August 15, 2024 5:53 PM EDT | Source: KWESST Micro Systems Inc.

Ottawa, Ontario–(Newsfile Corp. – August 15, 2024) – KWESST Micro Systems Inc. (TSXV: KWE) (TSXV: KWE.WT.U) (NASDAQ: KWE) (NASDAQ: KWESW) (“KWESST” or the “Company“) is pleased to announce the highlights of its fiscal 2024 (“Fiscal 2024“) third quarter (“Q3“) results. This announcement is a summary only and should be read in conjunction with KWESST’s unaudited condensed consolidated financial statements and related management discussion and analysis, for the three- and nine-month period ended June 30, 2024 (“Q3 2024 FS“). Q3 2024 FS have been filed on SEDAR and EDGAR.

Highlights for the Period:

KWESST’s commitment to execution of our strategy, our strong focus on cash management and capital allocation, and the beginning of KWESST’s pivot from development stage to revenue ramp-up is evidenced by the following key metrics for the period:

-

revenue for Q3 increased by 119% over the same period last year, driven by the DSEF government contract;

-

Land C4ISR sub-contract awarded and work commenced in June 2024;

-

sales and marketing expenses for Q3 and year to date (“YTD”) were reduced 69% and 51%, respectively over the same periods last year; and

-

overall YTD Fiscal 2024 cash used in operations was reduced by $4.5 million (39%) over the same period last year.

In Q3 and YTD Fiscal 2024, KWESST’s total revenue increased by $0.2 million and $0.3 million, respectively, and gross profit increased by 11% for the three-month period versus the comparable prior year period, and for YTD Fiscal 2024, we earned $0.2 million or gross margin of 24%, compared to $0.2 million or gross margin of 39% in the same prior period. The increase in Q3 revenue was mainly due to the ongoing DSEF government contract with our industry partners. KWESST’s Q3 operating loss decreased by 26% compared to the prior year period mainly due to a decrease in G&A and marketing spending, whereas its YTD Fiscal 2024 operating loss increased by 1% compared to the prior year period mainly due to increased research and development costs and personnel costs offset by a decrease in sales and marketing expenses.

KWESST’s Fiscal 2024, along with its Fiscal 2023 performance reflects the Company’s strategy of focused investments in key areas to drive revenue growth: securing large defense contracts, and the commercialization of the Company’s line of Non-Lethal Munition Systems including the PARA OPS next generation non-lethal system, and a new ARWEN 40mm munition. Operating expenses for the period increased due to headcount growth, and compliance-related costs following the Company’s listing on the Nasdaq. The Company has in parallel implemented cost reductions through the elimination of consultant fees and fewer sales and marketing related, as well as travel costs.

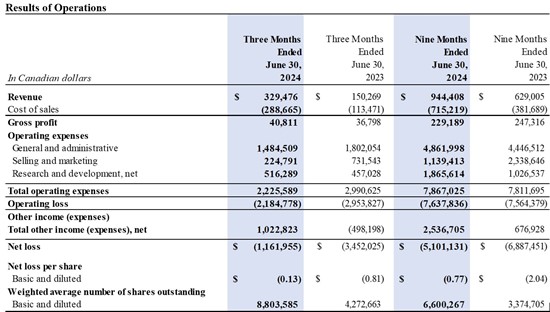

Results of Operations

To view an enhanced version of this table, please visit:

https://images.newsfilecorp.com/files/7366/220139_kwesttab1.jpg

For Q3 and YTD Fiscal 2024, KWESST’s operating loss was $2.2 million and $7.6 million, respectively a decrease of 26% and an increase of 1%, respectively over the comparable prior period mainly due to increased operating expenses driven by increased research and development costs and personnel costs, offset by an increase in revenue from our digitization contracts as well as a reduction in investor relations costs and marketing related travel and conference costs compared to the prior periods.

Revenue

Total revenue increased by $0.2 million in the third quarter compared to Q3 Fiscal 2023, mainly due to an additional $0.2 million generated from our digitization business line, offset by a negligible reduction from our non-lethal business line (driven from the sale of ARWEN products).

