In Summary

- Cryptocurrency regulations across top African countries in 2025 have established clear legal frameworks that enforce licensing, KYC/AML compliance, and consumer safeguards, significantly reducing fraud risks and boosting investor trust in digital assets.

- By integrating digital assets into regulated financial systems, African nations are fostering fintech innovation, improving access to financial services for underserved populations, and promoting efficient cross-border transactions, which are vital for economic diversification and growth.

- Countries like Nigeria, South Africa, and Mauritius are setting regulatory benchmarks that encourage foreign investment and regional cooperation, positioning Africa as a growing hub in the global cryptocurrency ecosystem and enhancing the continent’s economic resilience.

Deep Dive!!

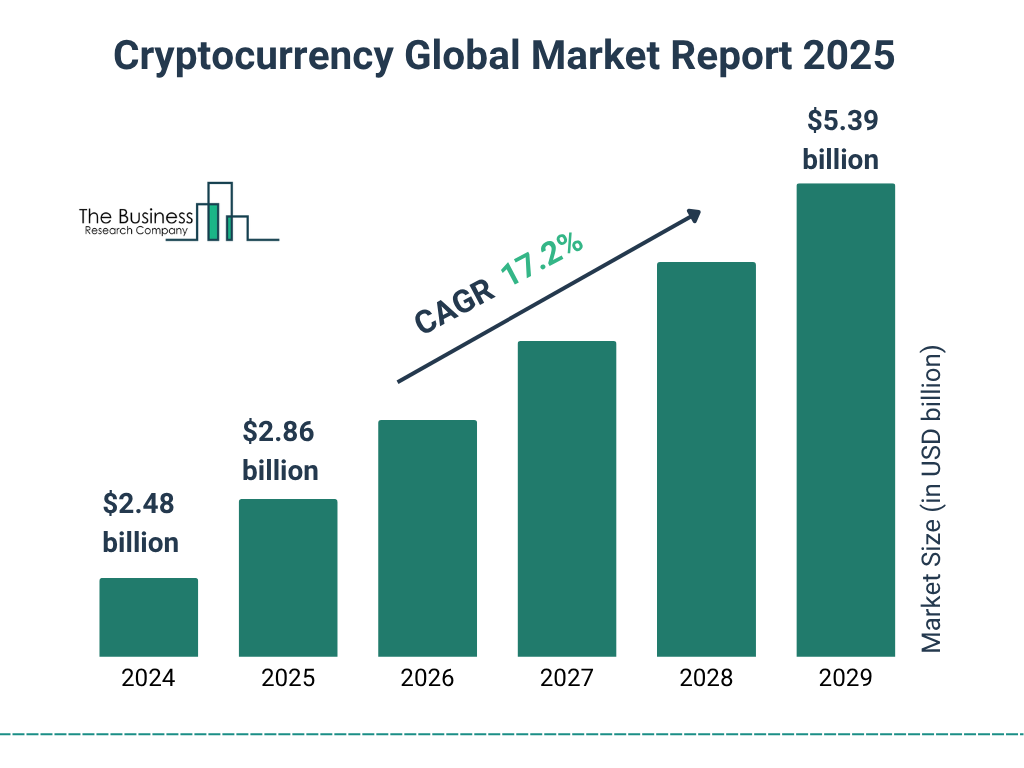

Africa is witnessing a remarkable transformation in the cryptocurrency landscape, with a growing number of countries implementing comprehensive regulatory frameworks to harness the potential of digital assets while safeguarding investors and ensuring financial stability. The continent’s rapid adoption of cryptocurrencies driven by factors such as financial inclusion, remittances, and economic diversification has prompted regulators to establish clear guidelines that balance innovation with consumer protection. According to the latest report by The BFT Online, more than 15 African nations have either introduced or are actively developing crypto regulations, signaling a significant shift from earlier skepticism and restrictive policies.

