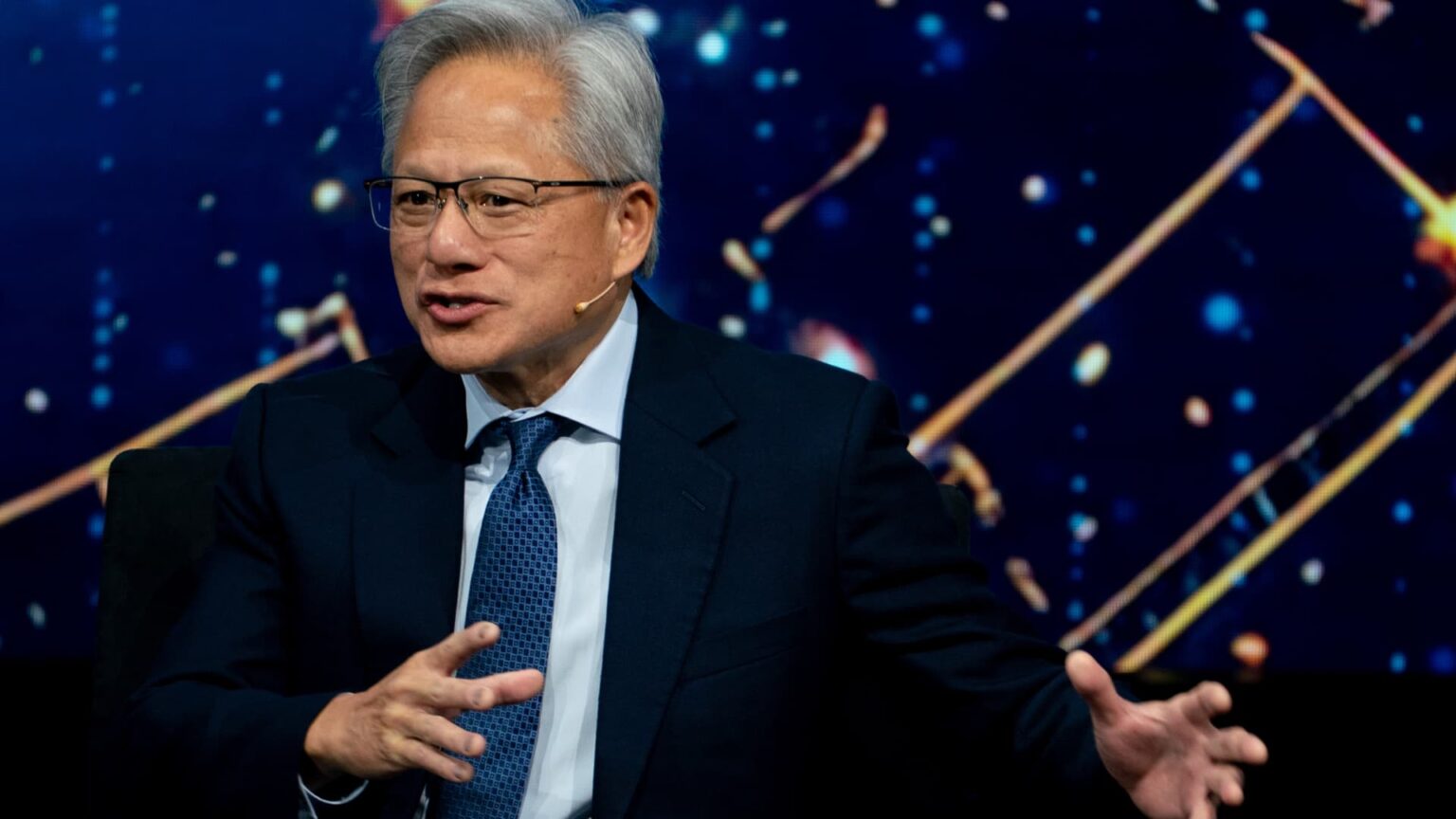

Jensen Huang, chief executive officer of Nvidia Corp., during the US-Saudi Investment Forum at the Kennedy Center in Washington, DC, US, on Wednesday, Nov. 19, 2025.

Stefani Reynolds | Bloomberg | Getty Images

This is CNBC’s Morning Squawk newsletter. Subscribe here to receive future editions in your inbox.

Here are five key things investors need to know to start the trading day:

1. No bubble, no trouble?

Nvidia blew past Wall Street’s earnings and revenue expectations last night, also providing a stronger-than-expected forecast for the current quarter. If futures trading is any indication, the results convinced investors that their concerns around the health of the artificial intelligence trade can be put to rest.

