Key Takeaways:

- MYX Finance price has surged dramatically, raising concerns about insider-driven growth.

- Bubblemaps researchers linked around 100 wallets to unusual funding and airdrop claims before launch.

- MYX Finance responded to the accusations, but many in the community found the explanation unconvincing.

- Despite rising trading volumes, MYX Finance revenue remains low — less than $0.5M monthly.

- Analysts suggest the rally looks more like speculation than organic demand in the current market.

Since the start of September, MYX Finance (MYX) price has surged more than 2,000%, sparking debate around the token and its underlying project. In just 10 days, market capitalization jumped from roughly $250 million to about $4.6 billion.

Charts show how volatile MYX Finance price has been. After hitting a new all-time high (ATH) on Sept. 11, the token dropped about 40% before quickly recovering. The same cycle repeated soon after, with another sharp correction followed by a return to previous highs.

Unlike typical meme coins that often display such swings, MYX Finance is positioned as a decentralized exchange (DEX) for perpetual trading. The project’s official X account even lists Consensys, the creators of MetaMask, as one of its backers.

Insiders at Play?

The story of MYX Finance has sparked discussions about possible insiders who could have influenced the MYX Finance price. Analysts from Bubblemaps have pointed to suspicious transactions linked to dozens of wallets involved in the token’s distribution.

The MYX token is not yet available for spot trading on many centralized exchanges (CEXs). Notably, it’s absent from Binance, even though the exchange often comes up in connection with the project. In May, the team conducted an IDO on the BNB Chain. An Initial DEX Offering (IDO) is a way of launching a token through a decentralized exchange, where investors buy tokens directly via smart contracts. Just a month later, MYX ranked among the top projects by IDO on Binance Wallet.

From the start, MYX Finance seemed to target the Asian market, especially China, often enjoying what appeared to be “unofficial” support from BNB Chain.

The project’s official account frequently reposts Binance Chain and BNB content, even though Binance hasn’t announced any MYX spot trading.

Binance has repeatedly faced accusations of insider trading, particularly through its Binance Alpha program, which promotes new projects and distributes tokens. MYX also took part in this program, with its main slogan being “Democratize alpha for all.”

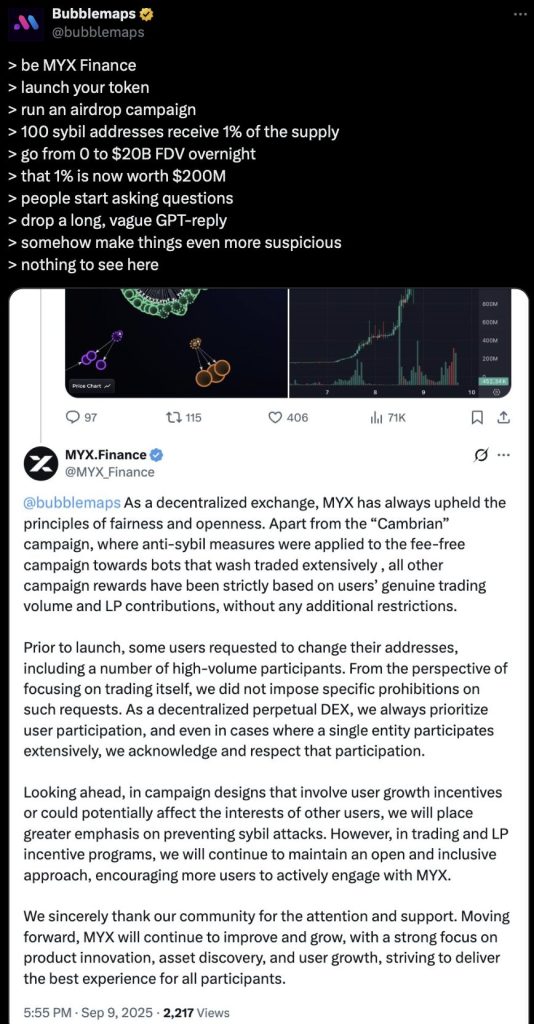

Bubblemaps analysts pointed to a cluster of roughly 100 new wallets that showed unusual activity ahead of the MYX airdrop. All of them were funded through OKX on the same day in April and received nearly identical amounts of BNB. When the airdrop went live, these wallets claimed MYX almost simultaneously, securing close to 1% of the total supply. Since they had no previous history of transactions, researchers argued the pattern was unlikely to be coincidental.

While no direct link to Binance has been established, most suspicions fall on the founder of MYX Finance. This coordinated activity could have significantly contributed to the rapid surge in MYX Finance price in the days following its launch.

Speculation or Genuine Success?

Such a rapid rise, combined with the Bubblemaps investigation, has led to suspicions that the surge in MYX Finance price may be fueled by insiders “pushing” the token. Even if MYX turns out to be a legitimate crypto project, analysts note that in the current market environment, it’s unlikely to achieve such explosive growth naturally. To many, this looks more like speculation than organic demand.

MYX Finance has officially responded to the accusations raised by Bubblemaps. However, the researchers and the broader crypto community found the explanation unconvincing.

Trading volumes on MYX Finance are indeed climbing, but the revenue figures raise concerns. According to DeFiLlama, monthly revenue doesn’t even reach half a million dollars. In August, daily revenue often hovered around $1,000 or less, with a peak of roughly $3,500 on Sept. 9. The highest point came back in May, at about $6,000 per day.

At this stage, the MYX Finance price rally appears to be driven more by speculation and possible insider involvement than by sustainable fundamentals.

The post MYX Finance Price Soars 2,000%: Who’s Pulling the Strings? appeared first on Cryptonews.

https://cryptonews.com/exclusives/myx-finance-price-soars-2500-despite-market-doubts-whos-pulling-the-strings/

TOP 9 Binance Wallet IDOs by ATH ROI (Updated: June 16th)

TOP 9 Binance Wallet IDOs by ATH ROI (Updated: June 16th)