Experts agree that the regulatory momentum in Africa is a vital step toward unlocking the continent’s economic potential. As Olusegun Adeyemi, an IT and fintech expert and CEO of Bigyard Digital observes, “By creating structured regulatory environments, African countries are not only reducing the risks of fraud and illicit activities but also attracting global investment, fostering local innovation, and paving the way for sustainable growth in the digital economy.” International organizations, including the IMF and FATF, have also recognized Africa’s regulatory progress, emphasizing the need for tailored approaches that address unique market dynamics and technological challenges on the continent.

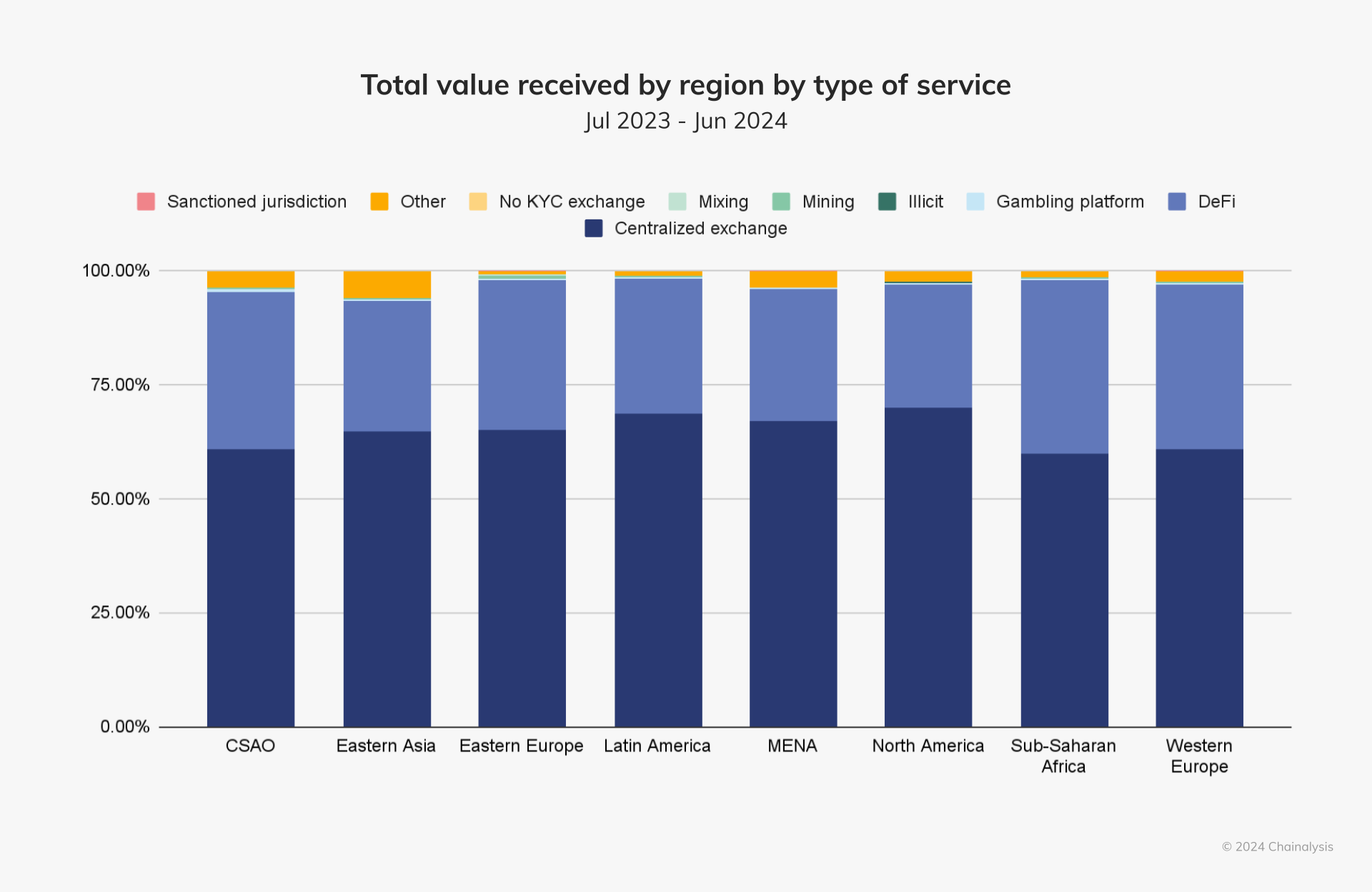

The impact of these regulatory efforts extends beyond individual countries, with a regional ripple effect that fosters cross-border collaboration and harmonization of crypto policies. For instance, Nigeria’s progressive regulatory stance and South Africa’s rigorous licensing regime serve as benchmarks for other nations in the region, encouraging the development of interoperable frameworks that can support pan-African digital finance initiatives. These initiatives are crucial for improving access to capital markets, reducing transaction costs, and enhancing economic resilience across diverse African economies.