Here’s what to know:

- The chipmaker said revenue topped $57 billion for the third quarter and expects sales to rise to around about $65 billion in the current three-month period.

- CEO Jensen Huang described sales for Nvidia’s Blackwell chips as “off the charts.”

- Huang also brushed off concerns of an AI bubble, saying the company sees “something very different.”

- The comments are significant as Nvidia is somewhat of a linchpin in the AI trade: It counts Amazon, Microsoft, Google and Oracle as customers, as well as most major AI developers.

- Yet despite announcing a $100 billion investment in OpenAI two months ago, Nvidia said there was “no assurance” of a final agreement with the ChatGPT maker.

- Shares of Nvidia climbed 5% overnight, igniting a broader rebound in futures this morning.

- Fellow chip stocks Advanced Micro Devices and Broadcom, as well as power infrastructure names including Eaton, also jumped as the report restored faith in the AI trade.

- Follow live markets updates here.

2. Walmart’s win

Sign at the entrance to a Walmart in Venice, Florida.

Erik Mcgregor | Lightrocket | Getty Images

Walmart beat analysts’ expectations on both lines this morning and raised its outlook for the second straight quarter, boosted by strength in its e-commerce business and new customers.

CFO John David Rainey told CNBC that Walmart won over “value-seeking” customers from varying income brackets. While the company saw an impact from the SNAP pause during the government shutdown, Rainey said the retailer is seeing a “rebound” as funds begin to be distributed again.

CNBC reported yesterday that Walmart is in talks to acquire R&A Data, an Israeli startup that monitors online marketplaces for scams and counterfeits. Two months ago, a CNBC investigation found Walmart over time loosened its controls for vetting online sellers and products to better compete with Amazon.

3. Fed feuds

Jerome Powell, chairman of the US Federal Reserve, during a news conference following a Federal Open Market Committee (FOMC) meeting in Washington, DC, US, on Wednesday, Oct. 29, 2025.

Al Drago | Bloomberg | Getty Images

Federal Reserve officials were divided over whether to cut interest rates at last month’s policy meeting, minutes released yesterday showed. The report also threw cold water on hopes for another rate cut at the central bank’s December meeting: “Many” of the officials, according to the minutes, said no more cuts are needed this year.

Meanwhile, Trump once again took aim at Fed Chair Jerome Powell yesterday, saying “I’d love to fire his ass.” The president urged Treasury Secretary Scott Bessent to “work on” Powell to lower rates.

We’re awaiting September’s jobs report due out this morning after it was delayed by the government shutdown. The Bureau of Labor Statistics said yesterday that October’s nonfarm payrolls won’t include an employment rate because the data “could not be collected” during the shutdown.

3. Epstein bill

A participant holds a banner that reads ‘Release the files now’ during the press conference on the Epstein Files Transparency Act with the Epstein abuse survivors at the US Capitol in Washington, DC, on November 18, 2025.

Celal Gunes | Anadolu | Getty Images

President Donald Trump said last night that he signed a bill ordering the release of files related to sex offender Jeffrey Epstein. The bill gives Attorney General Pam Bondi 30 days to publicly release unclassified records tied to Epstein and his accomplice Ghislaine Maxwell.

The legislation has exceptions to what can be released, such as information that personally identifies victims or materials tied to child sexual abuse. Records that would “jeopardize” an ongoing federal investigation or prosecution are also excluded from the order.

5. American dream

A For Sale sign is posted in front of a home for sale in San Marino, California on September 6, 2023.

Frederic J. Brown | AFP | Getty Images

Home buyers are seeing their strongest market in more than a decade, according to a report from Redfin. But there’s a catch: You have to be able to afford one.

The firm found there were over 36% more sellers than buyers last month, the biggest gap since 2013. But Redfin researchers noted that many Americans have been “priced out” of the housing market as affordability has cratered. “It’s only a buyer’s market for those who can afford to buy,” they said.

New data out yesterday also showed mortgage rates rose for a third straight week, causing a slide in demand from both current and and potential homeowners.

The Daily Dividend

Semrush shares surged 74% yesterday after Adobe said it reached a deal to acquire the search engine marketing firm for $1.9 billion.

— CNBC’s Kif Leswing, Ari Levy, Pia Singh, Gabrielle Fonrouge, Melissa Repko, Kevin Breuninger, Ashley Capoot, Jeff Cox, Fred Imbert, Samantha Subin and Diana Olick contributed to this report. Josephine Rozzelle edited this edition.

https://www.cnbc.com/2025/11/20/5-things-to-know-before-the-stock-market-opens.html