Donald Trump has now been back in the White House for 100 days — and it’s been a period of turbulence, uncertainty and chaos for the markets.

The crypto world had high hopes when the president secured a second term. But despite some significant pro-Bitcoin announcements, there’s been disappointment.

Just before the inauguration, there was market mania when he unveiled the official $TRUMP token — and no shortage of controversy. Some critics argued the move was a flagrant conflict of interest… and potentially a threat to national security.

At the time of writing, this meme coin is down 82% from an all-time high of $75.35 set on Jan. 19. But $MELANIA is faring far worse after crashing by close to 97%.

Once settled back in the Oval Office, there was feverish speculation that a flurry of pro-crypto executive orders would be signed on day one, including the creation of a strategic Bitcoin reserve. But they never came. BTC rallied to a record-breaking $109,000 on Jan. 20 — and hasn’t returned to this level since.

Trump did quickly follow through on some of the campaign pledges made on stage at Bitcoin 2024 in Nashville, though. Ross Ulbricht — the founder of the Silk Road darknet marketplace — was granted a full and unconditional pardon, and pictured smiling as he left prison for the first time in 11 years. Reports suggested that Sam Bankman-Fried was also lobbying for clemency, but this hasn’t materialized.

Meanwhile, several BTC-friendly members of Trump’s cabinet were swiftly approved by the Senate. They include Treasury Secretary Scott Bessent, who has declared: “Crypto is about freedom, and the crypto economy is here to stay.”

Others faced harsh scrutiny. Commerce Secretary Howard Lutnick was hauled over the coals during his confirmation hearing, but gave short shrift to questions about his firm’s ties to the Tether stablecoin.

The White House appointed its first AI and crypto czar in the form of David Sacks, who offloaded his investments in Bitcoin, Ether and Solana before taking office. That hire attracted widespread praise, including from SkyBridge Capital founder Anthony Scaramucci, who is otherwise a vocal critic of Trump.

We’ve also seen how the president’s businesses are gaining growing exposure to digital assets, with the Trump Media and Technology Group amassing vast crypto reserves and unveiling a flurry of exchange-traded funds.

One simple rule with Donald Trump is to always expect the unexpected. We saw this in action back on March 2 when — in an out-of-the-blue announcement on Truth Social — the president declared he intends to create a “U.S. crypto reserve” that consisted of XRP, Solana and Cardano. Each of these altcoins surged dramatically on the news, some by as much as 70%. Neither Bitcoin nor Ether were mentioned in the original post, but a follow-up stressed that both of these flagship digital assets would “be at the heart of the reserve.”

The news that BTC was going to be lumped with other altcoins went down like a lead balloon, with experts describing the proposal as “ridiculous” and “messed up.” Concerns were raised about how viable this plan actually was too, amid fears it may need congressional approval to get off the ground. Detail was also thin on the ground. We didn’t know anything about what allocations would look like, how the reserve would be funded, and when it would come into force.

All of these questions turned out to be irrelevant anyway. In what amounted to a substantial U-turn, Trump soon signed an executive order to establish a strategic Bitcoin reserve as originally planned — along with a separate stockpile of other cryptocurrencies.

Even though this amounted to one of the biggest adoption milestones in Bitcoin’s history, the world’s biggest cryptocurrency suffered sharp sell-offs as investors digested the news. Why? Because the executive order stated that no new BTC beyond those seized from criminals would be purchased for the reserve, unless acquisitions could be achieved in a budget-neutral way. That was also bad news for XRP, SOL and ADA, as the U.S. currently doesn’t own any of these tokens.

Bitcoiners had been widely hoping that the U.S. would become a substantial buyer of BTC — and follow through on Senator Cynthia Lummis’s huge ambition of amassing one million coins within five years. This would have inevitably caused prices to shoot up as supply was squeezed. But spending taxpayer money on such an effort would have been hugely hypocritical, especially considering Elon Musk’s work to dramatically downsize the federal government.