Total revenue increased by $0.3 million in YTD Fiscal 2024 compared to YTD Fiscal 2023, mainly due to our digitization business line. For the nine-month period ended June 30, 2024, we had sales from our non-lethal business line (driven from the sale of ARWEN products) of $280K, a decrease of $21K from the comparable prior period.

We expect revenue to increase with the commercial launch of KWESST LightningTM which we expect to be early in calendar 2025, with the expected demand/future orders for the new ARWEN 40mm ammunition and PARA OPS products, as well as from the recently announced LC4ISR (“Land command, control, communications, computers, intelligence, surveillance and reconnaissance”) subcontract. Management continues to work with our industry partners to determine the outlook for ramp-up on the DSEF program. The Company continues to expect no material impact to the overall potential revenue over the life of the contract.

Gross Profit

In Q3 Fiscal 2024, similar to the same period in Fiscal 2023, the gross profit was negligible. For YTD Fiscal 2024, we earned $0.2 million or gross margin of 24.3%, compared to $0.2 million or gross margin of 39.3% in the same period in 2023.

In Fiscal 2024, indirect costs associated with the ramp up of the Canadian Government contracts in Q1 resulted in lower gross margin as compared to the same period in 2023. We expect gross profit / margin to continue to increase during Fiscal 2024 from the other product lines described above as well as continued ramp up on the Canadian Government contracts.

Operating Expenses (“OPEX”)

Total OPEX decreased by $0.8 million from the comparable prior period in the three months ended June 30, 2024 due to the following factors:

-

S&M decreased by $0.5 million, primarily due to a decrease in investor relations costs and related sales and marketing costs ($0.4 million) in Fiscal 2024 as compared to Fiscal 2023;

-

G&A decreased by $0.3 million, primarily due to a decrease in professional fees and general office expenses, offset by an increase in senior management and directors compensation due to market adjustments and additional personnel as compared to Fiscal 2023; offset by

-

R&D increased by $0.1 million, primarily due to an increase in personnel costs advancing the KWESST LightningTM and BLDS projects in Fiscal 2024.

Total OPEX was $7.9 million for YTD Fiscal 2024 compared to $7.8 million in YTD Fiscal 2023, an increase of $ 0.2 million over the comparable prior year due to the following factors:

-

R&D increased by $0.8 million, primarily due to the fact that the LEC has reached commercial feasibility, and any associated costs are no longer being capitalized, while it was still in the development stage in Fiscal 2023 ($0.5 million), coupled with an increase in personnel costs advancing the KWESST LightningTM and BLDS projects in Fiscal 2024 ($0.7 million), offset by a reduction in consulting fees compared to the comparable prior year period ($0.3 million);

-

G&A increased by $0.4 million, primarily due to the amortization of the LEC intangible in Fiscal 2024 ($0.4 million), an increase in senior management and directors compensation to be in line with market and additional personnel as compared to Fiscal 2023 ($0.3 million), offset by a reduction in consulting & professional fees compared to the comparable prior year period ($0.2 million); offset by

-

S&M decreased by $1.2 million, primarily due to a decrease in investor relations costs and related sales and marketing costs ($1.0 million), and a decrease in business development costs ($0.2 million).

Other income (expenses), net

For Q3 Fiscal 2024, our total other income was $1.0 million, compared to total other expenses of $0.5 million in Q3 Fiscal 2023. This change in other income (expenses) net is mainly due to the favorable $2.0 million change in fair value of warrant liabilities as a result of the remeasurement of the warrant liabilities at June 30, 2024, driven by a decrease in the underlying common share price on June 30, 2024, offset by a $0.4 million increase in share issuance costs associated with the two US public offering financing activities in Q3 Fiscal 2024.

