It might be a moment of hush before chaos ensues, or it may be business as usual.

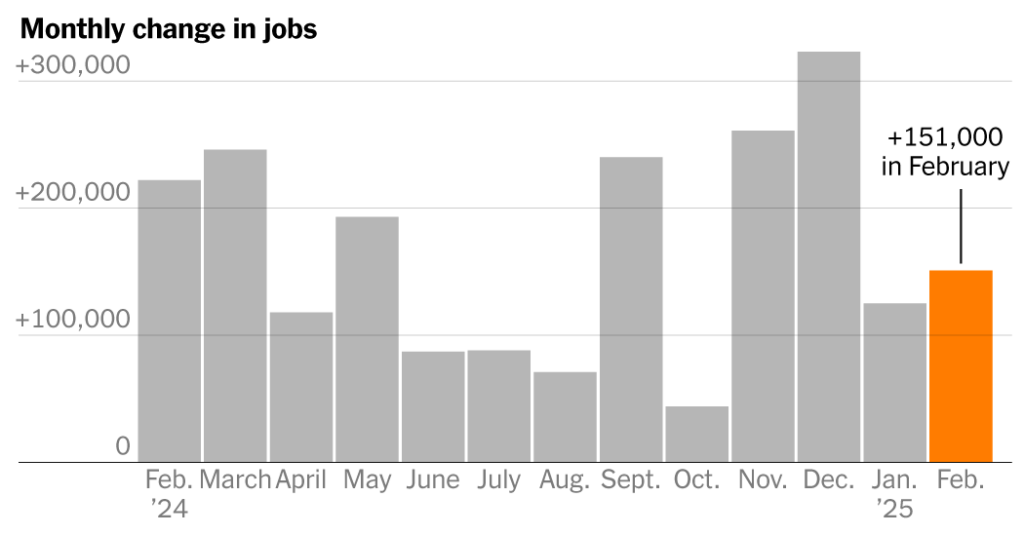

U.S. employers added 151,000 jobs in February, the first full month under the new Trump administration, the Labor Department reported on Friday. The gain extended a streak of job growth to 50 months. The unemployment rate ticked up slightly, to 4.1 percent, from 4 percent in January.

The report showed a decline of 10,000 in federal employment. But it was based on surveys conducted in the second week of February, as the Trump administration’s mass firings, buyouts and hiring freezes at federal agencies were still unfolding.

The survey has likely not registered “more than a sliver of the full impact from federal government layoffs,” said Preston Caldwell, chief U.S. economist at Morningstar. “That should change in next month’s job report.”

A similar waiting game is in store for those hoping to ascertain the effects that President Trump’s tariffs — those imposed and those still threatened — may have on global trading partners, business investment and employment.

Even without the shake-up in foreign trade and federal employment, private-sector hiring has slowed substantially from the blowout pace of 2021 to 2023. That has left labor market analysts and financial commentators gearing up for a potential cooling in economic growth this year.

For now, though, unemployment continues to glide just above record lows. And gains in average hourly earnings for workers have kept up a solid pace, overtaking inflation since mid-2023.

“This is a fundamentally healthy labor market, continuing its earlier momentum, albeit at a slightly slower pace,” said Justin Wolfers, an economist at the University of Michigan.

Yet several labor economists, including Guy Berger at the Burning Glass Institute, a research firm, noted that some trouble may be around the corner.

It was “not a terrible report” but “not a great report,” Mr. Berger said, and “this predates most of the more potent policy actions” from the president. He expects the unemployment rate to continue to rise in the coming months.

Typically, White House economic officials are among the most optimistic forecasters. But prominent Trump administration officials have been at least partly echoing predictions of pain to come, arguing that near-term harm may be necessary for longer-term benefit.

In an interview Friday morning with CNBC before the release of the data, Treasury Secretary Scott Bessent asserted that financial markets and the economy overall had become too reliant on government spending and that there was “going to be a detox period” going forward, prompted by Trump administration cutbacks.

“Could we be seeing that this economy that we inherited starting to roll a bit? Sure,” Mr. Bessent said.

Many business leaders had hoped that Mr. Trump would come into office, establish more corporate-friendly regulations, cut taxes and let a surge in investor confidence lead the way economically — with tariff talk mostly remaining talk.