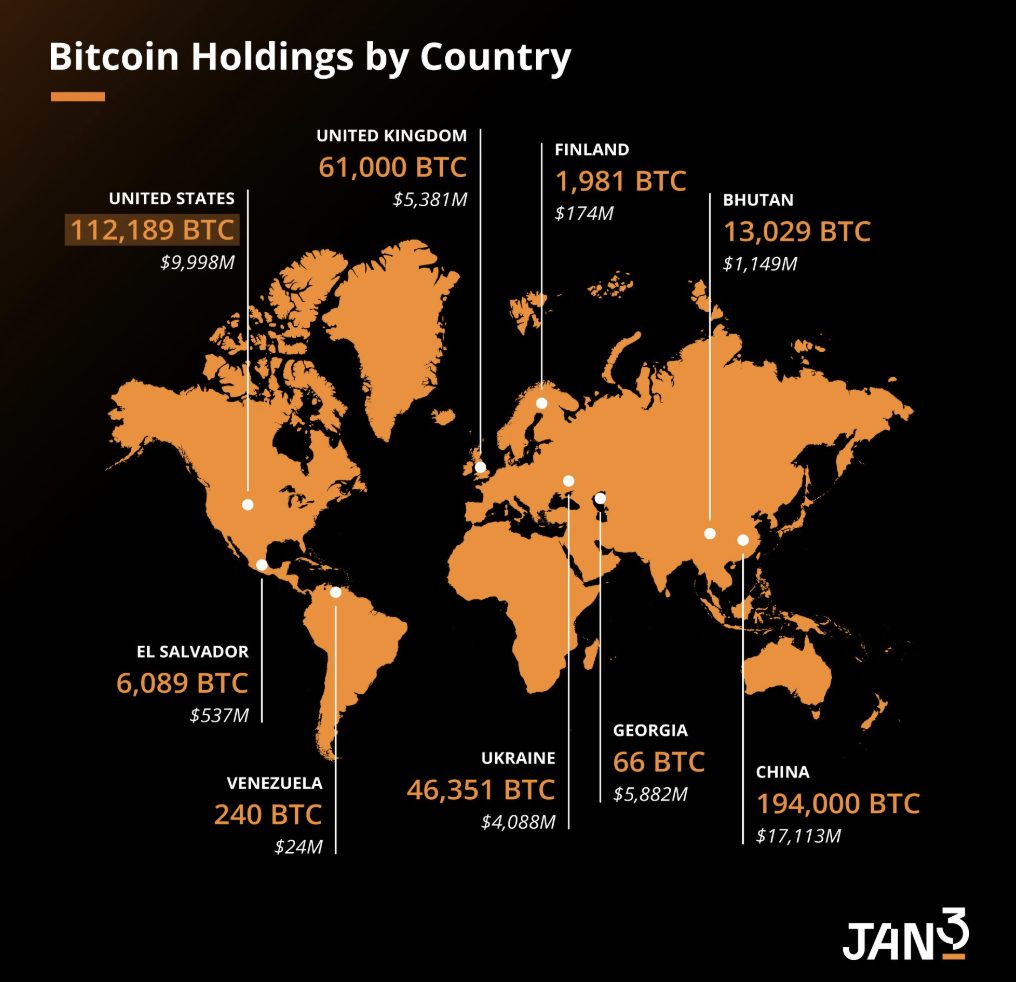

Data from Arkham Intelligence shows that the U.S. currently has about 198,000 BTC in its wallet — worth $18.8 billion at the time of writing. But as JAN3 CEO Samson Mow notes, the true size of America’s strategic Bitcoin reserve is likely to be much smaller — as 95,000 coins will eventually be returned to Bitfinex. Far from being downbeat about this though, Mow argues that the significance of Trump’s policy is still “immense,” as it’ll encourage other major economies to follow suit.