This article explores the top 10 African countries with cryptocurrency regulations in 2025, examining their legislative milestones, regulatory strategies, and the broader implications for the continent. Drawing on recent data, expert analysis, and official reports, we highlight how these nations are navigating the complex interplay between innovation and regulation. Ultimately, these developments reflect Africa’s growing influence in the global crypto ecosystem and its ambition to lead in the next wave of financial technology.

10. Botswana

Botswana marked a significant milestone in Africa’s crypto regulatory landscape when it passed the Virtual Assets Act No. 3 of 2022, establishing a formal legal framework for virtual assets. Enforced by the Non-Bank Financial Institutions Regulatory Authority (NBFIRA), the Act requires all entities offering virtual asset services, regardless of where they are located to obtain a license if they target Botswana residents. The law provides clear definitions (excluding digital legal tender and regulated securities) and mandates licensing with penalties, including fines and possible imprisonment, for non-compliance.

As of 2025, Yellow Card Botswana, a subsidiary of the Pan-African stablecoin exchange Yellow Card, remains the sole licensed Virtual Asset Service Provider (VASP) in the country. While no additional licenses have been publicly issued, the fact that a regulated operator exists at all is significant. It demonstrates both commitment and caution: Botswana’s regulatory authority is advancing the framework while still allowing the virtual asset market to develop under controlled conditions.

The Bank of Botswana has reinforced this balanced, precautionary approach. In its 2025 Financial Stability Report, the central bank acknowledged that while the current impact of digital assets on the country’s financial system remains modest, the global evolution of the crypto market could introduce systemic risks over time. It emphasized the growing need for oversight, particularly to guard against illicit uses such as money laundering and terrorism financing, and called for regulators to establish robust AML/CFT frameworks and collaboration with law enforcement.

Botswana’s regulatory strides carry broader implications for Africa. By combining legislative clarity, licensing infrastructure, and vigilant oversight, it sets a model for thoughtful crypto adoption, balancing innovation with risk management. This measured path sends a message to other countries in the region: Sustainable crypto integration is possible when regulation is thoughtfully designed. Botswana’s example may thus encourage broader continental cooperation and the eventual alignment of regulatory standards across Africa, an essential step toward creating a safer, unified digital asset ecosystem.

9. Rwanda

Rwanda has advanced significantly on its journey to regulate cryptocurrencies, bringing a landmark evolution to its financial system. In early March 2025, the Capital Markets Authority (CMA) and the National Bank of Rwanda (NBR) jointly introduced a draft law governing virtual assets and virtual asset service providers (VASPs). The framework defines virtual assets as digital representations of value, such as cryptocurrencies, tokenized real-world assets, and stablecoins, used for trading, payment, or investment. It mandates licensing for entities offering VASP services and establishes penalties of up to 30 million Rwandan francs (approximately $21,000) and five years in prison for non-compliance. The draft law also includes tough restrictions such as bans on crypto mining, crypto ATMs, and mixing services, while enforcing international standards like the FATF-recommended “travel rule”.

Beyond the legal framework, Rwanda is pursuing broader financial innovation with a long-term view. In mid-2025, the Central Bank Governor, Soraya Hakuziyaremye, indicated that public consultations on the virtual assets law were nearing completion, moving Rwanda closer to enacting a practical regulatory regime by early 2025. The draft regulations particularly emphasize the practical integration of stablecoins to support purposes such as remittances and cross-border payments—crucial where remittance fees of 3–6% weigh heavily on African economies. The CMA and NBR aim to blend financial innovation with stability, which aligns with Rwanda’s concurrent exploration of a Central Bank Digital Currency (CBDC) expected by 2026.

