The crypto market is up today, with the cryptocurrency market capitalization rising by 1.4% to $4.06 trillion. 90 of the top 100 coins have increased over the past 24 hours. At the same time, the total crypto trading volume is at $164 billion.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC) appreciated 1.4% at the time of writing, currently trading at $114,132.

Ethereum (ETH) is up by 2.6%, now trading at $4,435. It’s the second-best gainer today.

The highest increase is 3.4% by Dogecoin (DOGE), currently standing at $0.2496.

Solana (SOL) saw the smallest rise in this category: 0.4% to the price of $222.

When it comes to the top 100 coins, 90 are up at the time of writing. One of these recorded a double-digit increase. Mantle (MNT) is up 16.7% to $1.6.

Pump.fun (PUMP) follows with a 6.9% rise to the price of $0.005876.

On the other side, Provenance Blockchain (HASH)recorded a double-digit decrease: 16.1% to $0.03108.

It’s followed by Worldcoin (WLD)’s 5.1% fall to $1.75.

Notably, markets are now waiting for the key US inflation report. The Bureau of Labor Statistics is set to release the August Consumer Price Index data today. Following this, rate cuts are expected at the Federal Reserve meeting next week.

Meanwhile, a senior member of the US Banking Committee signaled that a landmark cryptocurrency market structure bill could stall this month. Sen. John Kennedy said, “I don’t think we’re ready. People that I talk to still have a lot of questions. I know I still have a lot of questions.”

‘This is Not a Crisis’

Przemysław Kral, CEO of zondacrypto, a European cryptocurrency exchange, commented that “the current market is abuzz with Bitcoin whales offloading 115,000 BTC, the largest such distribution in over three years.”

Some predict that BTC could drop below $90,000, but Kral often emphasizes “that market volatility and price fluctuations are commonplace and expected,” he writes.

Kral continues: “This is not a crisis, but a healthy correction after significant gains, a natural pause that markets often impose to clear out excesses and set the stage for a more sustainable advance. Institutional accumulation has been a key counterbalance to whale-driven pressure during this period. Traders should watch whether this institutional buying outweighs the selling pressure.”

Despite the recent movements, BTC has corrected just 8% from its mid-August ATH, “which is much shallower than previous instances. The long-term value, with the one-year moving average steadily increasing, is set to pass $100,000 next month. New entrants can unlock value by rapidly getting up to speed on market mechanics, custody solutions, and counterparty risks,” Kral concludes.

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC trades at $114,132. It shot up from the intraday low of $112,141 to the highest point until the time of writing of $114,451.

The coin is now 8.1% away from its all-time high of $124,128.

Bitcoin is consolidating just beneath a breakout level at $113,800. If it closes above $113,800, it could move towards $115,400, and then subsequently towards $118,617, as well as $125,000 in the medium term.

However, if it falls below $112,000, it could retreat to $111,000, $110,000, and $108,450.

Ethereum is currently trading at $4,435. The coin initially climbed to the price of $4,437 earlier in the day. It then plunged to the intraday low of $4,305 before surging to $4,444.

It’s now up 1.7% in a week and 3.3% in a month. It’s also down 10.4% from the ATH of $4,946.

ETH could continue climbing towards this ATH. If it surpasses $4,450 and holds it, it may rise towards $4,600 and $4,750. Conversely, it may slide back to $4,300 and $4,200.

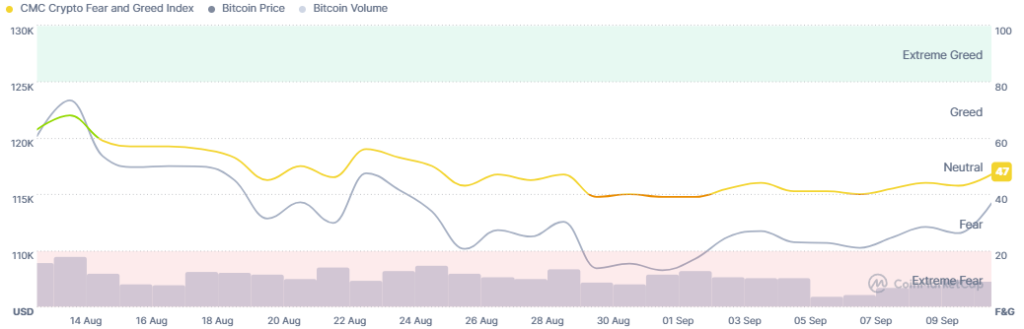

Meanwhile, the crypto market sentiment has increased within the neutral zone over the past day. The crypto fear and greed index went up from 43 yesterday to 47 today.

While caution persists in the market, there is also an increase in bullish sentiment. Investors are also waiting for the key reports and decisions coming from the US this and next week.

Moreover, the US BTC spot exchange-traded funds (ETFs) recorded significant inflows on 10 September of $757.14 million. This is the highest amount since mid-July. Nine of the 12 ETFs saw inflows, and there were no outflows.

Fidelity took in $298.98 million, followed by BlackRock’s $211.16 million and Ark&21Shares’ $145.07 million.

Additionally, the US ETH ETFs recorded inflows on Wednesday of $171.54 million. Eight of the nine funds saw flows, and none were negative.

The highest among these is BlackRock’s $74.5 million, followed by Fidelity’s $49.55 million.

Meanwhile, Bitmine received 46,255 ETH, worth $201 million, from a BitGo wallet across three addresses. Blockchain analytics firm Onchain Lens reported that the publicly traded Bitcoin mining company now owns a total of 2,126,018 ETH worth $9.24 billion.

In South Korea, Seoul abolished a seven-year-old ban, allowing cryptoasset-related companies to apply for venture capital (VC) funding. The ministry explained that the amendment “reflects the changing global status of the cryptoasset industry.”

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has increased over the past day, while the stock market saw a mixed picture on its previous day of trading. By the closing time on Wednesday, the S&P 500 was up by 0.3%, the Nasdaq-100 increased by 0.4%, and the Dow Jones Industrial Average fell by 0.48%. Investors are now waiting for the inflation data due today, with the next step being the US Federal Reserve policy meeting next week, when many expect interest rate cuts.

- Is this rally sustainable?

The market is still consolidating. We will likely continue seeing smaller increases and decreases in the near term. However, economic developments from the US will impact the market in the medium term.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC) appreciated 1.4% at the time of writing, currently trading at $114,132.

Ethereum (ETH) is…

The post Why Is Crypto Up Today? – September 11, 2025 appeared first on Cryptonews.

https://cryptonews.com/news/why-is-crypto-up-today-september-11-2025/