The cryptocurrency market witnessed a sharp decline on December 19, as Bitcoin (BTC) plunged below the $100,000 mark following the US Federal Reserve’s decision to cut interest rates by 25 basis points.

Contrary to expectations of a bullish response, the announcement triggered a broad market sell-off, impacting major altcoins like Ethereum (ETH) and XRP, which dropped by 6% and 10%, respectively.

Despite the downturn, trading volumes surged by 40% to $251 billion, indicating heightened market activity.

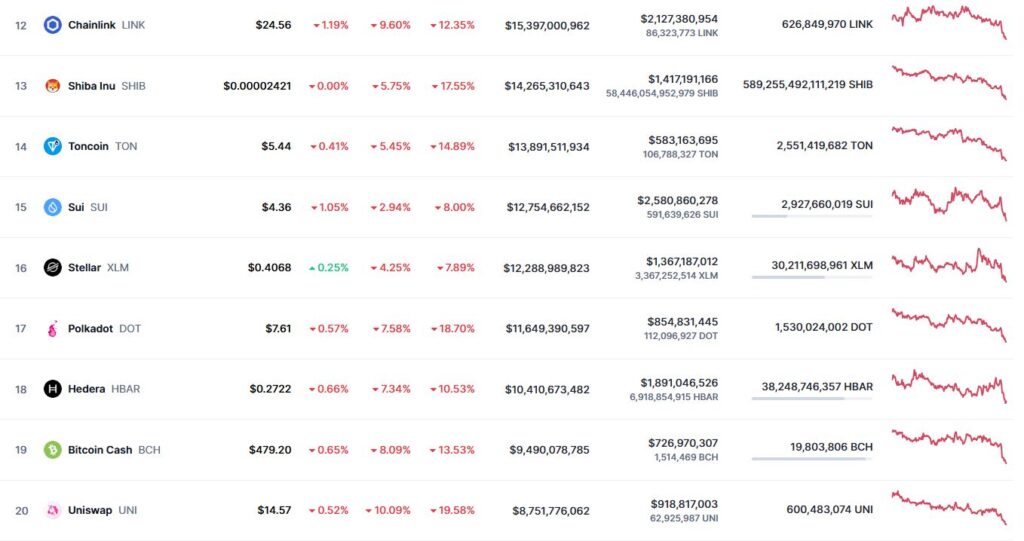

Source: CoinMarketCap

Bitcoin price down 3% today

Bitcoin (BTC) saw a 3% drop over the past 24 hours, trading at $100,880. It reached an intraday low of $98,874 and a high of $105,389. BTC’s market capitalization stands at $2 trillion, with a trading volume of $100 billion and a dominance of 57.12%.

BTC exchange-traded funds (ETFs) experienced significant outflows, totaling $84 million on Wednesday.

Grayscale led the outflows at $35 million, followed by Invesco with $25 million. BlackRock’s ETF data remains pending.

Meanwhile, the BOB (Build on Bitcoin) initiative continues to gain traction, integrating with Babylon, a Bitcoin staking protocol aimed at expanding BTC’s role in decentralized finance (DeFi).

Ethereum price slips 6% today

Ethereum (ETH) recorded a 6% dip, trading at $3,652, with a 24-hour range of $3,543 to $3,902.

Ethereum maintains its position as the second-largest cryptocurrency, with a market capitalization of $440 billion and a trading volume of $52 billion.

Ethereum ETFs saw outflows of $79 million, primarily driven by Grayscale ($65 million) and Bitwise ($14.62 million).

Amid these developments, Bitwise CIO Matt Hougan predicted that Ethereum could surpass Solana (SOL) in terms of growth by 2025, fueling discussions about the future of decentralized applications (dApps) and scalability.

Source: CoinMarketCap

XRP and Solana’s prices plunge

XRP suffered a steep 10% decline, trading at $2.32 with a market cap of $132 billion and a trading volume of $22 billion.

The cryptocurrency fluctuated between $2.184 and $2.585 over the past 24 hours.

Ripple expanded its ecosystem by launching RLUSD, a native stablecoin, signaling the company’s ambition to strengthen its presence in the stablecoin market despite the bearish trend.

Solana (SOL) dropped by 5% to $209, with a daily low of $200 and a high of $218. Despite the price dip, Solana remains the 6th largest cryptocurrency by market cap at $99 billion.

Notably, the Solana network achieved a new all-time high in ecosystem activity, underlining its increasing adoption in the blockchain space.

Meme coins slip

Meme cryptocurrencies also faced a downturn. Dogecoin (DOGE) declined by 7% to $0.36, while Shiba Inu (SHIB) dropped by 6%, trading at $0.00002425.

Other meme coins, including PEPE, BONK, and WIF, experienced losses ranging from 12% to 15%.

Top gainers

- Usual (USUAL): Gained 23%, trading at $1.02, with a 24-hour high of $1.16.

- Movement (MOVE): Rose by 14% to $0.70, showing robust momentum.

- Pudgy Penguins (PENGU): Increased 8% to $0.033, continuing its bullish streak after a Binance listing.

Top losers

- Dogwifhat (WIF): Declined by 14%, trading at $2.26.

- Floki (FLOKI): Fell 13%, now at $0.00019, as meme coins bore the brunt of market negativity.

- Theta Network (THETA): Dropped 12% to $2.32, reflecting the broader bearish sentiment.

Despite the overall market dip, the hourly charts show signs of recovery, with BTC gaining 0.5% and major altcoins like ETH, XRP, and BNB up by 1%.

While the market remains volatile, the increased trading volumes and growing ecosystem developments signal optimism in the short term.

The post Crypto market wrap Dec 19: Bitcoin slips below $100K as altcoins tumble after Fed rate cut appeared first on Invezz

https://invezz.com/news/2024/12/19/bitcoin-slips-below-100k-as-altcoins-tumble-after-fed-rate-cut/