in Africa approximately $400 million. Crucially, a significant portion of this revenue is reinvested into the South African economy. It supports a cutting-edge biomanufacturing sector, funds local R&D, and creates a large number of skilled, stable jobs. The dividends and taxes it pays contribute directly to the national fiscus. Biovac is more than a company; it is a strategic national project that guarantees animal health security for South Africa and its neighbors, making its economic impact profound and multifaceted.

1. Afrivet [South Africa]

Topping the list is Afrivet, a South African-born company that has grown into the largest animal health company on the continent by revenue. Afrivet’s remarkable success is built on a profound understanding of the African farmer. Its strategy is a “full-spectrum” approach, offering a complete range of products, from generics to innovative own-brand solutions, across all species, making it a one-stop-shop for everyone from subsistence farmers to corporate agribusiness. In 2025, Afrivet is leveraging its deep distribution network, which reaches the most remote rural areas, to roll out its new digital platform, connecting farmers with veterinary advice and streamlining supply chain logistics. The founder of Afrivet famously said, “Our business is not just about selling products; it is about building the productivity and resilience of African agriculture from the ground up.”

Afrivet’s impact on the African economy is monumental. It is arguably the single most important player in making animal health products accessible and affordable for the continent’s millions of smallholder farmers, who form the backbone of its agricultural sector. The company’s growth has created a vast distribution and retail ecosystem, providing livelihoods for thousands. By focusing on practical, cost-effective solutions and unparalleled market reach, Afrivet has not only achieved commercial dominance but has also become an indispensable partner in the mission to achieve food security and drive rural economic development across Africa.

Afrivet’s financial performance is a testament to the power of a grassroots, African-centric business model. It’s estimated 2025 revenue in Africa is approximately $450 million. As a privately held South African company, this immense revenue is a direct and powerful contributor to the national economy. The wealth generated by Afrivet is retained within South Africa and reinvested into further African expansion. It stands as the continent’s foremost example of how deep local knowledge, strategic vision, and a commitment to inclusivity can build a commercial empire that simultaneously drives profound developmental impact, making it a true African champion.

https://www.africanexponent.com/top-10-largest-animal-health-companies-by-revenue-in-africa-in-2025/