Stay informed with free updates

Simply sign up to the Artificial intelligence myFT Digest — delivered directly to your inbox.

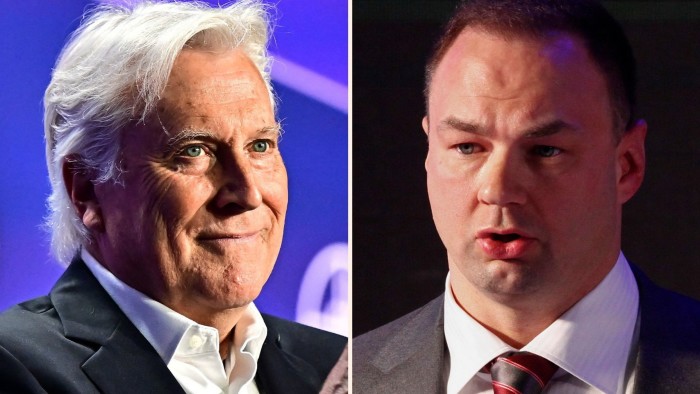

Mark Walter, the billionaire chief executive of Guggenheim Partners, and Thomas Tull, the former owner of Legendary Entertainment, have formed a $40bn holding company to make large bets on artificial intelligence.

Tull has become co-chair of TWG Global, which houses Walter’s assets spanning interests in the Los Angeles Dodgers, Chelsea FC and Guggenheim, among others.

Tull will contribute his own investments, which include a sprawling portfolio of venture capital and biotechnology bets and stakes in defence start-ups and media companies. In total, the assets inside TWG will be worth nearly $40bn, according to three people briefed on the matter.

“By joining together to co-lead TWG Global, we can more effectively grow and increase the value of the companies in the portfolio through the implementation of technology and operational enhancements,” said Walter in a statement to the Financial Times.

Tull added: “Our shared history of building businesses that have attempted to transform industries helps us identify opportunities others may not see.”

The partnership brings together two billionaire investors who have revolutionised their respective industries.

As the leader of Guggenheim Investments, Walter spurred the push of powerful Wall Street investment groups into mundane but lucrative insurance assets, now the lifeblood of growth in the $13tn private capital industry.

Under Walter, Guggenheim acquired the Los Angeles Dodgers baseball team, in part using capital from insurers the group controlled. He is also a co-owner of Chelsea FC, having acted as an instrumental part of a consortium that bought the football club from Russian oligarch Roman Abramovich for £4.25bn in 2022.

Tull, a serial entrepreneur who grew up poor in New York and made his first windfalls operating launderettes, later earned billions in Hollywood. Beginning in the mid-2000s, his Legendary Entertainment became a sensation, producing a string of box office hits including Christopher Nolan’s Batman Begins and The Dark Knight.

Tull sold the group for $3.5bn in 2016 to a Chinese financial conglomerate, but retained a 20 per cent interest.

After a rift with the buyer, Tull left Hollywood the following year and began to invest far away from the film industry. He ploughed his profits from Legendary into lucrative defence start-ups and venture capital bets.

Tull oversees Tulco, a venture capital firm, and United States Innovative Technology, an investment group that has spent billions backing “critical technologies relevant to the national interest”, such as weapons start-up Anduril.

Tull was introduced to Walter in 2019 through their joint personal investment in private equity owned insurance brokerage Acrisure. Afterward, they began discussing how AI would disrupt entire industries and could be used within the companies they controlled to create new profit streams, they said.

In 2022, the two decided that they should put their respective interests under one roof, TWG, and together have begun building broad AI capabilities.

Last year, they hired former JPMorgan executive Drew Cukor to oversee a data and AI division inside the holding company that will drive adoption of the technology across their portfolio companies.

The holding company will also use profits from existing assets to jointly seed new investments spanning sports, venture capital start-ups and media, among others.

https://www.ft.com/content/9f670b45-5aeb-4513-92ea-61e27248a968