For YTD 2024, our total other income was $2.5 million, compared to total other income of $0.7 million for the same period 2023 resulting in an increase of $1.8 million. The change in other income (expenses) was driven mainly by:

-

$0.3 million favorable change in fair value of warrant liabilities as a result of the remeasurement of the warrant liabilities at June 30, 2024, driven by a decrease in the underlying common share price on June 30, 2024. Under IFRS, we are required to remeasure the warrant liabilities at each reporting date until they are exercised or expired;

-

A decrease of $0.9 million in Share Offering Costs as $1.3 million related to the U.S. IPO and Canadian Offering in Fiscal 2023, compared to $0.4 million associated with the two US public offering financing activities in April and June 2024;

-

$0.5 million decrease in net finance costs is primarily due to the Fiscal 2023 recognition of the remaining unamortized accretion costs and interest expense relating to the repayment of all outstanding loans, following the closing of the U.S. IPO and Canadian Offering; and

-

$0.2 million increase in foreign exchange gain due to appreciation in the U.S. currency during the period.

Condensed Balance Sheet

To view an enhanced version of this table, please visit:

https://images.newsfilecorp.com/files/7366/220139_kwesttab2.jpg

Major Highlights – Quarter ended June 30, 2024 (“Q3 Fiscal 2024”)

The following is a summary of the major highlights that occurred during the quarter ended Q3 Fiscal 2024:

-

On April 3, we announced that the Company intends to offer to sell common shares (and/or pre-funded warrants (“Pre-funded Warrants”) in lieu thereof) in an underwritten United States public offering.

-

On April 4, we announced the pricing of its underwritten public offering of 1,538,500 common shares (or pre-funded warrants (“Pre-funded Warrants”) in lieu thereof) at a public offering price of US$0.65 per share, for gross proceeds of approximately US$1,000,000, before deducting underwriting discounts, commissions and offering expenses.

-

On April 9, we announced the closing of the previously announced underwritten public offering of 735,000 common shares and 803,500 pre-funded warrants with an exercise price of $0.001 (“Pre-funded Warrants”) at a public offering price of US$0.65 per share and US$0.649 per Pre-funded Warrant, less the underwriting discount.

-

On April 30, we provided a corporate update ahead of our fiscal Q2 result, highlighting status of our military digitization contracts through 2028, an MOU signed with the University of Ottawa to hire software coding graduates, work with a large Canadian police agency as first adopter of KWESST LightningTM in advance of full market release, ARWEN scaling to multiples of historical revenue and, major agencies continue evaluations of PARA OPS.

-

On May 17, we announced that it has been awarded a contract with its teaming partner CounterCrisis Tech (“CCT”) for a proof of concept project (the “Project”) to provide a situational awareness app in support of Canadian Red Cross (“CRC”) emergency and disaster relief operations.

-

On May 20, we announced today that the Company received written notification from The Nasdaq Stock Market LLC (“Nasdaq”) on May 16, 2024, indicating that the Company is not in compliance with the minimum bid price requirement set forth in the Nasdaq rules for continued listing on Nasdaq, which requires listed securities to maintain a minimum bid price of US$1.00 per share.

-

On June 10, we reported that it has been awarded a sub-contract by Thales Canada. Under the sub-contract, KWESST will deliver specialized software services for work under the Canadian Department of National Defence Land C4ISR series of contracts to modernize the Canadian Army’s capabilities through advanced land command, control, communications, computers, intelligence, surveillance and reconnaissance (C4ISR) systems.

-

On June 12, we announced that it intends to offer to sell common shares (and/or pre-funded warrants (“Pre-funded Warrants”) in lieu thereof) in a best efforts United States public offering.

-

On June 12, we announced the pricing of its best efforts public offering of 2,900,000 common shares at a public offering price of US$0.58 per share, for gross proceeds of approximately US$1,682,000, before deducting placement agent fees and offering expenses. All of the common shares are being offered by the Company.

-

On June 14, we announced the closing of its previously announced public offering of 2,900,000 common shares at a public offering price of US$0.58 per share, less the placement agent fees. The gross proceeds from the offering, before deducting placement agent fees of $0.0435 per common share (being an aggregate of US$126,150 or 7.5% of the public offering price of the securities) and estimated offering expenses payable by the Company, were approximately US$1,682,000.

