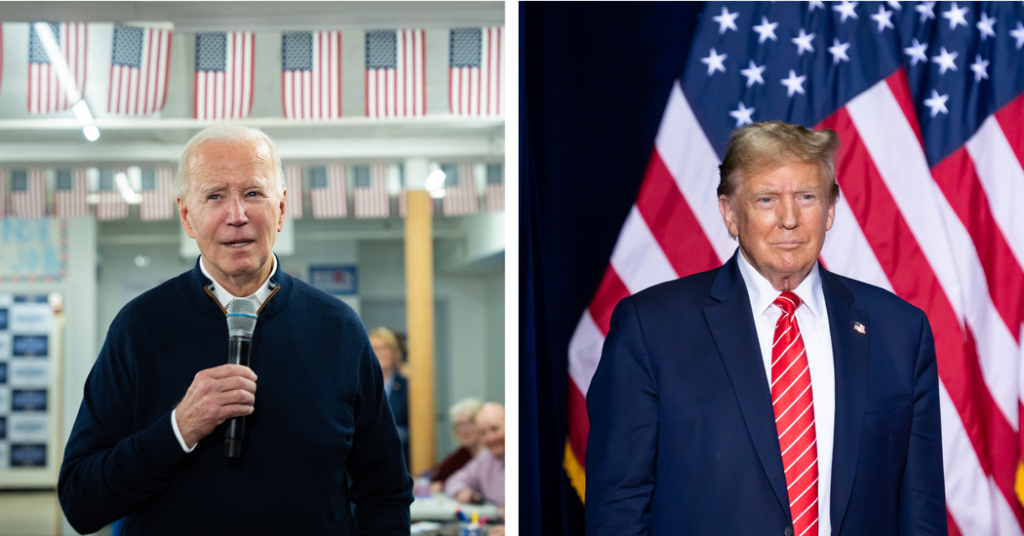

President Biden in his price range this week staked out main financial battle traces with former President Donald J. Trump, the presumptive Republican presidential nominee. The proposal gives the nation a glimpse of the diverging instructions that retirement packages, taxes, commerce and vitality coverage may take relying on the end result of the November election.

During the previous three years, Mr. Biden has enacted key items of laws geared toward bolstering the inexperienced vitality economic system, making infrastructure investments and reinforcing America’s home provide chain with subsidies for microchips, photo voltaic know-how and electrical automobiles. Few of these priorities are shared by Mr. Trump, who has pledged to chop extra taxes and erect new commerce boundaries if re-elected.

The inflection level will likely be arriving because the economic system enters the ultimate stretch of what economists are actually anticipating to be a “soft landing” after two years of excessive inflation. However, the prospect of a second Trump administration has injected elevated uncertainty into the financial outlook, as corporations and policymakers world wide brace for what may very well be a dramatic shift within the financial stewardship of the United States.

Here are among the most placing variations within the financial insurance policies of the 2 presidential candidates.

Sparring over the social security web

At first look, Mr. Biden and Mr. Trump would possibly seem to have related positions on the nation’s social security web packages. In 2016, Mr. Trump broke together with his fellow Republicans and refused to assist cuts to Social Security or Medicare. Mr. Biden has lengthy insisted that the packages needs to be protected and has hammered Republicans who’ve prompt chopping or scaling again the packages.

In his price range proposal on Monday, Mr. Biden reiterated his dedication to preserving the nation’s entitlement system. He known as for brand spanking new efforts to enhance the solvency of Social Security and Medicare, together with making rich Americans pay extra into the well being program. However, his plans have been mild on particulars relating to how to make sure each packages’ long-term sustainability.

Separately on Monday, Mr. Trump appeared to recommend that he was open to entitlement cuts. He stated on CNBC that there’s “a lot you can do in terms of entitlements in terms of cutting and in terms of also the theft and the bad management of entitlements, tremendous bad management of entitlements.”

The Trump marketing campaign clarified that the previous president was referring to chopping waste, however the Biden marketing campaign seized on the remark. It rapidly launched an commercial contrasting Mr. Trump’s remarks with Mr. Biden’s vow on the State of the Union to cease anybody who tries to chop Social Security or Medicare or increase the retirement age.

