Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

We wrote in November that President Trump was super-keen on a US sovereign wealth fund. We first focused on the crypto aspects of his plan, but it’s worth recalling that:

. . . in September, he promised the Economic Club of New York to make America its own sovereign wealth fund, “to invest in great national endeavour to the benefit of all of the American people”, funded by “tariffs and other intelligent things”. Among a list of uses for this wealth fund, he said that it would “return a gigantic profit which will help pay down national debt”.

On Monday, he signed an Executive Order directing the Secretary of the Treasury to come up with a plan within 90 days to create a Sovereign Wealth Fund.

Rather touchingly, the executive order ends by noting that the UK wants to start developing its own SWF.

This may have been a way to forestall the common criticism that countries need to run budget surpluses if they want to build sovereign wealth funds. We actually agree they don’t. Sovereign Wealth Funds tend to be canonically divided into savings funds (piggy banks for the distant future), stabilisation funds (piggy banks for rainy days), and strategic funds (special purpose vehicles into which state assets can be thrown and managed). Turkey, for example, has run a SWF despite a persistent budget deficit and current account deficit over the past decade.

Anyway, the EO argues that a SWF could start with the $5.7 trillion in assets that the US government already directly owns when natural resource reserves are excluded.

That’s a lot of assets! Unlike thousands of other US government websites, the US Treasury’s website has not yet been taken down. On it we found a government balance sheet detailing assets worth $5.4 trillion at the end of 2023, which is maybe close enough. So what are they?

There’s a lot to chew on. Being America, the numbers are all very large.

It’s striking, for example, that the federal government’s $566 billion valuation of all of its furniture, fixtures and equipment eclipses the combined market value of Australia’s Future Fund and Singapore’s Temasek. And its book of student loans and tax prepayments together had the same value as Tesla. (Not that we’re suggesting that this would be a good trade.)

Hidden away in the Cash & Other Monetary Assets section is the country’s gold reserve, valued at a mere $11 billion of book value. Using today’s market price this would swell what we’ll call the MAGA Fund by a further $732 billion, to a little over $6 trillion.

Chucking all your office furniture into a Sovereign Wealth Fund to raise the potential asset value may strike some as a little preposterous. But we thought we’d give you a glimpse as to the international sovereign wealth asset landscape in the event that this was pulled off.

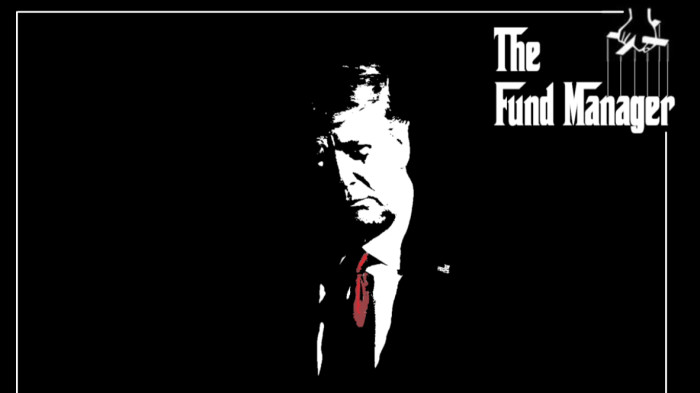

How would this new fund work? Early signs are that governance might be top-heavy. On signing the Executive Order, this is what Trump had to say:

We’re going to be doing something, perhaps with TikTok, and perhaps not. If we make the right deal, we’ll do it. Otherwise, we won’t but I have the right to do that. We might put that in the sovereign wealth fund.

Readers will recall that one of Trump’s first actions on taking office was to suspend for 75 days the enforcement of a law requiring ByteDance, TikTok’s Chinese parent company, to sell or close down the site in the US — supposedly on national security grounds. Faced with closure, we don’t have to stretch too hard to imagine that the price of otherwise zeroed assets might not be high. And if Trump really is the type to make offers you can’t refuse, any US Sovereign Wealth Fund might be able to quickly accrue assets at low prices.

A President-led governance framework would also give the administration the ability to provide an exit for any friends trapped in private equity deals or those seeking to cash out of private firms at elevated valuations. So swings and roundabouts.

https://www.ft.com/content/18c06f51-5162-4cf1-8301-c5b85b4a0aab