Bitcoin is at $117,000, down less than 1% in the last 24 hours, with a market cap of $2.32 trillion and $73 billion in daily volume. Price is consolidating above $116,000, where support has held in recent days. The chart shows a narrowing wedge, often a precursor to big moves in either direction.

The 50-period SMA at $117,462 is the immediate cap on short-term rallies. Recent candles are showing indecision, with small-bodied candles indicating hesitation between buyers and sellers. The RSI at 51 has bounced from oversold levels, and the MACD is flattening after a bearish stretch, both suggesting a change in momentum.

Bitcoin Institutional Moves Impact Sentiment

Institutional adoption is growing. Dutch firm Amdax has launched AMBTS B.V., a Bitcoin treasury to list on Euronext Amsterdam, with plans to control 1% of Bitcoin’s total supply, worth over $24 billion at today’s prices. This is another sign of European demand for BTC as a balance sheet asset, with at least 15 European companies already holding BTC.

Meanwhile, Michael Saylor’s Strategy added 155 BTC worth $18 million, bringing its total to 628,946 BTC valued at $74 billion. With unrealized gains of nearly $28 billion, Strategy is the largest corporate Bitcoin holder, even with short-term volatility.

Key points to note:

- Institutions and businesses now control over 10% of Bitcoin’s supply.

- Strategy has doubled its BTC holdings since the 2024 US election.

- European companies are pushing Bitcoin into mainstream finance.

Market Ahead of Fed

The broader crypto market is cautious ahead of Jerome Powell’s Jackson Hole speech, with traders liquidating $567 million in positions this week. Funding rates are negative, indicating near term downside. Powell is expected to talk about inflation and the weakening labor market, but may not confirm a September rate cut.

Technically, Bitcoin is at key levels. A break below $116,078 could see $114,650 and $112,680, while a break above $118,047 could see $120,374 and potentially $123,777. Traders are waiting for confirmation signals, such as engulfing candles or big volume spikes, to validate the next move.

Despite the short-term volatility, the long-term trend is still up. Institutional accumulation, growing adoption and a supply squeeze will set the stage for the next Bitcoin rally. If the momentum shifts, BTC could surge to $130,000 and beyond, entering the presales phase.

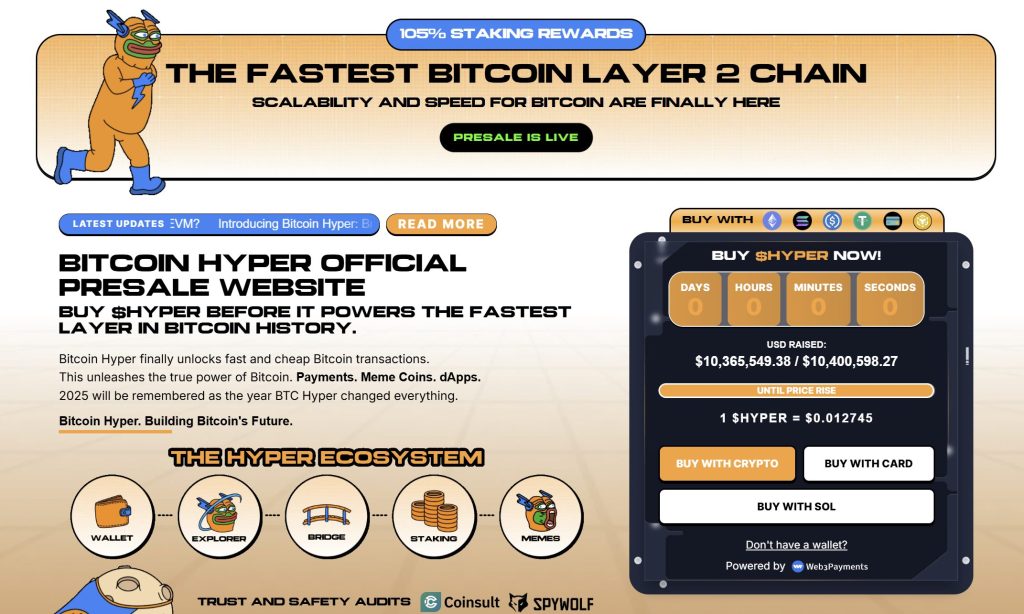

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $10.3 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.012745, but that price is set to rise soon.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Will BTC Rally to $123K or Drop to $112K? appeared first on Cryptonews.

https://cryptonews.com/news/bitcoin-price-prediction-will-btc-rally-to-123k-or-drop-to-112k/

Amdax plans to launch a

Amdax plans to launch a