Although Mr. Trump by no means signed cuts to Social Security or Medicare as president, he has beforehand flirted with the thought. Asked about entitlements cuts in a CNBC interview in 2020, he stated, “At the right time, we will take a look at that.”

To tax or to not tax?

One of the most important contrasts between Mr. Biden and Mr. Trump revolves round who — if anybody — ought to pay extra in taxes.

The president proposed greater than $5 trillion in tax will increase on companies and the rich this week, together with a brand new 25 % minimal tax on the wealthiest Americans and a rise within the company tax fee to twenty-eight % from 21 %.

Mr. Biden paired his proposed tax will increase on the rich with tax aid for the center class. He known as for an enlargement of the kid tax credit score, which many Republicans have opposed, broadening eligibility for the earned-income tax credit score and new tax credit that goal to make housing extra reasonably priced for first-time consumers.

Mr. Trump signed into legislation the 2017 Tax Cuts and Jobs Act, which included practically $2 trillion in tax cuts, a lot of which benefited corporations and the wealthy. Many of these tax cuts expire in 2025, which means that whoever is president can have a giant say in whether or not they’re prolonged or allowed to sundown.

Mr. Biden needs to roll again a lot of the 2017 legislation, apart from the components that profit taxpayers incomes lower than $400,000.

Mr. Trump has supplied few specifics about his tax plans, however prompt at a rally in February that he envisioned one other spherical of cuts.

“You’re all getting the biggest tax cuts because we’re doing additional cuts and a brand-new Trump economic boom like you’ve never seen before,” Mr. Trump stated.

Speaking to CNBC on Monday, Mr. Trump stated it will be “very bad for this country” if the Trump tax cuts weren’t prolonged.

The Friend-Shorer vs. the Tariff Man

While Democrats and Republicans have turn into extra polarized lately, commerce coverage is likely one of the few areas the place views appear to have converged.

For all their variations, Mr. Biden has largely left the commerce agenda that Mr. Trump handed to him intact. The tariffs on a whole bunch of billions of {dollars} of Chinese imports that Mr. Trump imposed have but to be rolled again, Mr. Biden has intensified scrutiny of Chinese investments within the United States and of American funding in China, and the Biden administration’s industrial coverage has rankled relations with some European nations.

If he’s re-elected, Mr. Biden is prone to proceed his coverage of deepening commerce ties with American allies — a coverage known as friend-shoring — and decreasing provide chain reliance on adversaries resembling China. The Biden administration is anticipated to finish a assessment of the China tariffs within the coming months and will scale back some levies on shopper merchandise and lift others that may additional shield the burgeoning U.S. electrical car sector.

Mr. Trump has indicated that he’s gearing up for a brand new spherical of commerce wars. The former president and self-proclaimed “Tariff Man” has mentioned imposing a ten % tariff on all imports in a second time period and a tariff of 60 % or extra on Chinese items.

Clashing on clear vitality

The Inflation Reduction Act of 2022 has turn into Mr. Biden’s signature piece of laws and its future — and the trajectory of U.S. local weather coverage — will depend on who wins the election.

Mr. Biden’s financial crew has been racing to roll out laws related to the tax and local weather legislation to entrench investments in clear vitality and the electrical car provide chain into the economic system. The Biden administration hopes that the legislation may show to be enduring as a result of many of those investments are being made in states which are led by Republicans.

However, Mr. Trump, who has lengthy derided electrical automobiles as overpriced, underpowered and a risk to American jobs, shouldn’t be counted on to embrace a lot of the legislation if elected.

“We are a nation whose leaders are demanding all electric cars, despite the fact that they don’t go far, cost too much and whose batteries are produced in China,” Mr. Trump stated at a rally in New Hampshire in January.

The former president, who pulled the United States out of the Paris local weather settlement, can also be unlikely to prioritize different clear vitality investments.

For years, Mr. Trump has argued that solar energy is ineffective and that wind generators are chargeable for the slaughter of birds.