Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Financial markets are full of quirky, monetisable correlations.

When, for example, the price of the S&P 500 E-mini (which is traded on the Chicago Mercantile Exchange) rises or falls, the Dax future (traded 7,000km away on the Eurex market in Germany) tends to do the same thing a few milliseconds later.

A trader with a fast enough network could therefore make a (very) quick profit by buying or selling the FDAX whenever the E-mini moves accordingly and waiting for everyone else to catch up.

Such advantages invite accusations that the game is rigged in favour of the fastest firms. Latency arbitrage — the exploitation by high-frequency traders of the infinitesimal amounts of time it takes price signals from one exchange to reach another — has over time become faster, more sophisticated and increasingly pernickety.

Earlier this month, the speed race being run by some of the world’s biggest HFT companies reached the Northern District Court of Illinois (h/t to FTAV reader ChicagoLocal.)

Indiana-based market infrastructure firm Skywave Networks had grand plans. In 2016, the company said it was ready to commercialise its new, superfast shortwave radio technology, which — unlike widely-used “line of sight” microwaves — could be refracted off the ionosphere and therefore used to transmit information around the curvature of the Earth.

Shortwave radio can conventionally carry far less information than optical fibre or microwave, but Skywave said its “innovative and patented” technology addressed this low bandwidth problem head on. Skywave claims this tech, once rolled out, would provide latency arbitrageurs with a “quantum leap in communications speed, particularly for transoceanic communications”.

By March 2017, according to October’s court filing, Skywave said it had “assessed and selected” transmitter and receiver sites in the US and Europe and was close to applying for the Federal Communications Commission-issued commercial licence required to transmit shortwave signals.

But there was a snag. Skywave alleges that at roughly the same time, other parties including Wall Street behemoths Jump Trading and Virtu Financial and rival infrastructure firms including New Line Networks (NLN) began using more relaxed experimental licences to send shortwave signals more efficiently than Skywave ever could.

Skywave is unhappy about this. From the court filing (emphasis our own):

This action arises from Defendants’ long-term, continuous racketeering and conspiracy scheme to fraudulently obtain experimental shortwave radio licenses from the Federal Communications Commission (“FCC”) to create a commercial trading network, unlawfully use those experimental licenses for commercial trading of financial instruments (“Commercial Trading”), and leverage the ill-gotten advantages of experimental licenses to maximize their own financial benefit and to the detriment of their competitors.

Jump declined to comment. Virtu and Skywave did not respond to requests for comment. A spokesperson for wireless network provider NLN said: “We completely dispute these baseless accusations, believe the claims are wholly without merit, and intend to defend ourselves vigorously.”

Experimental licences have more bandwidth than commercial licences, allow for “frequency hopping” and do not include expensive transmission power requirements, Skywave argues.

Skywave supposedly lost lots of money as a result and says there is evidence to back up its allegations of the defendants’ impropriety (our emphasis):

In 2022, Skywave discovered that a German company, Deutsche Börse, offered a market analytics tool called A7. The A7 tool enabled examination of CME and Eurex trading data for evidence of trading using shortwave networks.

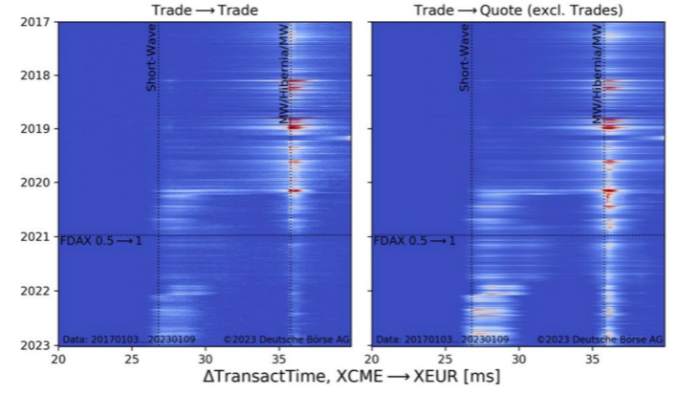

Using the A7 tool, Skywave discovered evidence of shortwave trading. For example, the A7 tool showed two different latencies for latency arbitrage trading of the E-Mini (abbreviated as “ES” in Figure 1) and the FDAX.

First, E-Mini price moves on the CME correlated with FDAX trading activity on the Eurex peaking approximately 37 milliseconds later. That 37-millisecond latency indicates trading over networks comprised of conventional optical fibre and microwave transmitters.

Second, the A7 data also showed E-Mini price moves on the CME correlated with FDAX trading activity on the Eurex peaking approximately 28 milliseconds later. That relatively low 28-millisecond latency indicates trading over networks that included shortwave transmissions

(High-res)

Defendants used their experimental licences to beat the market by 9 milliseconds, according to the complaint, transmitting trading signals from Illinois to Germany “faster than any other trader can legally do via optical fibre and microwave networks alone or a network that includes shortwave transmitters operated under a commercial licence”.

In short, Skywave is claiming Virtu, Jump and the rest of the defendants cheated: cutting corners by not waiting for a commercial licence as Skywave had done.

To “expand the scope of their scheme,” Skywave further alleges that defendants — now operating through several shell companies — constructed a shortwave transmission station in Ontario, Canada, to connect to their broader trading network, including a microwave link in Dunbridge, Ohio, and another “across the street”.

(High-res)

Skywave alleges that:

Instead of connecting these two microwave network links through an FCC license, which might have alerted U.S. regulators, Defendants built or caused to be built a hidden optical fiber cable that travels under a private driveway to connect the RuralConnect microwave link to the NLN microwave link. Figure 6 shows an aerial photograph of the hidden optical fiber’s path between the link labelled WROX998 and the link labelled WQQE624.

(High-res)

This “hidden optical fiber cable” connects the defendants’ shortwave transmission station in Ontario to their wider trading network, Skywave adds.

Shenanigans of the sort Skywave is alleging are pretty common in the HFT space, where macho nerds dominate and every millisecond counts.

The court filing notes how, in 2012, one HFT firm spent around $300mn to build a domestic network to save 3 milliseconds. In Trading at the Speed of Light, Donald MacKenzie describes one trader whose link ran “via antennas on a van he persuaded the owner of a bowling alley near a New Jersey data centre to allow him to leave in the bowling alley’s car park”.

Whether Skywave’s allegations amount to anything material for Jump, Virtu and the other defendants is now a matter for a judge.

https://www.ft.com/content/099342e4-cae8-4ac7-86bd-a3f2048065e8