Solana’s struggle beneath the $140 mark escalates amid mounting bearish sentiments.

Most cryptocurrencies breached reliable support barriers as Trump-driven crypto party ended with Bitcoin’s dip below $90K.

Solana changes hands at $133, with dwindled investor and trader activity suggesting more pain before solid reversals.

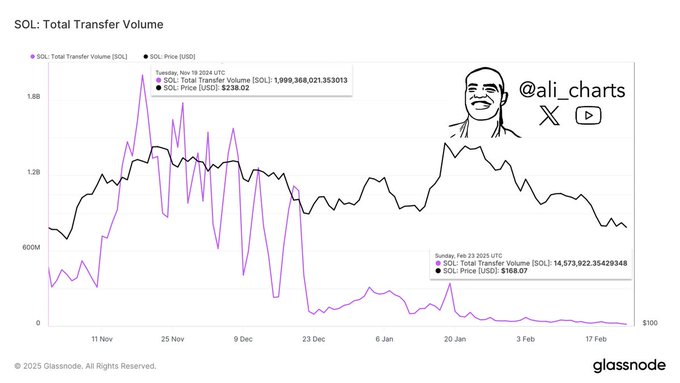

Glassnode data shows Solana’s total transfer volume plunged from $1.99 billion in November last year to this week’s low of $14.57 million.

Billions exit the Solana ecosystem

The over 99% dip coincided with SOL’s price slump from $238 to $168 in the three-month timeframe.

That reflects billions of users exiting the Solana ecosystem, denting the hopes of near-term bounce-backs for the altcoin.

Solana once dominated with billions in 24-hour transfers.

However, the trend has shifted, with steep plunges indicating dwindled on-chain participation and demand.

Factors such as reduced interest from institutional players or liquidity migration to other blockchains drive such trends.

These developments intensified as Solana faced increased criticism over the past few months.

Experts and the cryptocurrency community attacked the network for facilitating scam activities following LIBRA’s incident.

New Solana-based memes such as Donald Trump’s TRUMP and MELANIA have triggered staggering losses for investors.

Fraudulent deals have dented confidence in the SOL network, explaining the waning demand.

Will such trends delay Solana’s potential recoveries after the recent broad-market dip?

SOL price outlook

Solana trades at $133 after dropping more than 5% in the previous 24 hours.

The substantial daily trading volume slump highlights dominant selling, threatening more pain for SOL.

Technical indicators have flipped bearish following Solana’s massive decline from mid-January levels of $280.

The 50-day Exponential Moving Average dropped below the 100-day EMA, which has magnified the chances of a death cross — where the 50-day falls beneath the 200-day EMA.

Moreover, the daily Relative Strength Index has dipped into the oversold region, demonstrating heightened bearish momentum.

Meanwhile, the derivatives market data brings some hope.

Despite the plummeting prices, Solana’s long/short ratio reflects equal bulls and bears.

Moreover, the volume-weighted funding rate increased to 0.0033% (Coinglass data).

That indicates traders’ enthusiasm to pay premiums to execute longs.

Solana’s short-term trajectory will depend on its movements around the vital $130 support.

Stability above the foothold could trigger revivals beyond $140, which might attract substantial bull activity.

Nevertheless, the weakening demand signals more dips before decisive bounce-backs for SOL.

Analyst Ali Martinez highlights an emerging bearish right-angled upward broadening setup.

A break beneath $130 will likely trigger downsides to $65 – an approximately 51% dip from Solana’s current price.

Solana might take longer to recover from the latest slump due to dwindled on-chain activity, weak demand, and broad market struggles.

Enthusiasts will likely watch how developments such as Solana exchange-traded fund approval influence SOL’s performance in the upcoming sessions.

The post SOL price outlook: what’s next as Solana transfer volume plummets 99% appeared first on Invezz

https://invezz.com/news/2025/02/26/sol-price-outlook-whats-next-as-solana-transfer-volume-plummets-99/