The president’s Bitcoin reserve announcement was swiftly followed by the first-ever White House Crypto Summit on March 7, which was attended by industry heavyweights including Strategy’s Michael Saylor and Coinbase’s Brian Armstrong. But it had mixed reviews, with one analyst arguing “it was more of a political stage than a meaningful policy forum.”

Investors had bigger fish to fry though, with Trump facing accusations that he was deliberately attempting to crash the stock market so the Federal Reserve would lower interest rates. The S&P 500 and the tech-heavy Nasdaq 100 were nursing heavy losses — and a close correlation meant Bitcoin’s sell-offs were even larger.

Things went from bad to worse in the immediate aftermath of “Liberation Day,” where the president announced sweeping and punishing tariffs on some of America’s closest trading partners — dramatically hiking the cost of imported goods in the process. BTC sank towards $80,000 at the beginning of April as the odds of a recession rose, and a war of words escalated between Washington and Beijing.

At one point, Bitcoin was in danger of slumping below $75,000 — and trading at a 30% discount to the record high seen on inauguration day. But there was some temporary relief when Trump confirmed that reciprocal tariffs on most nations would be paused for 90 days, all while tariffs on China were hiked once again to a jaw-dropping 145%. There was further optimism when smartphones and computers were exempted from these aggressive trade policies. Yet the constant flip-flopping from the White House has left investors anxious and weary, with many now reducing their exposure to U.S. assets and gravitating toward gold.

It has become near impossible to keep up with the endless barrage of headlines from Washington. While all of this was happening, Trump was upping his attacks on Federal Reserve chairman Jerome Powell — writing on Truth Social that his “termination cannot come fast enough!”

While presidents normally lack the power to fire the heads of independent federal agencies, a Supreme Court case could change this precedent, and embolden Trump to start intervening in the Fed’s affairs. Critics from across the political spectrum fear this could cause the markets to start tanking once again, with the S&P 500 on the brink of a bear market at one point.

One key appointment that has been slightly delayed relates to the confirmation of SEC chair Paul Atkins, who was chosen to replace anti-crypto Gary Gensler. That finally happened last week — and one of his first tasks will be to decide whether exchange-traded funds tracking altcoins like XRP should be approved.

Meanwhile — despite the value of $TRUMP dropping like a stone — those behind this meme coin have come up with a novel way to drum up interest. An “exclusive” dinner is going to be held for the 220 biggest holders of this token, sparking a race to amass as much as possible between now and May 12. The value of $TRUMP spiked by 64% once the race was announced, with the current runners and riders displayed on a live leaderboard.

But some on Crypto Twitter are nervous, and argue that this dinner “is a trap to dump and make millions more from FOMO buyers.” One analyst has urged anyone who bought $TRUMP at elevated levels to get out while they still can.

Bitcoin has fallen by 12% over the past 100 days, while the S&P 500 is down 8.6%. The threat of tariffs continues to loom large. And now, a new CNN poll suggests that 59% of Americans think Trump’s policies have made the U.S. economy worse. About 60% say he’s exacerbated the cost-of-living crisis, and an increasing number of consumers fear a recession could be on the horizon.

Meanwhile, hopes are fading fast that we’ll see BTC reach a new all-time high this year. Just 67% on Polymarket think the world’s biggest cryptocurrency will break $110,000 by the end of 2025 — falling to 54% odds for $120,000, 40% for $130,000, and 30% for $150,000. Back in January, all of these were regarded as pretty conservative targets for Bitcoin, showing how quickly things can change.

Trump’s erratic, whirlwind approach to politics makes it near impossible to know what’s going to happen next week — let alone next month or next year. And that makes charting Bitcoin’s future direction even harder. Take anyone making bold and confident price predictions with a very large pinch of salt.

So much has changed in the past 100 days, and there are still 1,361 to go.

The post Trump’s First 100 Days: The Impact on Crypto appeared first on Cryptonews.

https://cryptonews.com/exclusives/trumps-first-100-days-the-impact-on-crypto/