The policy process has been inclusive and transparent, inviting public participation to ensure buy-in and practical rigor. On March 6, 2025, regulators opened the draft law to public comment, hosting a virtual consultation and inviting input from fintech experts, bankers, legal practitioners, and consumers. As Carine Twiringiyaremye, Manager of Licensing and Approvals at the CMA, explained:

“The Financial Action Task Force is particularly worried that virtual assets could serve as a channel for money laundering. This is why these regulations are being implemented to reduce such risks and offer clear guidance to both the public and virtual asset service providers.” These regulatory efforts are echoed in the broader context of Rwanda’s ambition to become a regional financial and fintech hub. Supported by national strategies to expand digital financial penetration, boosting fintech adoption from its current base toward ambitious targets, this regulatory groundwork helps cultivate investor confidence and create institutional legitimacy.

Rwanda’s shift toward formal cryptocurrency oversight represents a nuanced blend of innovation facilitation and financial prudence. The framework enhances investor protection, aligns with global standards, and positions the nation as a forward-thinking regulatory model. Furthermore, the integration of stablecoins to address cross-border remittances could inspire ripple effects across Africa, where remittance costs and financial inclusion remain pressing economic priorities. Let me know if you’d like similar write-ups for other African countries or deeper analysis of Rwanda’s fintech strategy.

8. Tanzania

Tanzania made a notable regulatory move with the Finance Act of 2024, which introduced a 3% withholding tax on payments made for digital asset exchanges or transfers to Tanzanian residents, if the payer is a nonresident owner of a digital asset platform. This framework defines “digital assets” broadly, encompassing cryptocurrencies, tokens, and non-fungible tokens, and establishes that platform operators must act as withholding agents, registering with Tanzania’s simplified tax system and remitting the tax to the Tanzania Revenue Authority.

While no direct follow-up reports have detailed post-enactment revenues or additional guidelines in 2025, industry analysts view the law as a deliberate compromise between fiscal pragmatism and regulatory caution. A Tanzanian economist, Dr. Bravious Kahyoza, underscored the shift in policy direction:

“The ban has outlived its usefulness. We must lift it, under strict controls,” he argued, recommending a structured regulatory framework that includes smart taxation and public education on AML/CFT standards.

This tax measure places Tanzania alongside regional peers like Kenya, which introduced a similar 3% digital asset tax earlier. Allan Kakai, Legal Chief at Steakhouse Financial and Director at the Kenya Virtual Assets Chamber of Commerce, noted that this harmonization “is not just Kenyan; it’s a pan‑African framework guiding crypto standards across the continent.” Yet, challenges remain: Cascading concerns exist over implementation, especially in the absence of a full legal framework governing virtual asset operations. Banks remain cautious, crypto activity is still largely informal, and public understanding is limited.

Ultimately, Tanzania’s move signals a shift from blanket prohibition to measured engagement. By capturing tax revenue from offshore cryptocurrency platforms, the country not only acknowledges the pervasive nature of digital asset transactions, but also begins laying the foundations for a more inclusive fintech ecosystem. With nearly 2.3 million Tanzanians estimated to hold crypto assets and stablecoin usage growing at 53% annually, outpacing Kenya’s 30%, the economic relevance is clear. These developments pave the way for stronger regulatory capacity, increased investor trust, and eventual harmonization across East Africa.

7. Kenya

Kenya has transitioned from a cautious crypto stance to proactive regulation with its Virtual Asset Service Providers (VASP) Bill, first unveiled by the Cabinet Secretary on January 9, 2025, and currently progressing through Parliament. Delivered under the National Treasury and Economic Planning’s guidance, this groundbreaking legislation aims to establish licensing, consumer protections, and a governance framework tailored for digital asset activities. As of April 2025, the updated VASP Bill was tabled before Parliament and had its First Reading on April 8.