The prospects of tax cuts and deregulation remain. But the swift and at times chaotic actions on tariffs, federal staffing and federal contracts have caught many businesses, small and large, off guard.

Michael R. Strain, an economist at the American Enterprise Institute, a conservative think tank, said Mr. Trump’s policies on trade and immigration, and his no-holds-barred approach to federal job cuts, would have a damaging effect.

“What President Trump has proposed will not cause a recession,” he said, “but it will slow economic growth.”

“It will take money out of people’s pockets,” Mr. Strain continued. “It will increase the unemployment rate. It will cost people jobs. It will make American businesses less competitive.”

The federal government is the nation’s single largest employer, with about three million workers, or about 1.9 percent of the civilian work force. But the federal work force has generally declined as a share of overall employment in recent decades.

One tally, by the outplacement firm Challenger, Gray & Christmas, put the number of federal job cuts in February at 62,000. Up to 75,000 federal employees may have accepted a buyout offer. This will leave them uncounted in official unemployment data through summer, but they will join the slowly swelling ranks of job seekers who have recently had a harder time landing roles.

Still, administration officials have made the case that the economy will be better off, and more productive, if federal staffing is further reduced. (The public sector overall added jobs in the February report, because of hiring by state and local governments.)

Torsten Slok, chief economist at Apollo Global Management, recently modeled the impact of tariffs, which are taxes on imports, as well as the effects of spending cuts made by the so-called Department of Government Efficiency led by Elon Musk. Mr. Slok projects that inflation will be somewhat higher in the coming months and that overall economic growth will be a half-percentage point lower — a significant loss for the $30 trillion U.S. economy.

If tariffs end up reigniting inflation, or even just keep it from falling further, the Federal Reserve may not cut interest rates any more than it already has this cycle, even if the job market slows.

According to researchers at Bank of America, the February data “underscores the risk of mild stagflation — softer but still positive growth and modestly higher inflation — in coming months.”

Reports from business contacts at regional branches of the Federal Reserve and surveys of small businesses have suggested that uncertainty prompted by the Trump administration’s rhetoric and actions may be weighing on hiring decisions in the near future.

“Headwinds are mounting,” said Diane Swonk, chief economist at the accounting firm KPMG. “Uncertainty is paralyzing, and it is showing up everywhere”

Global business indexes that measure uncertainty have, for instance, surpassed their pandemic levels.

Jobs reports are inherently backward-looking snapshots. Nevertheless, evidence of a broad deterioration in U.S. economic conditions is scarce.

A collection of commentary from over 130 companies from recent earnings calls and conference presentations released by a team at Deutsche Bank showed that “on the risk of tariffs, many companies expressed a belief that while the escalations are not welcome, they would not have a dramatic impact on their businesses.”

Several executives attributed their resilient confidence to their diversified and adaptable supply chains, though that pliability may soon be further tested.

“Tensions are high, and we expect for this to play out for some time,” said Ted Krantz, chief executive of Interos, a supply chain intelligence firm whose clients include major multinational corporations.

On the domestic front, the often abstract or far-off seeming machinations of Washington politics have become painfully tangible for the families of federal workers.

On Feb. 13, Margaret Woodbridge, 35, an ecologist for the National Forest Service who lives in Black Mountain, N.C., got an email from the agency, which operates under the U.S. Department of Agriculture.

The subject line: “Notification of Termination During Probationary Period.”

Dr. Woodbridge was shocked. She had been doing postdoctoral work for the Forest Service since 2020 and was appointed to a full-time position in early 2024.

“The agency finds, based on your performance, that you have not demonstrated that your further employment would be in the public interest,” her termination letter says.

“I received four performance awards in my 11 months,” said Dr. Woodbridge, whose research covers the health of southern Appalachia’s old growth forest. “My boss called and was crying.”

She follows the news closely and has heard the rationales coming from the White House for the cuts, and she even agrees that agencies like hers could be more efficient. She doesn’t see how what’s happening to employees like her is helping.

“What’s actually happening is very different from what the message is,” Dr. Woodbridge said.

Ben Casselman and Colby Smith contributed reporting.