The following is a summary of major highlights that occurred after June 30, 2024:

-

On August 7, the Company announced that a G7 capital city police service (the “Agency”) has taken delivery of three T-SAS™ systems and in conjunction has entered into an agreement (at the close of business on August 6) with the Company for a limited time free trial of KWESST Lightning™. The trial has been initially rolled out to a team within the Tactical unit of the Agency to stress-test the equipment and services provide valuable user feedback that will shape the full commercial version once released, and as part of the trial, KWESST will provide training and support to obtain maximum user engagement. During the three-month trial period, the Agency will have access to the full capability of command, communication, and critical-incident management through the KWESST Lighting™ interface on all Android-based devices and leverage peer-to-peer and cloud-based secure networked tactical video streams across KWESST’s secure SaaS (“Service as a Software”) cloud service.

-

On August 12, the Company announced that it has entered into definitive agreements for the purchase and sale of 4,715,000 common shares at a purchase price of US$0.20 per common share in a registered direct offering. The gross proceeds to the Company from the offering were approximately US$943,000 before deducting placement agent fees and other offering expenses payable by the Company. In a concurrent private placement, the Company issued unregistered warrants to purchase up to 4,715,000 common shares at an exercise price of US$0.25 per share that were immediately exercisable upon issuance and will expire five years following the date of issuance. The registered direct offering was closed on August 13, 2024.

About KWESST

KWESST (NASDAQ: KWE) (NASDAQ: KWESW) (TSXV: KWE) (FSE: 62UA) develops and commercializes breakthrough next-generation tactical systems for military and security forces. The company’s current portfolio of offerings includes digitization of tactical forces for real-time shared situational awareness and targeting information from any source (including drones) streamed directly to users’ smart devices and weapons. Other KWESST products include countermeasures against threats such as electronic detection, lasers and drones. These systems can operate stand-alone or integrate seamlessly with OEM products and battlefield management systems, and all come integrated with TAK. The company also has a new proprietary non-lethal product line branded PARA OPSTM with application across all segments of the non-lethal market, including law enforcement. The Company is headquartered in Ottawa, Canada, with representative offices in London, UK and Abu Dhabi, UAE.

Forward-Looking Statements

This press release contains “forward-looking statements” and “forward-looking information” within the meaning of Canadian and United States securities laws (collectively, “forward-looking statements“), which may be identified by the use of words such as “plans”, “is expected”, “expects”, “scheduled”, “intends”, “contemplates”, “anticipates”, “believes”, “proposes” or variations (including negative and grammatical variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Such statements are based on the current expectations of KWESST’s management and are based on assumptions and subject to risks and uncertainties.

Although KWESST’s management believes that the assumptions underlying such statements are reasonable, they may prove to be incorrect. The forward-looking events and circumstances discussed in this press release may not occur by certain specified dates or at all and could differ materially as a result of known and unknown risk factors and uncertainties affecting KWESST, including KWESST’s inability to secure contracts and subcontracts (on the timelines, size and scale expected or at all), statements of work and orders for its products in 2024 and onwards for reasons beyond its control, the renewal or extension of agreements beyond their original term, the granting of patents applied for by KWESST, inability to finance the scale up to full commercial production levels for its physical products, inability to secure key partnership agreements to facilitate the outsourcing and logistics for its Arwen and PARA OPS products, overall interest in KWESST’s products being lower than anticipated or expected; general economic and stock market conditions; adverse industry events; loss of markets; future legislative and regulatory developments in Canada, the United States and elsewhere; the inability of KWESST to implement its business strategies; risks and uncertainties detailed from time to time in KWESST’s filings with the Canadian Security Administrators and the United States Securities and Exchange Commission, and many other factors beyond the control of KWESST. Although KWESST has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and KWESST undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its respective Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/220139

The post KWESST Micro Systems Announces Q3 2024 Financial Results appeared first on Invezz

https://invezz.com/news/2024/08/15/kwesst-micro-systems-announces-q3-2024-financial-results/