Under the proposed structure, the Bill introduces a dual-regulator model; the Central Bank of Kenya (CBK) overseeing custodial wallet providers, stablecoin issuers, and payment processors; and the Capital Markets Authority (CMA) managing exchanges, token issuers, brokers, and investment advisors. Licensing mandates include maintaining a physical office, minimum capital, cybersecurity standards, transaction transparency, and real-time regulator access to data. Non-compliance carries stiff penalties, including fines between KES 3 million to 20 million and possible imprisonment.

During the Second Reading of the VASP Bill on June 24, 2025, Hon. Kuria Kimani, Chairperson of the Parliamentary Finance Committee, highlighted Kenya’s digital asset momentum: “We have approximately 6.1 million users” and “US$2 billion traded in decentralized protocols” over the past year. He projected that this Bill could generate at least US$1 billion in foreign direct investment and potentially create 25,000 jobs. His remarks reflect strong belief in crypto’s transformative potential for the Kenyan economy.

Across the industry, Kenya’s progressive trajectory has garnered praise from key stakeholders. At a Nairobi press briefing, Larry Cooke (Binance’s Head of Legal for Africa) and Allan Kakai (Director of VAC) commended Kenya’s legislative clarity but cautioned that “smart, enabling tax policies” will be essential to sustain momentum. Cooke asserted, “With smart, enabling tax policies, (Kenya) can become the epicentre of blockchain innovation on the continent.”

Kenya’s new regulatory framework bridges the gap between innovation and consumer protection. By anchoring VASPs within existing institutes and insisting on robust compliance, Mexico aims to defend integrity while boosting investment and innovation. The articulated job creation, investor confidence, and segmentation across CBK and CMA make Kenya’s approach one of the most comprehensive in Africa, setting a standard for other nations.

Moreover, aligning with Financial Action Task Force (FATF) standards signals Kenya’s readiness to play on the global stage. The inclusion of stablecoins, tokenization platforms, and ICOs under regulatory purview brings clarity to emerging fintech niches while deterring abuse. As the largest and most dynamic crypto market in East Africa, Kenya’s pivot could catalyze continental harmonization of cryptocurrency regulation, encouraging cross-border collaboration and investor activity.

6. Ghana

In August 2024, the Bank of Ghana (BoG) released its Draft Guidelines on Digital Assets, signaling a significant shift towards formal regulation of the cryptocurrency sector. The draft outlines comprehensive measures, including the licensing of Virtual Asset Service Providers (VASPs), implementation of Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) protocols, establishment of regulatory sandboxes, and enhanced consumer protection mechanisms. These guidelines aim to address the growing adoption of digital assets and mitigate associated risks such as fraud and cyber threats.

Following the release of the draft guidelines, the BoG initiated a public consultation process, seeking feedback from industry stakeholders, experts, and the general public. The consultation period closed on August 31, 2024, with the BoG indicating that the final regulatory framework would be submitted to Parliament by September 2025. This timeline underscores Ghana’s commitment to developing a robust regulatory environment for digital assets.

In a decisive move, the Bank of Ghana mandated that all VASPs operating within the country must register with the central bank by August 15, 2025, or face regulatory sanctions. This directive marks a departure from previous policies where digital asset activities operated in a largely unregulated space. The registration requirement is part of Ghana’s broader strategy to integrate digital assets into the formal financial system, ensuring transparency and accountability in the sector.

Ghana’s proactive approach to cryptocurrency regulation positions it as a leader in digital finance within West Africa. By establishing clear guidelines and regulatory frameworks, Ghana aims to foster innovation while safeguarding consumers and the financial system. This regulatory clarity is expected to attract investment, enhance financial inclusion, and set a precedent for other African nations considering similar regulatory measures. As the continent grapples with the challenges and opportunities presented by digital assets, Ghana’s regulatory developments serve as a model for balancing innovation with oversight.

5. Namibia

In 2023, Namibia enacted the Virtual Assets Act (VAA), establishing a legal framework for the regulation of virtual assets within the country. This legislation empowers the Bank of Namibia (BoN) to license and supervise Virtual Asset Service Providers (VASPs) and Initial Token Offering Service Providers (ITOSPs). The VAA introduces a two-tier licensing system, beginning with provisional licenses that allow entities to establish operations under specific conditions. Upon meeting these conditions, entities can transition to full operational licenses, ensuring compliance with regulatory standards.

On January 13, 2025, the Bank of Namibia granted provisional licenses to two entities under the VAA: Mindex Virtual Asset Exchange (Pty) Ltd and Landifa Bitcoin Trade CC. These provisional licenses are valid for six months, during which the entities are required to fulfill specific pre-authorization conditions set by the BoN. During this period, the entities are prohibited from offering services to the public until they meet all regulatory requirements.

The Bank of Namibia’s approach emphasizes a structured and transparent process for integrating virtual asset services into the financial ecosystem. The two-step licensing process ensures that entities are thoroughly vetted and comply with the necessary regulatory standards before commencing operations. This methodical approach aims to mitigate risks associated with virtual assets, such as fraud and money laundering, while fostering a secure environment for innovation and investment in the sector.

Namibia’s regulatory developments position the country as a progressive leader in the African cryptocurrency landscape. By establishing a clear legal framework, Namibia aims to attract investment, promote financial inclusion, and ensure consumer protection in the digital asset space. This regulatory clarity is expected to inspire confidence among investors and stakeholders, potentially leading to increased participation in the virtual asset market. Furthermore, Namibia’s approach serves as a model for other African nations considering similar regulatory measures, contributing to the development of a cohesive and robust cryptocurrency regulatory environment across the continent.

4. Seychelles

In August 2024, the Seychelles National Assembly unanimously approved the Virtual Asset Service Providers Act (VASPA), marking a significant step in the country’s efforts to regulate the cryptocurrency sector. The act came into effect on September 1, 2024, and mandates that all Virtual Asset Service Providers (VASPs) operating in or from Seychelles must obtain a license from the Financial Services Authority (FSA). The legislation aims to enhance transparency, investor protection, and compliance within the fast-evolving virtual asset space, such as cryptocurrency exchanges, custodial services, and related platforms.

Under the VASPA, existing VASPs were required to submit a complete application for a license by December 31, 2024, to continue operations legally. Entities that failed to apply by this deadline faced severe penalties, including fines or imprisonment for directors. The licensing process includes requirements for VASPs to establish a meaningful presence in Seychelles, such as appointing a resident director and maintaining an office with competent staff. These measures aim to ensure that VASPs operate responsibly and reduce the risk of misuse by illegal actors.

The Financial Services Authority (FSA) is designated as the regulatory authority responsible for enforcing the VASPA legislation. The FSA is empowered to inspect and investigate cases of non-compliance, grant and revoke licenses, register Initial Coin Offering (ICO) and Non-Fungible Token (NFT) promoters, issue guidelines and directives to ensure compliance, request information, and undertake enforcement actions. This proactive approach empowers the FSA to maintain the integrity of the Seychelles financial landscape.

Seychelles’ implementation of the VASPA positions the country as a progressive leader in the African cryptocurrency landscape. By establishing a clear legal framework, Seychelles aims to attract investment, promote financial inclusion, and ensure consumer protection in the digital asset space. This regulatory clarity is expected to inspire confidence among investors and stakeholders, potentially leading to increased participation in the virtual asset market. Furthermore, Seychelles’ approach serves as a model for other African nations considering similar regulatory measures, contributing to the development of a cohesive and robust cryptocurrency regulatory environment across the continent.

3. Nigeria

In 2025, Nigeria has taken significant strides in integrating cryptocurrency into its financial system. The enactment of the Investment and Securities Act (ISA) 2025 by President Bola Tinubu marked a pivotal moment, officially recognizing cryptocurrencies and other digital assets as securities under the jurisdiction of the Securities and Exchange Commission (SEC). This legislation mandates that all Virtual Asset Service Providers (VASPs) operating in or targeting Nigerian users must obtain a license from the SEC, ensuring regulatory oversight and compliance with established standards.

The SEC’s new framework introduces stringent requirements for VASPs, including a minimum paid-up capital of ₦500 million and a 25% fidelity bond. Additionally, the Central Bank of Nigeria (CBN) has relaxed its previous stance, allowing licensed VASPs to open designated bank accounts, provided they adhere to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. This regulatory clarity aims to foster a secure and transparent environment for digital asset operations, balancing innovation with consumer protection.

Parallel to regulatory developments, Nigeria has seen a surge in the adoption of its Central Bank Digital Currency (CBDC), the e-Naira. By the first quarter of 2025, over 9.7 million e-Naira wallets had been registered, with transactions totaling $1.3 billion. This adoption underscores the growing acceptance of digital currencies among Nigerians, driven by factors such as inflation, currency volatility, and the need for efficient cross-border transactions.

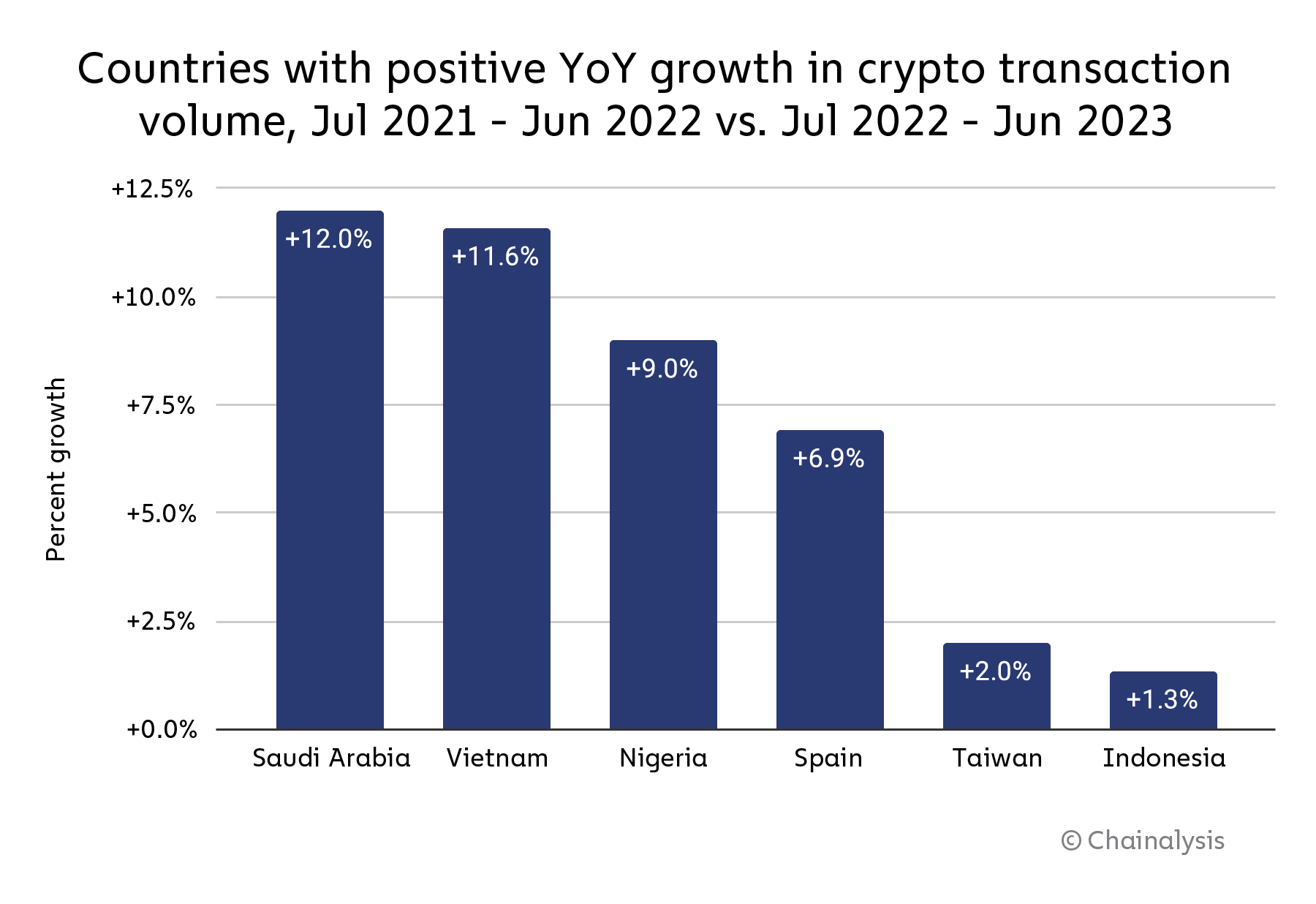

Nigeria’s regulatory advancements position it as a leader in Africa’s digital asset landscape. The country’s proactive approach has not only enhanced investor confidence but also attracted international attention, with Nigeria ranking first globally in stablecoin adoption and second in overall digital asset usage. These developments have the potential to stimulate economic growth, promote financial inclusion, and set a precedent for other African nations considering similar regulatory frameworks.

2. Mauritius

Mauritius has established itself as a pioneering jurisdiction in Africa regarding cryptocurrency regulation. In February 2022, the country enacted the Virtual Asset and Initial Token Offering Services Act (VAITOS Act), granting the Financial Services Commission (FSC) the authority to license and supervise Virtual Asset Service Providers (VASPs) and issuers of Initial Token Offerings (ITOs). This legislation aligns with international standards, including those set by the Financial Action Task Force (FATF), to mitigate risks such as money laundering and the financing of terrorism.

Under the VAITOS Act, the FSC has implemented a comprehensive licensing regime for VASPs and ITO issuers. Entities seeking to operate in or from Mauritius must establish a physical presence in the country, ensuring compliance with local regulations. The Act defines “virtual assets” as digital representations of value that can be traded or transferred and used for payment or investment purposes, excluding digital representations of fiat currencies, securities, and other financial assets under the Securities Act.

The VAITOS Act not only provides a clear legal framework for cryptocurrency activities but also emphasizes investor protection. It imposes fit-and-proper requirements on VASPs and ITO issuers, mandates ongoing reporting obligations, and outlines procedures for winding up operations. These measures aim to enhance transparency and accountability within the sector, fostering a secure environment for both investors and service providers.

Mauritius’s proactive approach to cryptocurrency regulation has positioned it as a regional fintech hub. By adopting comprehensive legislation, the country has attracted international attention, offering a model for other African nations considering similar regulatory frameworks. This development contributes to the growth of a cohesive and robust cryptocurrency regulatory environment across the continent, promoting financial inclusion and innovation.

1. South Africa

As of 2025, South Africa has emerged as a frontrunner in cryptocurrency regulation within Africa, establishing a comprehensive legal framework that balances innovation with investor protection. The Financial Sector Conduct Authority (FSCA), operating under the Financial Advisory and Intermediary Services (FAIS) Act, has recognized cryptocurrencies as financial products, thereby subjecting them to regulatory oversight. This move aims to safeguard consumers and mitigate risks associated with money laundering and terrorism financing.

Since the commencement of the licensing process in June 2023, the FSCA has received 383 applications for Crypto Asset Service Provider (CASP) licenses. By June 2024, 138 of these applications had been approved, encompassing a diverse range of services including exchanges, wallet providers, and tokenization platforms. Notably, the FSCA has implemented stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, aligning with the FATF’s “travel rule”, which mandates the sharing of transaction information between financial institutions. These measures are currently being enforced to enhance transparency and combat illicit activities in the crypto space.

The regulatory framework established by the FSCA emphasizes investor protection through the imposition of fit-and-proper requirements for CASPs, mandatory disclosures, and adherence to fair treatment principles. Additionally, the FSCA has committed to ongoing supervision and enforcement, with investigations targeting unauthorized crypto-related financial services. This proactive approach aims to maintain market integrity and build public trust in the cryptocurrency ecosystem.

South Africa’s regulatory advancements have positioned it as a leading jurisdiction in Africa’s digital asset landscape. The country’s comprehensive regulatory approach serves as a model for other African nations seeking to establish clear and effective cryptocurrency regulations. By fostering a secure and transparent environment, South Africa aims to attract investment, promote financial inclusion, and stimulate innovation in the digital economy.

https://www.africanexponent.com/top-10-african-countries-with-cryptocurrency-regulations-in-2025/